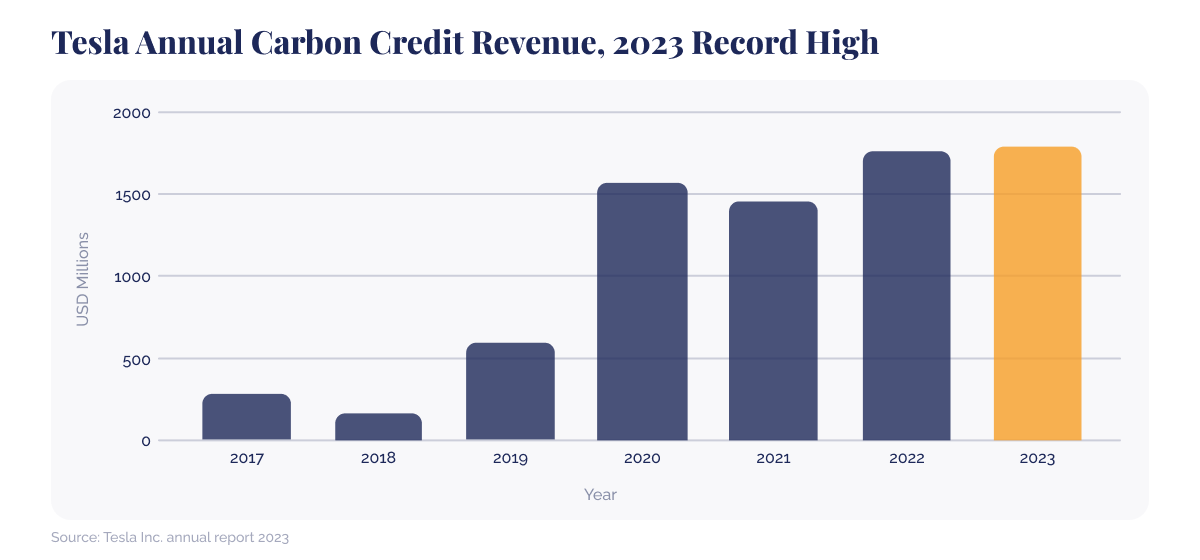

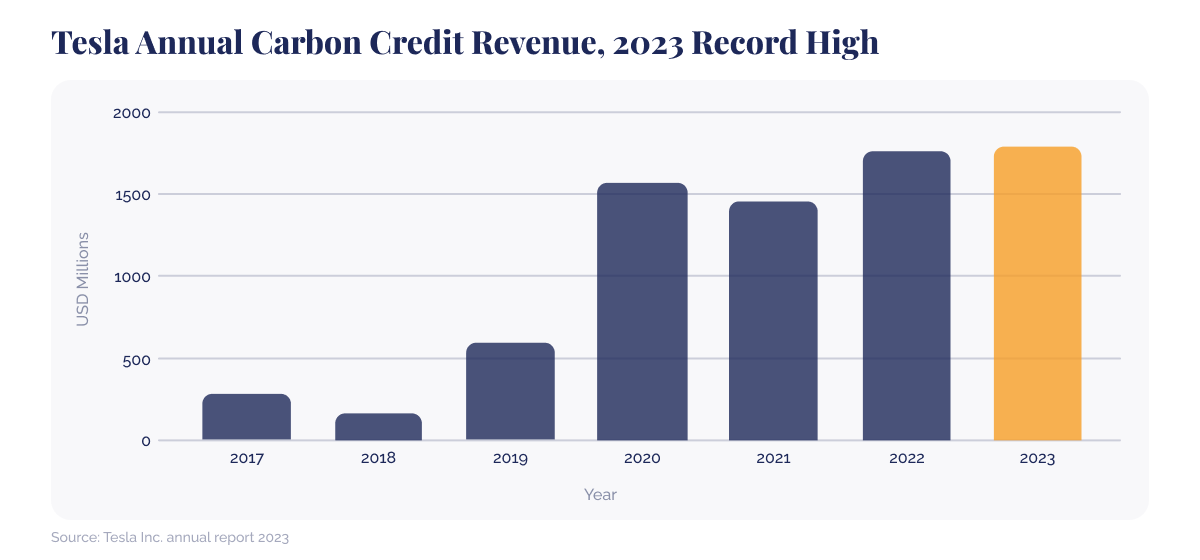

Tesla Inc. has once again showcased its financial prowess, this time through its lucrative carbon credit (carbon unit) sales, which amounted to a staggering $1.79 billion in the past year. The company's latest financial disclosures reveal that since 2009, Tesla has raked in nearly $9 billion from the sale of these credits, underscoring its significant impact on the automotive sector's push towards sustainability.

Drone photo of a Tesla car driving on a road towards the sun among hills. AI generated picture.

Drone photo of a Tesla car driving on a road towards the sun among hills. AI generated picture.

These earnings stem from Tesla's role in the carbon credit market, where it sells regulatory credits to other automakers struggling to comply with stringent emission standards in key markets like the US, Europe, and China. This business model has proven exceptionally profitable for Tesla, with minimal costs associated with generating these credits.

Read more: Tesla’s carbon credit sales soared to $1.78 billion in 2022

Despite a slight year-over-year decrease in quarterly revenue from carbon credit sales, dropping 7% to $433 million in the fourth quarter, Tesla's annual sales in 2023 edged up, setting a new record. This performance contradicts earlier predictions that income from carbon credits would dwindle as more companies enter the electric vehicle (EV) market.

Tesla's financial health is strengthened by carbon credit sales, contributing significantly to its overall gross margin. While automotive revenues saw a modest increase, missing analysts' estimates, Tesla's commitment to clean energy and its burgeoning energy generation and storage business continue to attract attention.

Read more: Industry carbon footprints: transport, events, and celebrities

Amid this success, the global automotive landscape is shifting. Tesla faces increased competition, particularly from Chinese automaker BYD, which has surged ahead in EV sales. However, Tesla's all-electric production remains impressive, underscoring its leadership in the sector.

Furthermore, as global and regional emissions regulations tighten, Tesla's innovative approach to sustainable transportation positions it well for future growth. The company's ability to capitalise on carbon credit sales, alongside its investment in clean energy, ensures its continued relevance and leadership in the evolving automotive industry.

Join our free webinar this Thursday: Understanding Carbon Footprinting for Beginners

DGB Group stands as your perfect ally on the path to sustainability. With our certified, high-quality carbon credits (carbon units), we empower both industries and individuals to compensate for their carbon footprint, promoting a greener and more sustainable environment. We help businesses of any size and industry to develop a CO2 strategy in line with their environmental goals. DGB offers an ideal solution for entities and people alike to mitigate their ecological impact, contributing to the restoration of nature and creating a healthier future.

Explore the benefits offered by DGB's carbon units