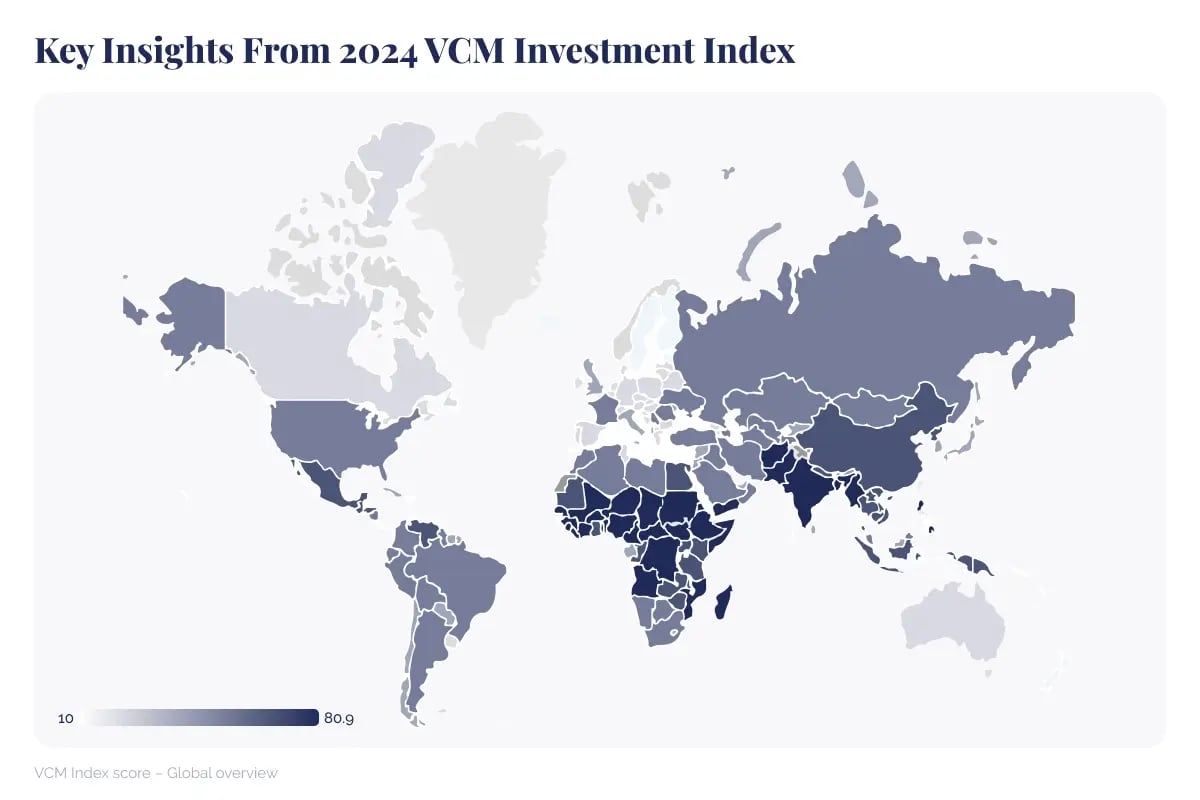

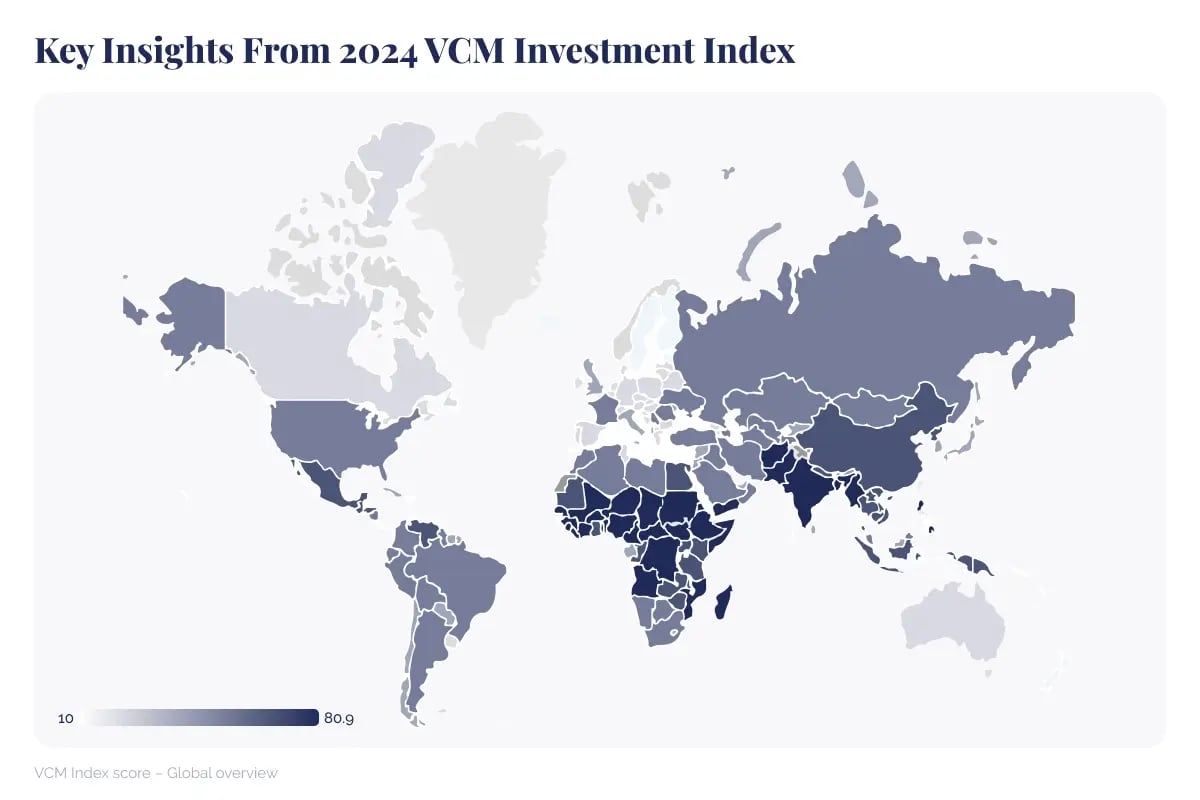

During Climate Week NYC in September, Abatable, a leading provider of carbon market solutions, unveiled its 2024 Voluntary Carbon Market (VCM) Investment Attractiveness Index. The Index ranks the top five countries for carbon credit investments based on their regulatory frameworks, market readiness, and potential for future growth.

Vast and biodiverse Amazon Rainforest in Colombia. AI generated picture.

Vast and biodiverse Amazon Rainforest in Colombia. AI generated picture.

Colombia, Kenya, Cambodia, Mexico, and Peru topped the list, recognised for creating stable environments for carbon project developers. Colombia’s rise to the top spot, climbing 13 places from last year, is attributed to its carbon tax, which has boosted market activity. As one of the world’s 17 megadiverse countries, Colombia also benefits from rich biodiversity and has become a leader in nature-based solution carbon credits, issuing 142 million tonnes since the market’s inception.

Kenya, ranked second, has made significant progress with the introduction of its 2024 carbon market regulations. These policies have created a favourable climate for carbon project development and compliance with Article 6 of the Paris Agreement, positioning the country as a key player in the global carbon market.

Read more: The power of DGB Group’s high-quality carbon projects in Kenya

Abatable’s co-founders, Maria Eugenia Filmanovic and Valerio Magliulo, explained that the Index not only assesses regulatory factors but also considers a country’s broader impact on the environment, nature, and people. They emphasised that access to reliable data is essential for making informed investment decisions. Magliulo noted, ‘The VCM Investment Attractiveness Index is a critical tool that helps democratise carbon market data for participants, enabling informed decisions and helping scale the market.’

The Index evaluates 24 indicators across three main pillars: investment potential, national readiness for carbon trading, and opportunities for improving social and environmental outcomes. This year’s rankings reflect a trend toward increased engagement in the VCM, driven by countries introducing compliance schemes and carbon crediting mechanisms.

Other countries have also made notable gains. Brazil, for instance, jumped 33 spots due to a surge in carbon credit availability, attracting investment from major tech companies such as Google and Microsoft. Early engagement with Article 6 has given countries like Brazil, Zambia, and Madagascar a first-mover advantage in this evolving market.

The Index highlights how regulatory progress can drive investment. For example, Colombia’s national carbon registry and innovative carbon pricing mechanisms have positioned it as a leader in both voluntary and compliance markets. Similarly, Kenya’s new policies have set the stage for steady growth in carbon credit supply, attracting investor interest.

Read more: Colombia creates agency to manage responsible carbon credits

As the demand for carbon credits grows, Abatable’s Index serves as a critical tool for de-risking investments and supporting the scaling of global carbon markets. With countries like Colombia and Kenya at the forefront, the VCM is expected to continue offering both financial and environmental opportunities. Filmanovic also pointed to the growing interest in Article 6.2 credits, which allow for cross-border trading of emissions reductions, as a promising sign of recovery and expansion in the VCM.

In the face of increasing environmental action pressures, countries adopting innovative compliance schemes are likely to see continued investment growth, underscoring the importance of strategic policies in shaping the future of the carbon market.

As sustainability becomes a growing priority for businesses, the voluntary carbon credit market is vital in advancing global nature restoration. By investing in DGB Group's high-integrity nature-based projects, you support a future where thriving communities coexist with restored ecosystems. Our projects, with a priority on areas like Kenya, focus on long-term environmental stewardship, generating premium carbon units that meet rigorous standards. With increasing demand for high-quality carbon units, partnering with DGB presents a unique opportunity to drive meaningful impact while benefiting from the expanding carbon market.

Invest in a green future with DGB

Vast and biodiverse Amazon Rainforest in Colombia. AI generated picture.

Vast and biodiverse Amazon Rainforest in Colombia. AI generated picture.