The Corporate Sustainability Reporting Directive (CSRD) is a significant regulatory development aimed at enhancing transparency and accountability in corporate sustainability practices within the European Union. This directive broadens the scope of companies required to report on their sustainability efforts and introduces more detailed and standardised reporting requirements.

Close-up of a tree seedling leaf, a man planting trees in the background. AI generated picture.

Close-up of a tree seedling leaf, a man planting trees in the background. AI generated picture.

In this blog, we will delve into what CSRD entails, the key features of the directive, its compliance requirements, its impact on small and medium-sized enterprises (SMEs), and its strategic implications for businesses. Additionally, we will explore how partnering with DGB Group can help businesses navigate the complexities of CSRD compliance with regard to their carbon footprint.

Understanding CSRD

The Corporate Sustainability Reporting Directive (CSRD) is an EU regulation designed to enhance the transparency and accountability of corporate sustainability practices. It requires companies to disclose comprehensive information on how they manage and address social and environmental challenges. By replacing and expanding the previous Non-Financial Reporting Directive (NFRD), CSRD aims to create a more consistent and detailed framework for sustainability reporting across Europe.

Read more: Aligning with CSRD: the smart move for future-proofing your business

The CSRD builds on the foundation laid by the NFRD but introduces several key enhancements. Unlike the NFRD, which applied primarily to large public-interest entities, the CSRD encompasses a broader range of companies, including large private companies and listed SMEs. This expansion aims to increase transparency and ensure that a greater number of businesses contribute to sustainable development.

The primary goals of the CSRD are to standardise sustainability reporting, making it easier to compare and assess companies' environmental and social impacts, and to drive accountability. As businesses increasingly focus on Environmental, Social, and Governance (ESG) metrics, understanding the implications of CSRD is crucial. By mandating detailed disclosures, the directive encourages businesses to adopt more sustainable practices and address their ESG responsibilities comprehensively.

Measure your environmental impact today

Key differences from NFRD

One of the significant changes introduced by the CSRD is the broader range of companies it affects. While the NFRD targeted approximately 11,700 large public-interest entities, the CSRD extends its reach to around 50,000 companies across the EU. This includes large EU companies, listed SMEs, and certain non-EU entities with substantial operations within the EU.

The CSRD introduces more comprehensive reporting requirements compared to the NFRD, making it easier for stakeholders to assess corporate performance. It emphasises double materiality, which assesses both the sustainability risks affecting a company and its impact on society and the environment. It mandates forward-looking qualitative and quantitative information, including targets and progress. Additionally, companies must report on intangible assets such as social, human, and intellectual capital. Reporting must also align with the Sustainable Finance Disclosure Regulation (SFDR) and the EU Taxonomy, ensuring greater transparency and consistency in sustainability reporting.

Illustration showing different directives.

Illustration showing different directives.

Another key difference is the inclusion of all three scopes of emissions. Under the CSRD, companies are required to report on Scope 1 (direct emissions), Scope 2 (indirect emissions from purchased energy), and Scope 3 (all other indirect emissions). This comprehensive approach ensures that stakeholders have a clear understanding of a company's overall environmental impact.

Read more: Uncovering the impact of Scope 3 emissions

Corporate sustainability reporting overview

Corporate sustainability reporting has become a cornerstone of business performance. It has transitioned from voluntary disclosures to a structured requirement under initiatives like CSRD. This evolution reflects the growing recognition of the importance of sustainability in corporate performance and risk management. By providing detailed information on ESG metrics, companies can offer stakeholders a comprehensive view of their sustainability efforts and risks, facilitating better decision-making and strategic planning.

Sustainability efforts extend beyond mere compliance. Companies that embrace sustainability reporting can build a reputable brand that resonates with modern consumers and investors who prioritise environmental responsibility. Additionally, as larger companies seek sustainable suppliers, SMEs that adopt these practices gain a competitive edge, securing more business opportunities and fostering stronger partnerships.

Read more: The power of sustainability: Why investing in sustainability drives faster company growth

Key features of CSRD

The CSRD introduces new rules that integrate sustainability with financial reporting, providing a unified view of a company's economic performance and its environmental and social impact. Your sustainability report must form part of your financial statements and should be added to your management report. This comprehensive approach aims to enhance transparency and accountability, making it easier for stakeholders to assess corporate sustainability efforts and risks.

Download CSRD brochure

The CSRD's double materiality concept requires companies to evaluate both the inward impact of ESG factors on their business and the outward impact of their operations on the environment and society. Companies must conduct a double materiality assessment to identify relevant disclosures and data points, ensuring transparency for stakeholders. By 2026, companies must also obtain limited assurance from a third-party auditor for their sustainability information, and by 2028, they will need reasonable assurance, confirming the accuracy of their ESG reports.

The CSRD recognises that different industries face unique sustainability challenges and opportunities. As such, it requires sector-specific disclosures, which will be guided by the upcoming European Sustainability Reporting Standards (ESRS). These tailored requirements ensure that sustainability reports address the specific needs and impacts of each industry.

Read more: Industry carbon footprints: transport, events, and celebrities

Compliance requirements

Sustainability reporting will be done at the group level by parent entities of a large group. Under the CSRD, companies must disclose a wide range of information to provide a clear and comprehensive view of their sustainability impacts and practices. This includes:

-

General company information: such as strategy, implementation, and performance related to sustainability.

-

Environmental factors: like your impact on climate, pollution, water and marine resources, biodiversity, and resource management.

-

Social factors: including your workforce and value chain workers, community impacts, and consumer rights.

-

Governance matters: such as business conduct, board responsibilities, and stakeholder policies.

Independent third-party verification is crucial to ensuring the credibility and compliance of sustainability reports. Auditors will review the reports to confirm that they meet CSRD standards and accurately reflect the company's sustainability practices.

Read more: The importance of carbon offsetting in achieving net zero

Timeline for compliance

The compliance dates for the CSRD are staggered, starting in 2025 for companies previously under the NFRD, with SMEs and foreign companies following in subsequent years. The implementation timeline for CSRD is structured to give companies time to adapt.

Illustration showing CSRD timeline.

Illustration showing CSRD timeline.

Who needs to comply?

The CSRD is mandatory for a broad range of companies within the EU, including large companies, listed SMEs, and certain non-EU entities with significant operations in the EU:.

- large EU companies, whether they are publicly listed or not, and include EU and non-EU subsidiaries, that meet two of the following three criteria:

-

-

250+ employees

-

€50+ million in net turnover

-

€25+ million in total assets

- listed EU SMEs, except micro undertakings that don’t meet at least two of the following three criteria:

-

-

50+ employees

-

€8+ million in net turnover

-

€4+ million in total assets

- certain non-EU companies that operate within the EU market generating a turnover of €150 million or more within the EU and own at least one of the following:

-

-

a large EU-based subsidiary

-

a subsidiary with securities listed in the EU

-

a branch with €40 million in net turnover

While listed SMEs have a staggered compliance timeline, starting in 2027 with an optional two-year deferral, non-EU companies with significant EU operations must also comply. This extraterritorial impact ensures that all businesses operating in the EU adhere to the same sustainability standards, promoting a level playing field and driving global sustainability practices.

Read more: 100 Reasons carbon credits are the best thing that ever happened to improve conditions on our planet

Impact on SMEs

While the CSRD primarily targets larger corporations, its impact on SMEs cannot be overlooked. As larger companies enhance their sustainability practices, they will likely expect the same from their suppliers and partners, many of whom are SMEs. This creates a ripple effect, compelling smaller businesses to adopt similar standards to remain competitive, maintain business relationships, and become a sustainable partner.

A woman planting a tree seedling. AI generated picture.

A woman planting a tree seedling. AI generated picture.

Early engagement in sustainability reporting is crucial for SMEs. By starting to align with CSRD requirements now, SMEs can gradually build their capacity to meet these standards. This proactive approach allows you to:

- Identify and address operational inefficiencies, leading to cost and time savings and improved performance. By identifying areas where resources can be used more efficiently and collecting data from an early stage, your SME can reduce waste, save time, and lower operating costs. For example, implementing energy-saving measures or optimising supply chain operations can lead to significant financial benefits over time.

- Align with the sustainability standards of larger corporations, which is increasingly important for your SME. As major companies are held accountable for the sustainability practices of their suppliers, SMEs that already comply with CSRD requirements will be more attractive partners. This alignment facilitates business opportunities and strengthens partnerships with larger corporations, which can lead to long-term stability and growth.

- Position your SME as a responsible and forward-thinking business, enhancing your reputation in the market. Adopting proactive sustainability practices offers a competitive edge for SMEs. By demonstrating a commitment to sustainability, you can differentiate yourself from competitors and attract environmentally conscious customers and investors. This competitive advantage is particularly significant as more consumers and businesses prioritise sustainability in their decision-making processes.

Read more: Sustainability simplified: Carbon footprinting for beginners

Strategic implications for businesses

The introduction of the CSRD requires companies to reassess and often revamp their sustainability reporting strategies. To meet the directive's requirements, businesses need robust data collection and management systems that can accurately track and report on various ESG metrics. This involves integrating sustainability into the core of business operations, ensuring that all aspects of your company contribute to your sustainability goals. By doing so, your company can enhance its transparency, build trust with stakeholders, and position itself as a leader in sustainability.

Under the CSRD, companies must report on all three scopes of greenhouse gas (GHG) emissions. Scope 1 includes direct emissions from owned or controlled sources, Scope 2 covers indirect emissions from the generation of purchased energy, and Scope 3 encompasses all other indirect emissions from the value chain.

Read more: Unveiling hidden carbon footprints: overlooked emissions sources in business operations

Reporting and addressing these emissions requires a comprehensive understanding of the entire value chain, making it a strategic challenge for many businesses. However, this detailed reporting and emissions compensation also presents opportunities for innovation and improvement in environmental performance.

DGB Group’s role in sustainability reporting

DGB Group specialises in providing precise carbon footprint analyses, helping companies understand their environmental impact across all three scopes of emissions. This expertise allows businesses to identify areas for improvement and implement effective strategies to reduce their carbon footprint.

Learn how to measure your carbon footprint today

DGB also offers verified carbon units to help companies compensate for past emissions or emissions that are difficult to eliminate. These high-quality carbon units, derived from nature-based projects, not only help businesses achieve their net-zero goals but also contribute to broader environmental and community benefits.

Learn more about DGB’s carbon units

Partnering with DGB provides businesses with the necessary support to navigate the complexities of CSRD compliance with regard to their carbon footprint. From measuring carbon footprints to implementing sustainability strategies, DGB's comprehensive services ensure that companies meet regulatory requirements and enhance their sustainability profiles.

Drone picture of seedlings nursery. Hongera Reforestation Project, DGB.

Drone picture of seedlings nursery. Hongera Reforestation Project, DGB.

By working with DGB, businesses can stay ahead of emerging sustainability standards and regulatory changes. This proactive approach not only ensures compliance but also positions companies as leaders in sustainability, attracting investors, customers, and partners who value environmental responsibility.

Download CSRD brochure

Start your sustainability journey with DGB Group

The CSRD represents a significant step forward in enhancing corporate sustainability practices within the EU. Its comprehensive requirements are set to reshape how businesses approach ESG reporting, embedding sustainability into the core of their operations. Understanding and complying with these requirements is crucial for businesses to remain competitive and resilient in an increasingly eco-conscious market.

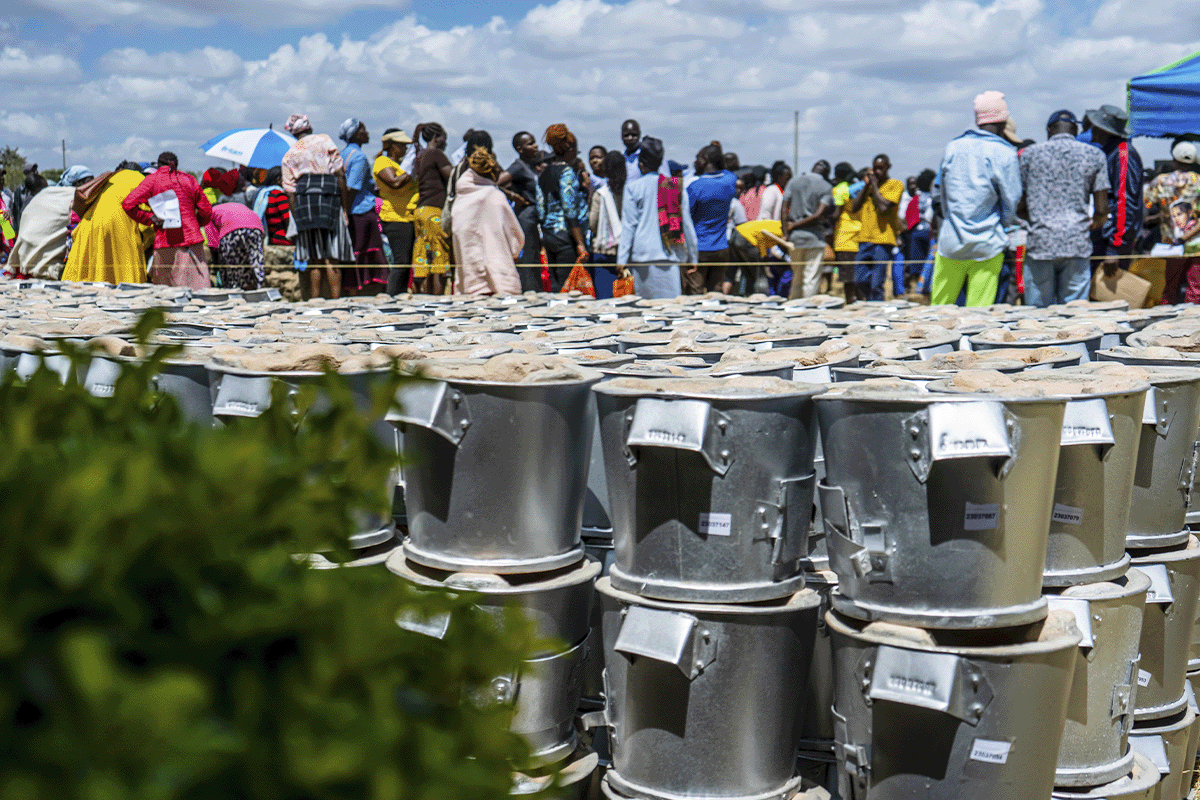

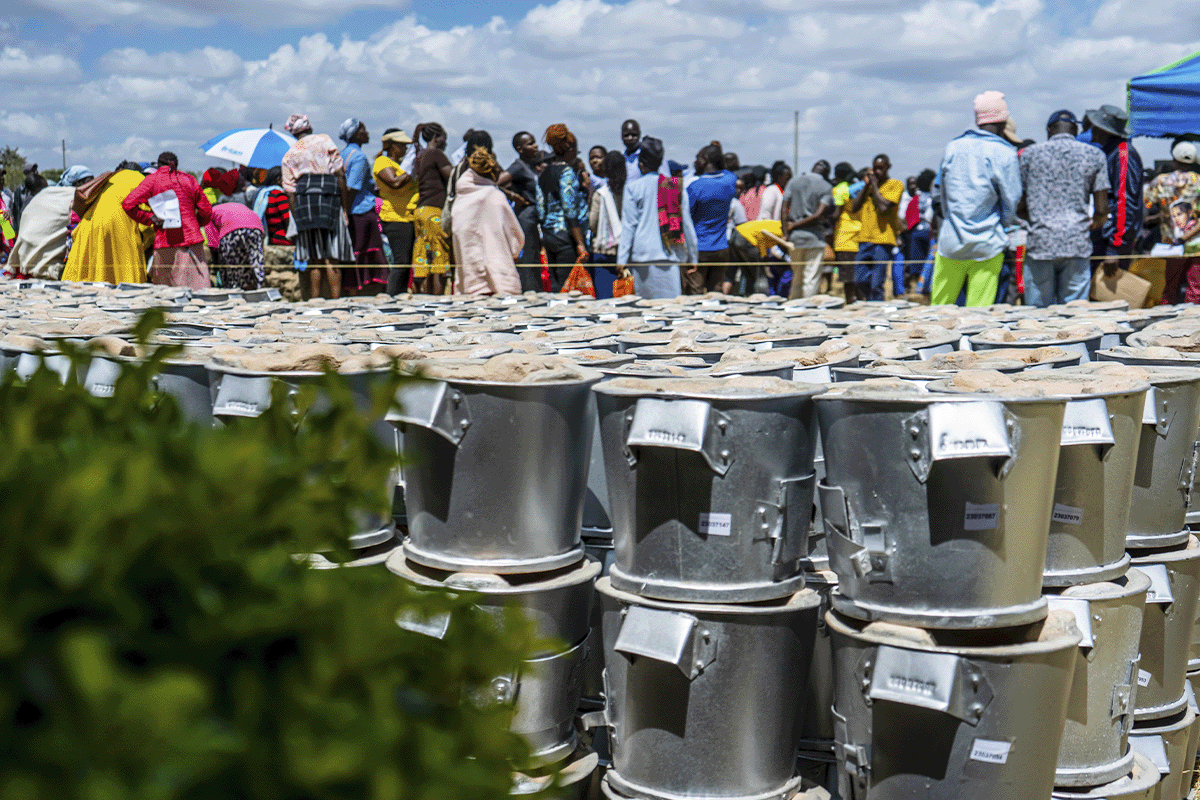

Close-up of energy-efficient cookstoves, local community members in the background. Hongera Energy Efficient Cookstoves Project, DGB.

Close-up of energy-efficient cookstoves, local community members in the background. Hongera Energy Efficient Cookstoves Project, DGB.

Embarking on your sustainability journey with DGB can provide the expertise and support needed to navigate your sustainability compliance effectively. DGB offers a range of services, from carbon footprint analysis to carbon reduction and compensation strategies, ensuring that your business meets regulatory standards and achieves its sustainability goals.

Taking your first step towards sustainability now can benefit your business. Start with measuring your environmental impact. Contact DGB today to assess your carbon footprint and develop a comprehensive strategy to reduce and compensate for your emissions. Our team of professionals is ready to assist you in achieving your sustainability objectives and positioning your business as a leader in environmental responsibility.