The role of carbon credits in nature-based solutions

Carbon credits (also called carbon units, carbon offsets, or carbon footprint credits) are used in carbon markets to encourage businesses and governments to reduce or offset their carbon emissions. Quality carbon credits are not a mysterious figure but a representation of measurable positive environmental impact.

Aerial view of a forest.

What are carbon credits?

Carbon credits are tradable permits that represent reducing or removing carbon dioxide (CO2) and carbon dioxide equivalent (CO2e) emissions from the atmosphere. A carbon credit represents one metric tonne of CO2 or CO2e, such as methane or nitrous oxide, that has been prevented from being emitted into or removed from the atmosphere.

Read more: Sustainability simplified: Carbon units for beginners

High-quality carbon credits are usually generated by nature-based projects that reduce carbon emissions or activities that prevent CO2 emissions from reaching the atmosphere. These projects include planting trees and restoring degraded land through reforestation or providing better alternatives for household items, such as energy-efficient cookstoves.

Read more: The rising demand for nature-based credits

Organisations that need to compensate for their carbon emissions can purchase carbon credits from these projects or activities to help offset their emissions and reach net-zero and sustainability goals. It provides opportunities for effectively funding the development of nature-based solutions and helps to reduce carbon emissions.

Why are carbon credits important?

The importance of carbon credits lies in their ability to provide a financial incentive for companies and organisations to reduce their carbon emissions. It incentivises companies to reduce their carbon footprint and invest in more sustainable practices, such as reforestation, afforestation, and renewable energy projects, energy efficiency improvements, and carbon-capture and -storage technologies.

In addition, carbon credits provide economic benefits to communities by creating job opportunities in nature conservation projects and renewable energy and carbon offset markets. This can spur economic development while also reducing carbon emissions.

Read more: The importance of carbon offsetting in achieving net zero

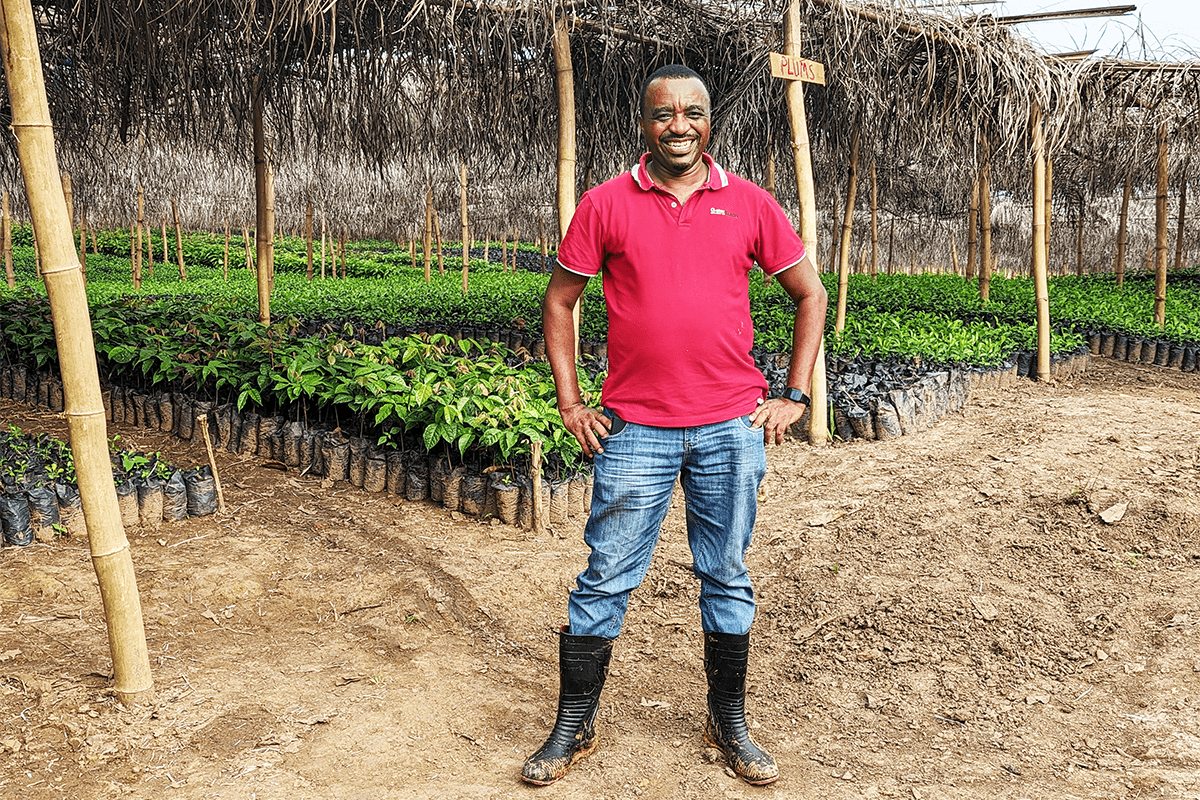

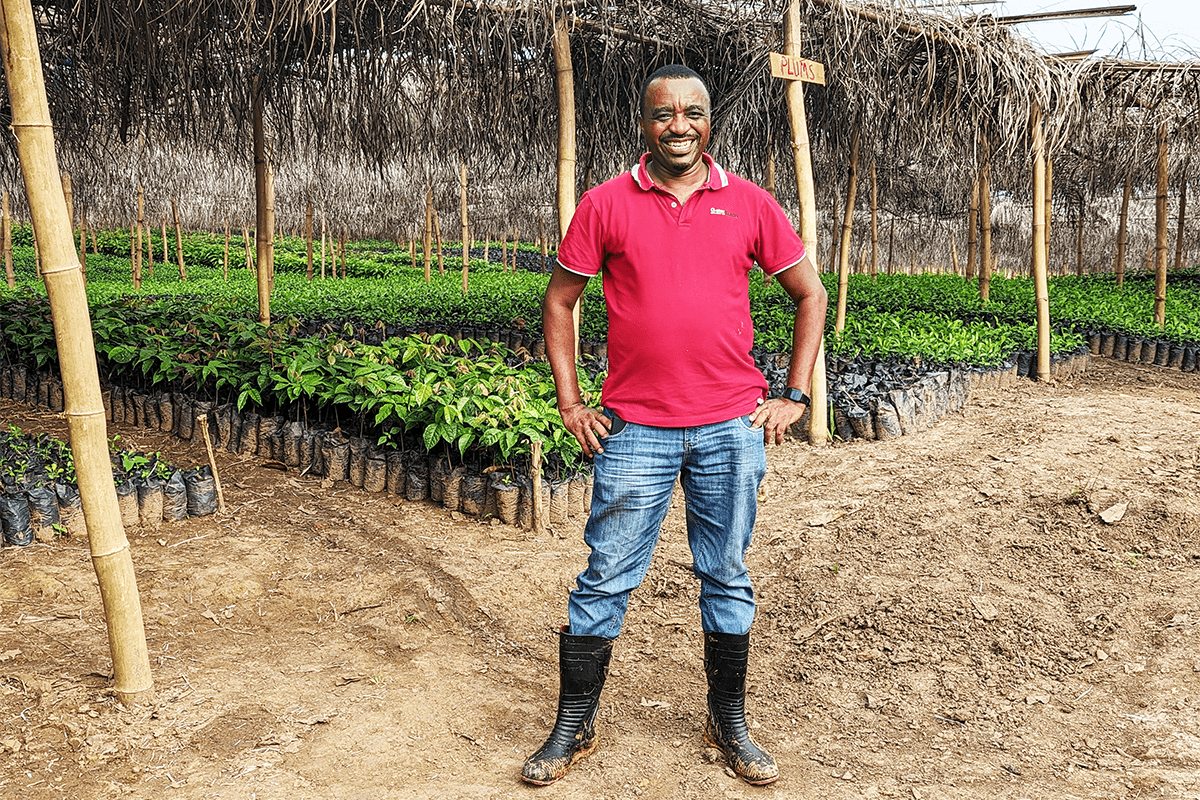

Young tree nursery.

How are carbon credits generated?

Carbon footprint credits are generated through activities or projects that reduce or remove carbon emissions from the atmosphere.

For example, a reforestation or nature-restoration project that plants trees or protects existing forests can receive carbon credits for the CO2 removed from the atmosphere by trees that absorb carbon during photosynthesis.

Read more: How are carbon credits issued?

Similarly, a renewable energy project, such as a wind farm or solar power plant, generates electricity without producing carbon emissions. The project developer can then receive carbon credits for the avoided emissions using renewable energy instead of fossil fuels.

To generate quality carbon credits, these projects must be approved and verified by an independent third-party organisation that ensures the project meets specific standards and criteria. For example, at Green Earth, we originate our carbon credits based on industry-leading standards such as Gold Standard and Verra.

Read more: What makes Green Earth’s reforestation projects unique?

These programmes assess projects’ methodology, calculate the amount of carbon emissions avoided or removed, and issue carbon credits accordingly.

Tree nursery - Greenzone Afforestation Project, Cameroon, Green Earth.

Once issued, carbon credits can be bought and sold on carbon markets, such as the Clean Development Mechanism (CDM) under the United Nations Framework Convention on Climate Change (UNFCCC) or various regional carbon markets. The revenue generated from selling carbon credits funds the further development of more nature-based projects that sequester more carbon and empower more local communities and habitats.

Integrate trees into your business

We can help your company become more sustainable by integrating trees into your business.

What are the different types of carbon credits?

There are several types of carbon credits, which can be classified based on the type of project that generates them or the standard used to certify them. Here are some examples:

- Forestry credits: These green carbon credits are generated by afforestation, reforestation, or avoided deforestation projects. Forests absorb and store atmospheric CO2, making them a key tool in mitigating changing environmental conditions.

Read more: How forest carbon credits are changing the wood market

- Verified Carbon Standard (VCS) credits: These credits are certified under the Verified Carbon Standard, a widely recognised and respected standard for carbon offsets. VCS credits are generated by various projects, such as renewable energy, forestry, and energy efficiency.

- Gold Standard (GS) credits: These credits are certified under the Gold Standard, which is a standard that requires high levels of environmental and social sustainability in addition to carbon reduction. GS credits are generated by renewable energy, energy efficiency, sustainable agriculture, and forestry projects.

- Carbon Capture and Storage (CCS) credits: These credits are generated by projects that capture CO2 emissions from industrial processes or power generation and store them underground or in other long-term storage facilities.

- Renewable Energy credits (RECs): These are carbon credits generated by renewable energy projects, such as wind, solar, hydro, or biomass. The carbon emissions avoided by generating electricity from renewable sources can be translated into carbon credits.

- Energy Efficiency credits: These credits are generated by projects reducing energy consumption and promoting energy efficiency. Examples include building retrofits, lighting upgrades, and installation of more efficient heating and cooling systems.

These are just a few examples of the carbon credit types. Each type of credit has unique characteristics and can play an important role in reducing carbon emissions and promoting sustainable development.

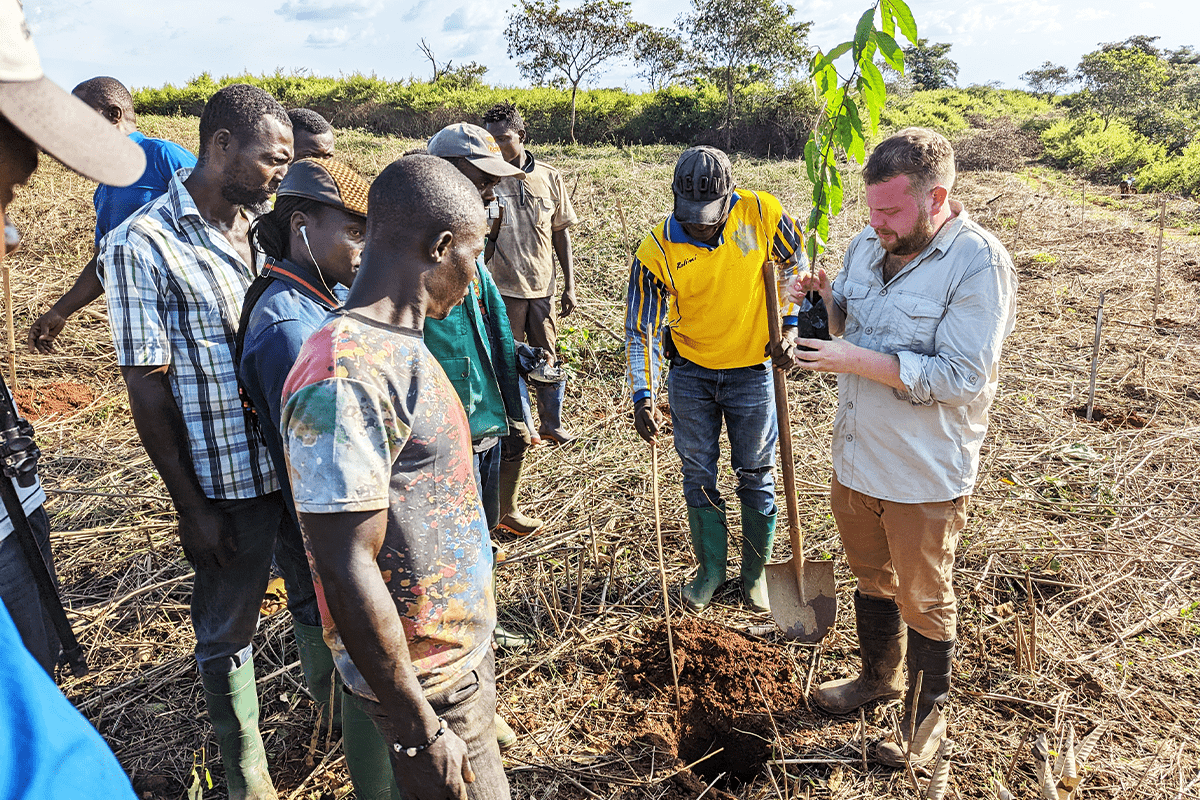

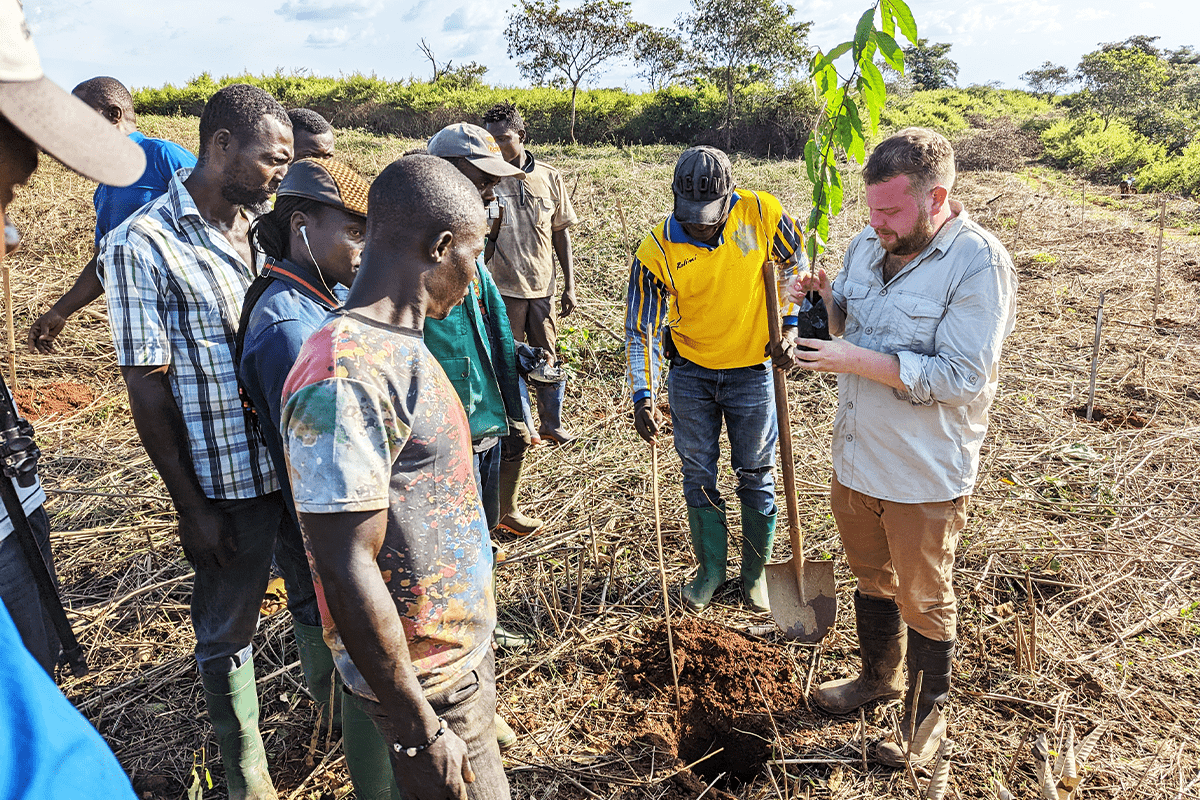

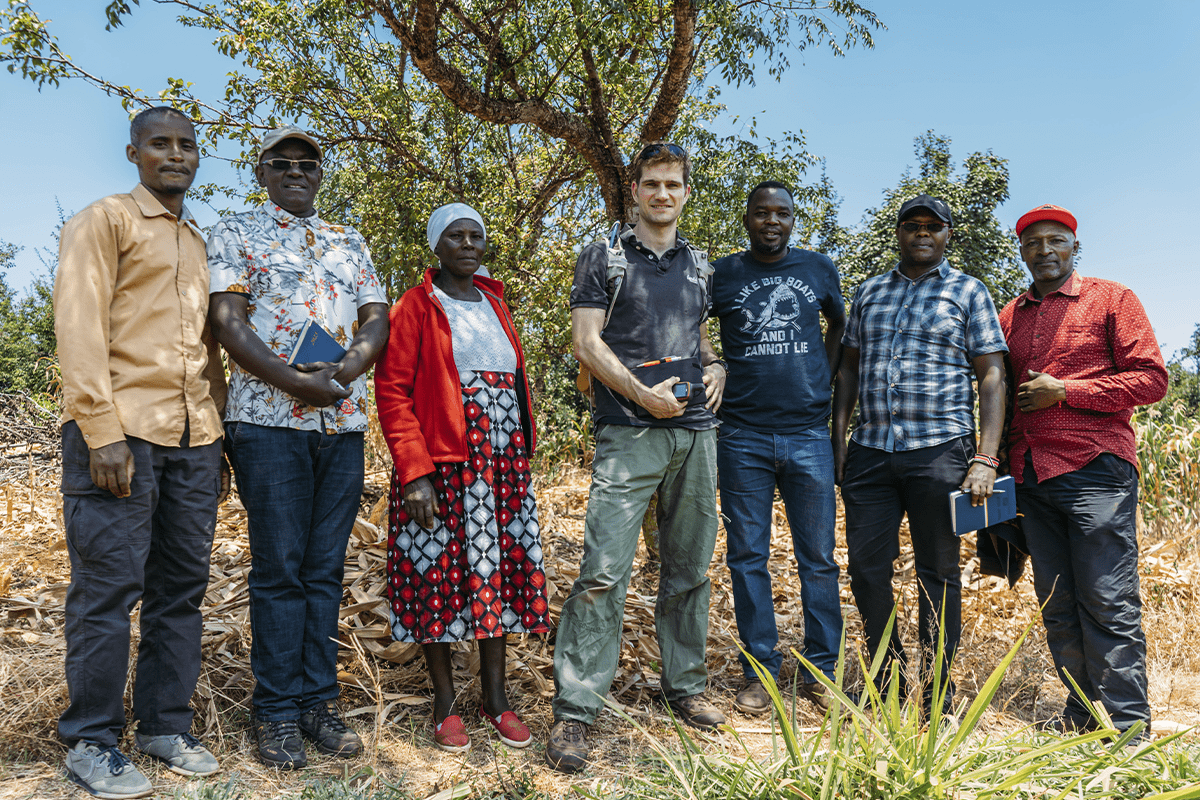

Nicholas Wall providing training, Afforestation Project, Cameroon, Green Earth.

Benefits of carbon credits

Carbon credits benefit nature, ecosystems, communities, agriculture, and economic development. They encourage organisations, businesses, and governments to invest more in nature and at a larger scale. Below we will review the benefits of carbon credits in further detail.

Environmental benefits of carbon credits

- Reducing carbon emissions: The primary environmental benefit of carbon credits is that they help reduce carbon emissions, the leading cause of changing environmental conditions. By creating an emissions reduction market, carbon credits provide a financial incentive for companies and individuals to reduce their carbon footprint, invest in nature and clean energy, and implement carbon reduction measures.

- Conserving nature at scale: Green carbon credits enable large investments in nature-restoration projects, therefore making a tangible positive impact in forests and wetlands. Nature-based solutions such as afforestation, reforestation, and nature conservation are among the best ways to originate high-quality carbon credits.

- Promoting sustainable land use: Carbon credits generated by forestry and land-use projects encourage sustainable land-management practices, such as agroforestry and regenerative agriculture. These projects help reduce carbon emissions and provide a range of co-benefits, including community education, biodiversity conservation, soil erosion control, and improved water quality.

Corn field.

- Fostering sustainable development: Carbon credits support sustainable development by financing carbon farming, sustainable land use, community carbon projects, renewable energy, and energy efficiency. This can help address energy poverty and reduce emissions in regions that are growing the fastest.

- Encouraging renewable energy development: Renewable energy projects, such as wind and solar power, generate carbon credits by displacing fossil fuels and reducing carbon emissions. By incentivising renewable energy development, carbon credits promote the transition to a low-carbon economy and reduce our dependence on fossil fuels.

Read more: 100 Reasons carbon credits are the best thing that ever happened to improve conditions on our planet

Social benefits of carbon credits

- Supporting local communities: Many carbon credit projects, such as those involving carbon farming and sustainable land use, directly benefit local communities. For example, reforestation projects can create jobs and improve local air quality. Locals get comprehensive training on sustainable practices, how to plant and protect trees, and other vital subjects that influence their relationship with their ecosystems. Sustainable land-use projects provide income for local communities through sustainable agriculture and forest management practices.

- Improving health: Carbon credits help reduce air pollution and improve public health. Carbon projects can reduce particulate matter emissions and other pollutants that can cause respiratory problems and other health issues. Energy-efficient cookstoves projects can also reduce indoor air pollution, improving the health of the whole family.

- Promoting social equity: Carbon credits can be designed to promote social equity by ensuring the benefits of emissions reductions are distributed fairly. This can involve working closely with local communities to ensure they are engaged in the design and implementation of carbon credit projects and receive a fair share of the benefits.

- Supporting environmental justice: Carbon credits can support the principles of environemtnal justice by providing a way for developed countries to help finance emissions reductions in developing countries. This ensures that the burden of reducing carbon emissions is shared fairly across the global community.

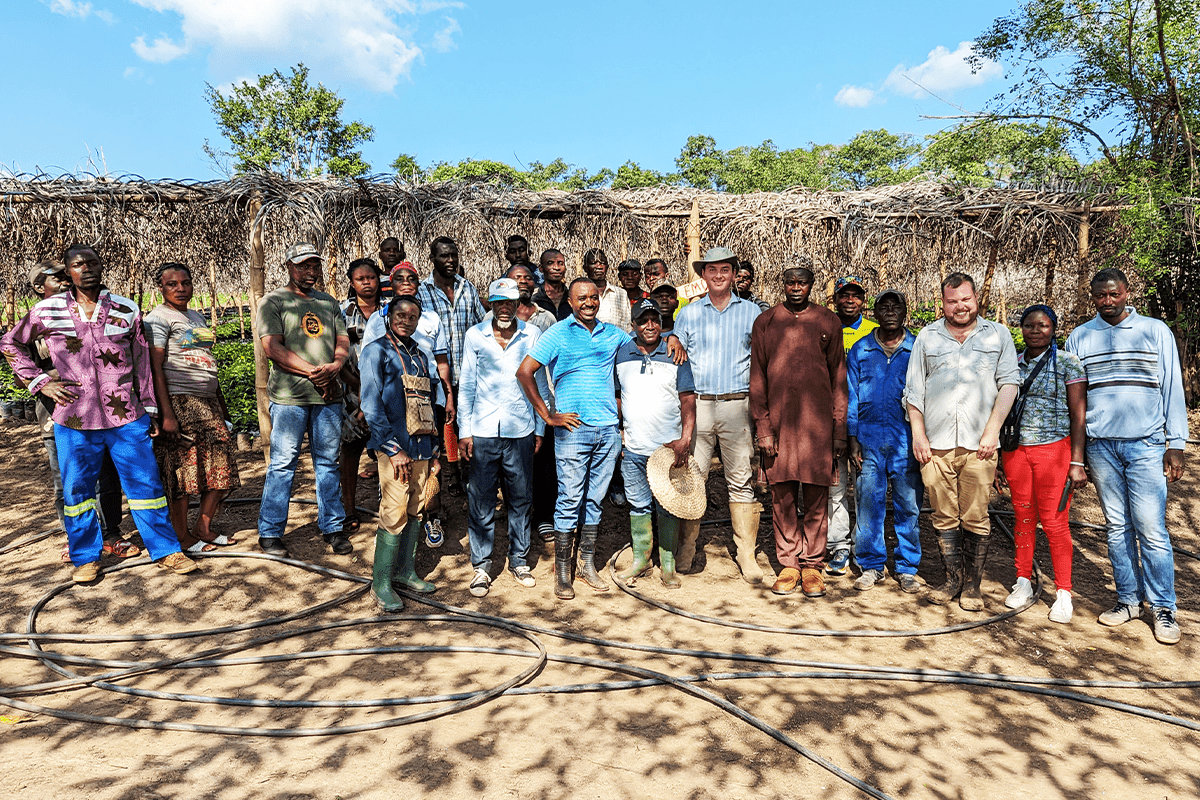

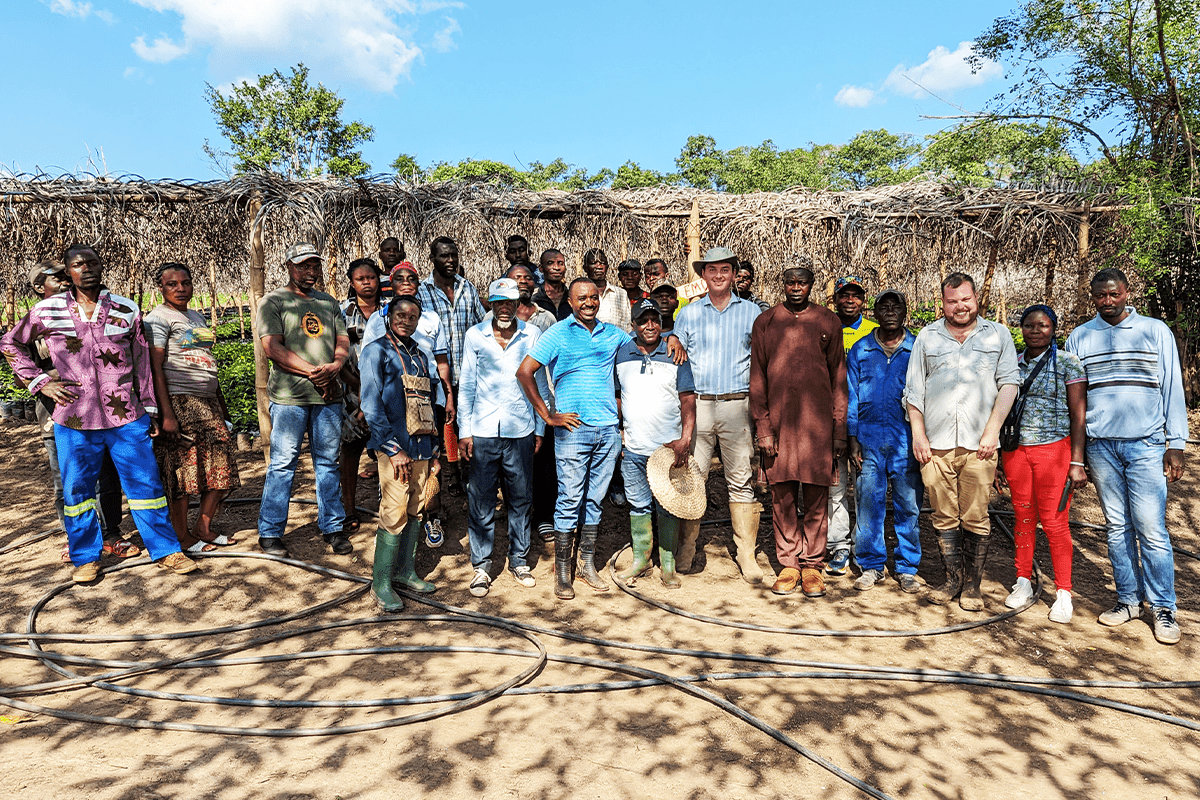

The Green Earth team with locals, Greenzone Afforestation Project, Cameroon, Green Earth.

Economic benefits of carbon credits

- Stimulating investment in nature conservation: Carbon credits provide a financial incentive for companies to invest in nature conservation which helps reduce emissions and promote economic growth through fertile soils providing increased yields, improved water supply, and ecosystem restoration. In addition, it can create opportunities for ecotourism.

- Creating new jobs: Carbon credit projects, like carbon farming and reforestation projects, can create jobs in sectors such as agriculture, construction, manufacturing, and installation. Reforestation and afforestation projects provide job opportunities and income for local villagers.

- Generating revenue: Selling carbon credits can generate revenue for companies and individuals that reduce emissions. This provides an additional revenue stream and helps offset the costs of investing in low-carbon technologies.

- Encouraging innovation: Carbon credits provide a financial incentive to develop new low-carbon technologies and practices. This can lead to more new products and services that benefit society, nature, and companies that tap into $7 trillion worth of nature-based markets.

- Supporting sustainable development: Carbon credits support sustainable development by financing nature-based, carbon farming, land-use, renewable energy, and energy efficiency projects. Carbon credits can create new economic opportunities in the agriculture, forestry, and clean energy sectors.

- Facilitating international cooperation: Carbon credits can facilitate international cooperation by providing a way for developed countries to help finance emissions reductions in developing countries. They help to build trust and promote collaboration to protect and restore nature and natural habitats globally.

Theo Oben - Greenzone Afforestation Project, Cameroon, Green Earth.

Read more: Carbon neutral vs carbon positive: What is the difference and which is better?

The carbon credit market

The global carbon market is designed to incentivise emissions reductions and provide a market-based approach to address increasing carbon emissions. It is a system of buying and selling carbon units.

Read more: The interconnected world of carbon: exploring key carbon market concepts

The global carbon market comprises two main types of markets: compliance markets and voluntary markets.

- Compliance markets are regulated by government bodies and require companies to meet emissions reduction targets. Companies that exceed their targets can sell their excess reductions as carbon credits. The largest compliance market is the European Union Emissions Trading System (EU ETS), covering over 40% of Europe's emissions.

- Verified (voluntary) markets are not regulated by governments, and companies can participate voluntarily. Organisations purchase carbon credits to offset their carbon footprint, and the credits are typically used for corporate social responsibility (CSR) programmes or to meet sustainability targets.

The global carbon market has experienced significant growth over the past few years. Most of the market (76%) is made up of compliance markets, while voluntary markets account for the remaining 24%.

In 2020, the market grew to an estimated $273 billion. In 2022, the value of traded global markets for carbon credits reached a record €850 billion ($909 billion). 12.5 billion tonnes of carbon credits changed hands in the world's emissions markets, and the value of markets rose by 14% as carbon credit prices were much higher compared to 2021.

Carbon financing is emerging as one of the smartest bets for future-proof investing—particularly when working with established project developers whose low loan-to-value (LTV) ratios offer investors greater confidence and security.

Read more: Why carbon credits are a smarter investment than Bitcoin

Who are the key players in the global carbon market?

The carbon credit market involves various players, including governments, corporations, project developers, carbon credit brokers, and verification and certification bodies. Here are some key players in the carbon credit market.

- Governments: Governments play a key role in the carbon credit market by implementing regulations and policies that drive demand for carbon credits. They also create compliance markets, such as the EU ETS, and participate in voluntary carbon-offset programmes.

- Corporations: Many corporations participate in the carbon credit market by purchasing carbon credits to offset their carbon emissions, meet sustainability targets, or fulfil CRS goals.

- Project developers: Project developers are responsible for developing carbon reduction projects, such as afforestation, reforestation, nature conservation, renewable energy, or energy efficiency projects. For example, Green Earth is among the leading project developers focusing on reforestation, habitat restoration, and energy-efficient cookstove projects.

Read more: Who’s who in the carbon market: Key institutions and frameworks and what they do

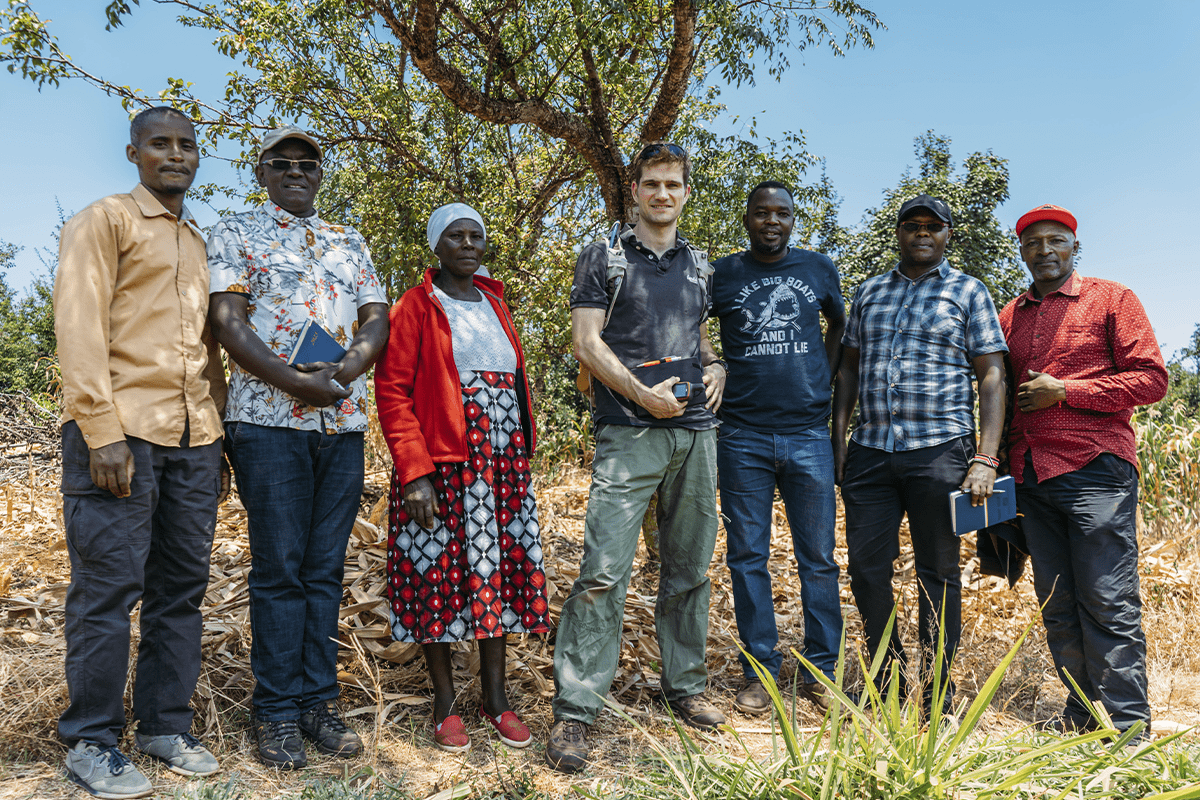

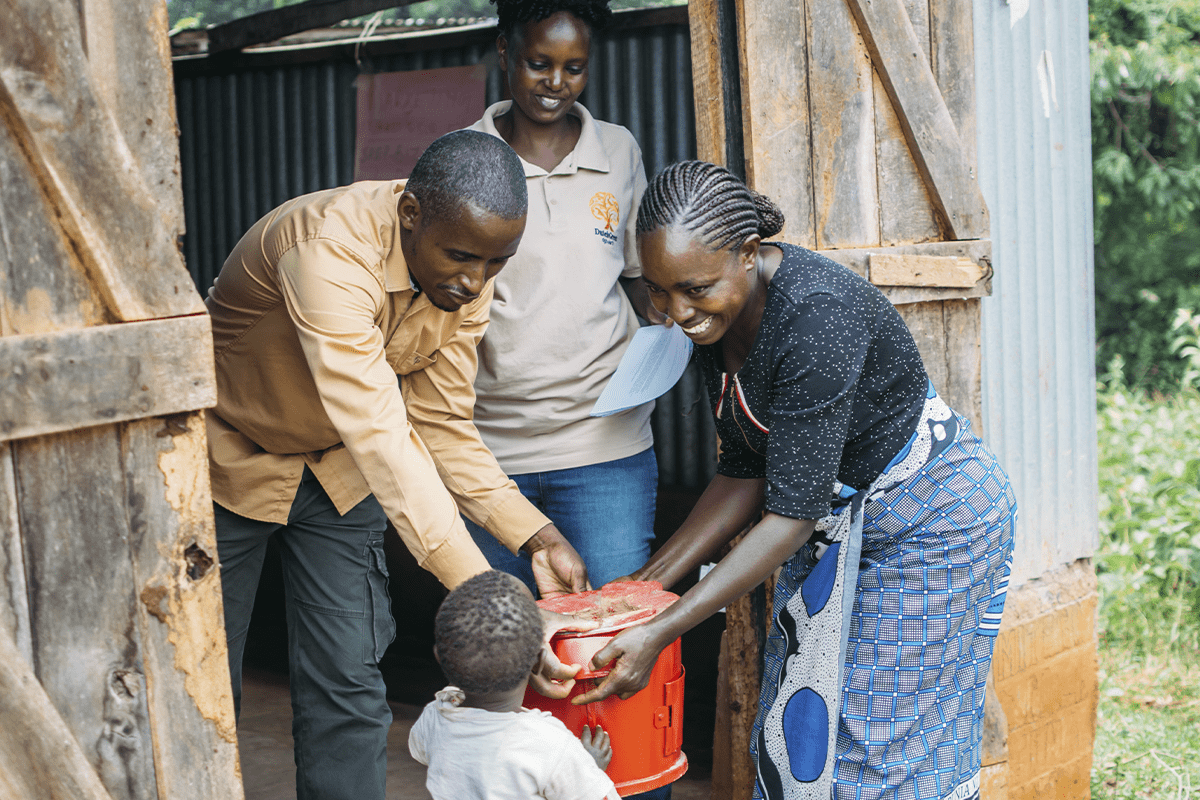

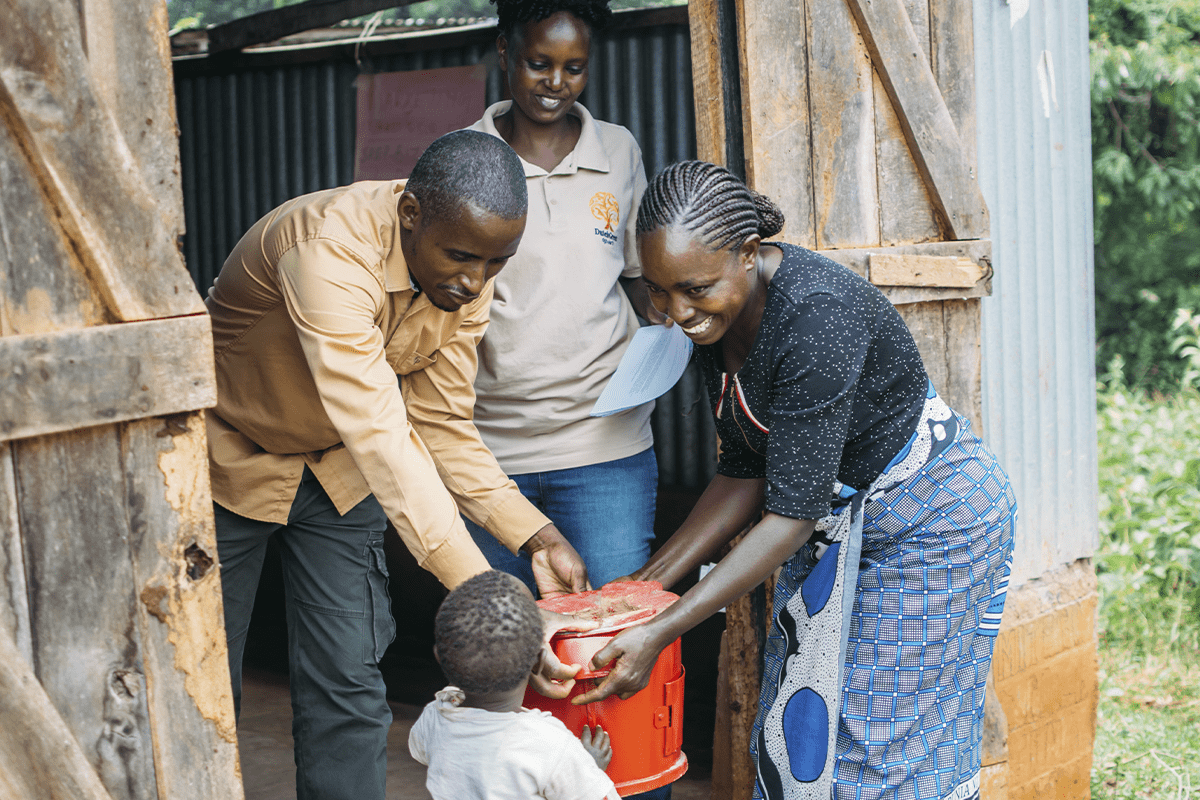

The Green Earth team with locals, Hongera Energy Efficient Cookstoves Project, Kenya, Green Earth.

What determines the carbon credit price?

Carbon credits are traded in the global carbon market, which operates as a two-sided market, with buyers and sellers of carbon credits. The trading and pricing of carbon credits vary depending on the type of market, compliance or voluntary, and the specific trading platform or exchange.

Read more: Cracking the code of carbon pricing: How does it work?

In compliance markets, the carbon credit price is determined by supply and demand, as well as regulatory mechanisms such as the cap-and-trade system. Companies unable to meet their emissions reduction targets must purchase carbon credits to offset their excess emissions. This creates demand for carbon credits, driving up the price. Conversely, companies that have reduced their emissions below their targets can sell their excess credits, increasing supply and leading to a decrease in price.

In verified (voluntary) markets, the price of carbon credits is typically determined by the buyer and seller in a negotiation process. The price can vary widely, depending on factors such as the type and quality of the carbon credits, the project size, and the specific market or exchange. Carbon credit prices are often set through contracts, which specify the quantity and quality of the credits, the price, and the delivery date.

Read more: Carbon pricing: global solutions for a global challenge

Various factors, including government policies and regulations, economic trends, and market demand, can influence the price of carbon credits. Carbon credits can also be influenced by environmental factors such as weather patterns and natural disasters, which can impact emissions reductions.

The pricing of carbon credits is typically expressed in terms of a cost per metric tonne of CO2e. Prices range widely, from a few dollars to over $100 per metric tonne, depending on the specific market and the quality of the credits. The price of carbon credits can significantly impact the scale of emissions-reduction projects, as higher prices can provide greater financial incentives for companies to reduce their carbon footprint and invest in carbon-reduction projects.

Read more: High-quality carbon credits vs regular carbon credits: what sets them apart?

Let us inform you

We will keep you updated on all the latest news.

Carbon credits and reducing carbon emissions

How do carbon credits help reduce carbon emissions?

Carbon credits make investing in nature, planting trees, and conserving land financially attractive. Giving a price to carbon emissions creates a system where governments, businesses, and individuals can calculate their carbon footprint and offset their negative environmental impact. As a result, carbon emissions are reduced and offset at a large scale.

Read more: How to use Green Earth's carbon footprint calculator on your journey to net zero

Carbon credits provide an opportunity to measure and make tangible steps towards sequestering CO2 at a large scale. It also attracts much-needed attention and investments in nature restoration and the protection of ecosystems.

Read more: Carbon footprint measurement: a practical guide

Types of carbon credit projects

There are many different types of carbon credit projects that can be undertaken to reduce carbon emissions. We discuss a few below:

- Afforestation and reforestation projects involve planting new forests or restoring degraded forests. Trees absorb CO2 from the atmosphere and prevent it from entering the atmosphere. Project developers, like Green Earth, bring ecologists and local communities together to design and manage reforestation projects. We have several large-scale projects to plant millions of trees to conserve nature and natural habitats. Each project is evaluated and certified by an independent third party to ensure it meets strict emissions reduction and sustainable development standards.

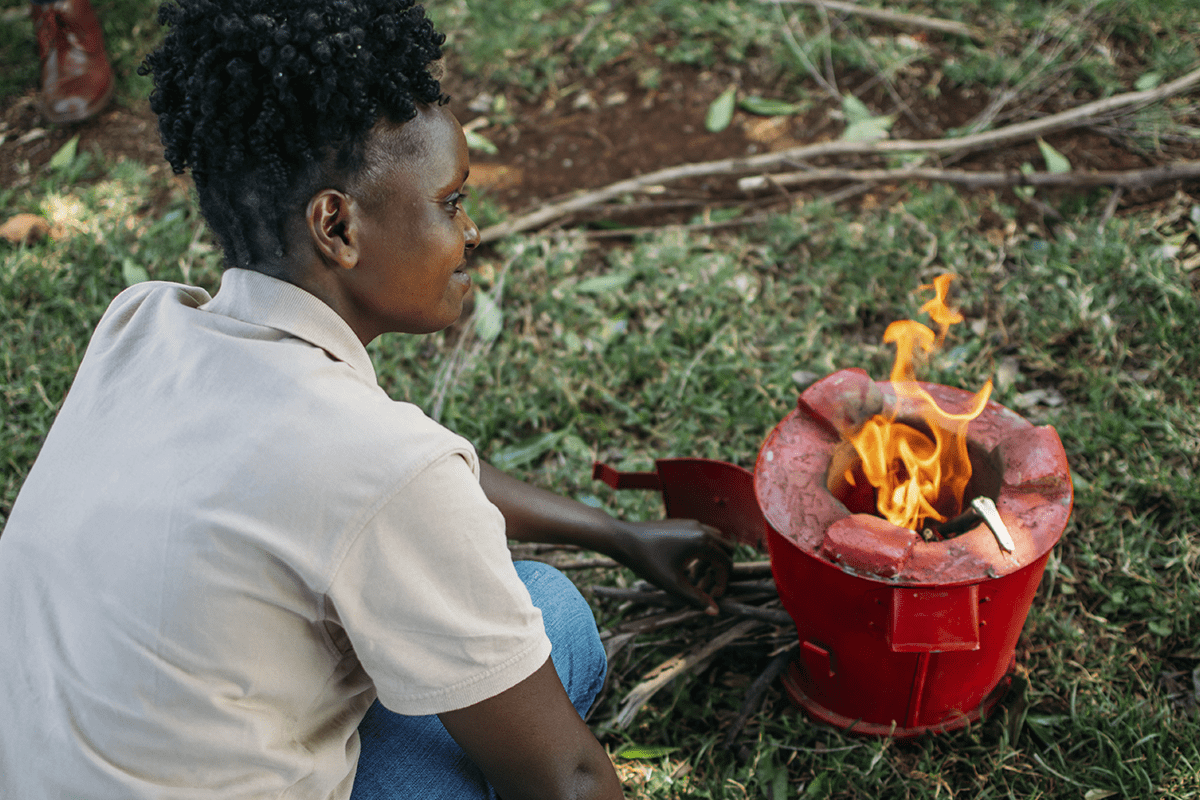

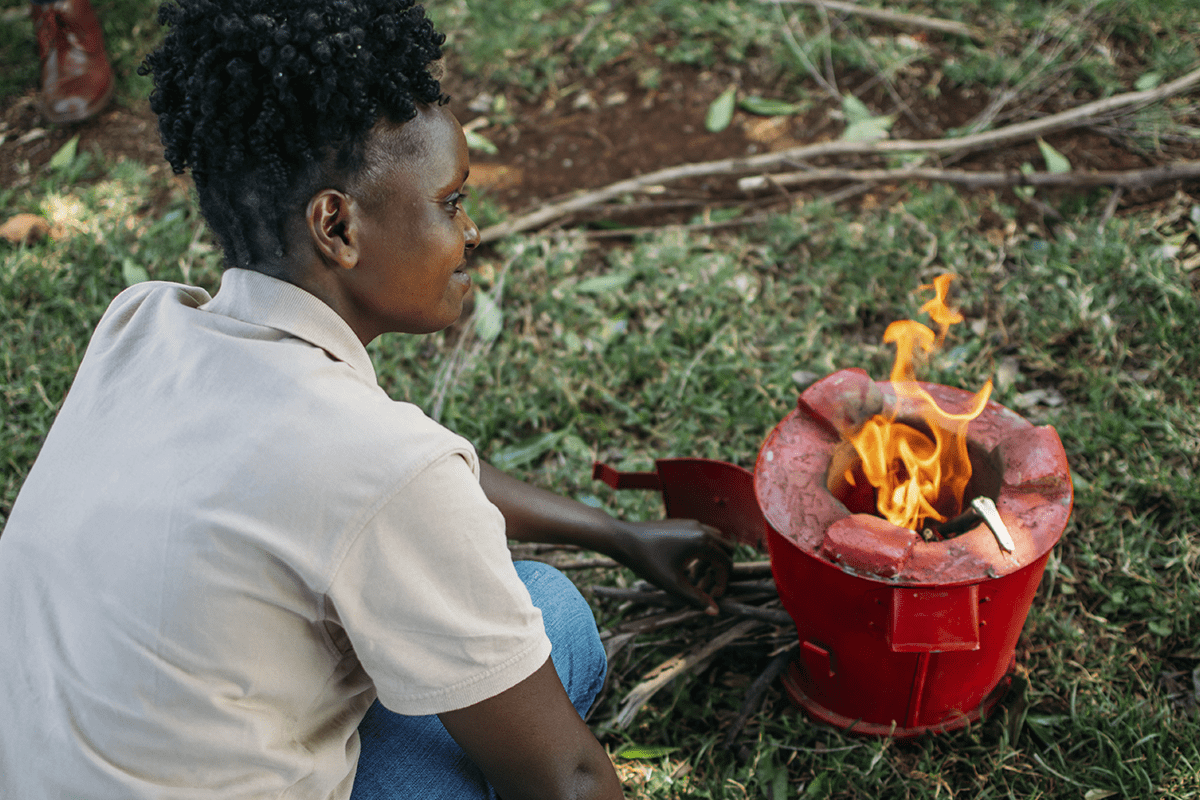

- Energy efficiency projects focus on reducing energy consumption and improving efficiency in buildings, factories, and other facilities. For example, Green Earth has energy-efficient cookstove projects in Cameroon and Kenya. 2.6 billion people depend on wood and charcoal as their primary fuel source. Therefore, it is essential to develop a cookstove that helps them use natural resources in the most efficient way possible. This leads to less deforestation, air pollution, and carbon emissions.

Woman with energy-efficient cookstove, Hongera Energy Efficient Cookstoves Project, Kenya, Green Earth.

- Renewable energy projects generate clean energy from renewable sources such as wind, solar, and hydropower. By investing in these projects, companies can earn carbon credits and offset their emissions.

- Methane capture and utilisation projects involve capturing methane emissions and using the gas as a fuel source. Methane is a potent greenhouse gas released during the production of oil and gas, as well as from landfills and agricultural operations. By investing in these projects, companies can earn carbon credits.

- Carbon capture and storage (CCS) projects involve capturing CO2 emissions from industrial processes and power generation, storing them underground, or repurposing them for other uses. By investing in CCS projects, companies can earn carbon credits and offset emissions.

Challenges of carbon credits

- Additionality: One of the biggest challenges of carbon credits is ensuring that the carbon reduction would not otherwise have occurred without the carbon project. This requires careful monitoring and verification to ensure projects are leading to actual emissions reductions.

- Measurement and verification: Measuring the emissions reductions achieved by a carbon credit project is complex. It requires accurate measurement and monitoring of both the baseline emissions and the emissions reductions achieved. Verification is also needed to ensure the emissions reductions are permanent and sustainable.

- Leakage: Leakage occurs when emissions reductions in one area lead to increased emissions in another. For example, if a carbon credit project reduces emissions in one region, but the same emissions are shifted to another, then the overall impact on emissions is limited. Leakage can be challenging to measure and control, and it can diminish the effectiveness of carbon credit projects.

- Permanence: Some carbon credit projects rely on long-term carbon storage in trees and other biomass. However, there is always the risk that the carbon stored will be released back into the atmosphere due to natural events such as wildfires or deforestation. Ensuring the permanence of emissions reductions achieved through carbon credits can thus be challenging.

Read more: Net zero and a circular economy: Top 3 opportunities and challenges

Thomas Donia, Hongera Energy Efficient Cookstoves Project, Kenya, Green Earth.

These challenges require carbon project developers to have more transparent and tangible operations in place. The strict rules of verifying bodies, such as Gold Standard and Verra, help global carbon markets grow in the right direction, ensuring the growth of the carbon market, the development of impactful projects, the generation of high-quality credits, and the establishment of a decarbonised economy.

Read more: Overcoming sustainability challenges: practical solutions for your business

Our projects

We develop large-scale, impactful projects.

Carbon credits and corporate social responsibility

Benefits for companies to participate in carbon-credit programmes

- Public relations: By participating in carbon-credit programmes, companies demonstrate their commitment to reducing carbon emissions and being environmentally responsible. This can improve their reputation and help them attract environmentally conscious customers and investors.

- Compliance: In some regions, companies may be required to meet emissions reduction targets or pay a penalty. Participating in carbon-credit programmes can help companies meet these requirements and avoid penalties.

- Innovation: Carbon-credit programmes can incentivise companies to invest in new technologies and processes that reduce emissions. This can lead to innovation and new, more sustainable business models.

- Access to new markets: Some carbon-credit programmes, such as the EU ETS, allow companies to trade carbon credits globally. This can provide new opportunities for companies to generate revenue and access new markets.

Read more: What is CSRD and how does it affect your business?

Locals with energy-efficient cookstove, Hongera Energy Efficient Cookstoves Project, Kenya, Green Earth.

Carbon credits in corporate social responsibility (CSR) strategies

Carbon credits play an important role in CSR strategies because they enable companies to offset their carbon emissions, demonstrate their commitment to environmental sustainability, and enhance their brand reputation among stakeholders. The social responsibility aspect of business is becoming increasingly important to stakeholders, including customers, investors, and employees, who demand that companies take proactive steps for their environmental impact.

Read more: Aligning with CSRD: the smart move for future-proofing your business

Which companies are buying carbon credits?

Many companies from different industries are buying carbon credits for sustainability strategies. Here are some examples of companies that have purchased carbon credits.

Microsoft pledged to become carbon negative by 2030 and invested in several carbon-reduction projects, including buying carbon credits from reforestation initiatives and renewable energy projects.

Apple committed to becoming carbon neutral by 2030 and purchased carbon credits to offset its emissions from manufacturing, transportation, and other activities.

Amazon pledged to reach net-zero carbon emissions by 2040 and invested in renewable energy projects and forest conservation initiatives, among other efforts.

BP committed to becoming a net-zero company by 2050, investing in carbon capture and storage projects and purchasing carbon credits from reforestation and other carbon-reduction initiatives.

Unilever committed to becoming carbon neutral by 2030 and purchased carbon credits to offset its emissions from manufacturing, logistics, and other operations.

Delta Airlines committed to becoming carbon neutral by 2030 and purchased carbon credits to offset its emissions from flights and other activities.

Leading companies in the Netherlands, Germany, Ireland, Belgium, UK, and Spain as well as world-famous companies in sport are also taking action, and becoming more sustainable through carbon compensation. They prove that compensating for emissions now is a proactive approach to sustainability, and complementary to other carbon reduction efforts.

These are just a few examples of companies that have purchased carbon credits, but many more are following suit as part of their efforts to reduce their carbon footprint and mitigate the impacts of rising emissions.

Carbon credits and Sustainable Development Goals

The role of carbon credits in Sustainable Development Goals

Carbon credits are linked to several Sustainable Development Goals (SDGs) established by the United Nations. The following are examples of how carbon credits support SDGs:

- SDG 7 - Affordable and Clean Energy: Carbon credits support the transition to clean energy sources by incentivising the development of renewable-energy projects and energy-efficient measures.

- SDG 13 - Climate Action: Carbon credits support climate action by incentivising emissions reduction projects, which are essential to achieve the sustainability goals in the 2015 Paris Agreement.

- SDG 14 - Life Below Water: Carbon credits can be generated via marine conservation projects, like mangrove reforestation, which provide important habitats for marine life and can sequester carbon.

- SDG 15 - Life On Land: Carbon credits can become a part of land-restoration and reforestation projects, which are vital for protecting biodiversity, combatting desertification, and mitigating changing environmental conditions.

- SDG 17 - Partnerships for the Goals: Carbon credits provide a mechanism for public-private partnerships to support SDGs by creating incentives for businesses to invest in emissions-reduction projects in developing countries.

Overall, carbon credits are closely linked to several SDGs and can be essential in achieving these goals by providing a mechanism for funding emissions-reduction projects.

Read more: Preparing for the future: How SMEs can align with net-zero targets

How do carbon credits help achieve Sustainable Development Goals?

Carbon credits play a vital role in achieving SDGs by providing a mechanism for funding emissions-reduction projects. Here are some ways carbon credits are important for achieving SDGs:

- Carbon credits provide the needed funding for carbon-reduction projects, such as reforestation, nature conservation and ecosystem restoration projects.

- Addressing poverty and inequality are among the benefits of carbon-credit projects. They provide income and employment opportunities for communities and marginalised groups in developing countries.

- Carbon-credit projects promote the development of nature restoration and habitat protection measures. In addition, it brings nature-friendly alternatives to local households and helps them incorporate new practices that are both good for their health and surrounding ecosystems.

- Projects that generate carbon credits benefit the conservation and restoration of forests, wetlands, and other ecosystems, supporting biodiversity and sustainable land-use practices.

- Carbon credits promote public-private partnerships to invest in sustainable development projects. These partnerships help mobilise private sector investment in sustainable development projects and support the achievement of multiple SDGs.

Avocado fruit in a tree.

Examples of carbon credit projects contributing to Sustainable Development Goals

Hongera Reforestation Project (Mt Kenya and Aberdares)

Green Earth, in partnership with the Applied Institute of Agriculture and Technology of Kenya, will plant 16.97 million trees in Kenya over a period of seven years, empowering 50,000 families. It includes fruit trees and indigenous and fast-growing trees as part of Green Earth’s drive to rapidly accelerate reforestation and generate Verified Carbon Units (VCUs).

Like our other projects, the reforestation project in Kenya offers diverse benefits for nature, ecosystems, and local communities. The project aligns with SDG 15, Life On Land and SDG 17, Partnerships for the Goals. The reforestation project in Kenya sequesters carbon, protects biodiversity and helps combat desertification in areas where forests have been degraded or destroyed.

Energy-efficient cookstoves projects in Cameroon and Kenya

We are working with local communities in Kenya and Cameroon to replace their conventional stoves with energy-efficient alternatives that align with SDG 13, Climate Action and SDG 17, Partnerships for the Goals. These stoves use less wood, reducing deforestation. They also help reduce indoor air pollution. As part of these programmes, we will distribute 300,000 cookstoves to households, effectively offsetting over 4 million metric tonnes of CO2 emissions.

Read more: Green Earth’s cookstove projects: How they truly make a difference

Local woman with energy-efficient cookstove, Hongera Energy Efficient Cookstoves Project, Kenya, Green Earth.

Carbon credits: the solution for nature restoration

The future of carbon credit markets

Carbon credits are an effective and timely tool to develop a more nature-conscientious way to live and do business. When combined with transparency and industry-leading standards, carbon credits offer tangible environmental and social benefits.

Read more: Industry carbon footprints: transport, events, and celebrities

Carbon credits are a sign that taking care of nature is no longer a nice-to-have, but a prerequisite to becoming a sustainable business or government. As many companies and countries look for ways to offset their emissions, the carbon credit market will likely grow and mature, settling to become a regular aspect of a decarbonised economy.

Read more: Why we need to restore high-priority areas like Africa

Access transparent and quality carbon offsets with Green Earth

At Green Earth, we are working with businesses and investors to help them tap into the rapidly growing global carbon market. We develop verified carbon units through large-scale, nature-based solutions such as reforestation, afforestation, and energy-efficient cookstove projects. Both large and small companies, governments, or individuals can partner with us to plant trees to offset their carbon emissions. You can start by calculating your carbon footprint or directly contact our team for customised solutions for you.