Donald Trump has been sworn in as the US president, completing a remarkable political comeback. He is set to reshape the carbon market landscape, particularly the voluntary carbon market. Known for his pro-business stance, Trump has often expressed scepticism about mainstream climate policies. Nevertheless, his administration has demonstrated a commitment to nature-based solutions, emphasising the conservation and protection of American landscapes. This pragmatic focus on natural resource preservation could drive the voluntary carbon market, as corporations and investors seek alternative pathways to achieve sustainability.

White House in Washington D.C. AI generated picture.

White House in Washington D.C. AI generated picture.

As our CEO, Selwyn Duijvestijn, stated on Dutch TV, ‘We adapt our strategies to align with current policies and market forces.’ For DGB Group, the priority remains to identify opportunities within the voluntary carbon market and leverage expertise to invest in high-quality projects.

Selwyn Duijvestijn forecasts the effects of Trump's re-election on RTL7. Watch it with English subtitles on YouTube/Settings/Auto-translate.

With Trump’s return, more companies may turn to the voluntary carbon market to meet Environmental, Social, and Governance (ESG) goals in a deregulated environment. High-quality, nature-based carbon credits, such as those generated through reforestation and land conservation, could see significant demand as US corporations pursue verifiable environmental initiatives.

This article explores how Trump’s policy approach—combining a conservative stance on climate regulation with targeted support for nature conservation—along with the involvement of influential figures like Elon Musk and Robert F Kennedy Jr, known for their focus on green initiatives, can drive demand and influence prices in the voluntary carbon market.

Trump’s first move: withdrawal from the Paris Accord

Donald Trump’s scepticism towards traditional climate policies remains a defining feature of his approach to environmental issues. On his first day back in office, President Donald Trump signed an executive order initiating the formal withdrawal of the United States from the Paris Climate Agreement. He justified the withdrawal on the grounds that the Paris Agreement imposed unfair economic burdens on the US while allowing major polluters like China, India, and Russia to continue unchecked.

This marked the second time Trump had taken such a step, having previously announced the US’s withdrawal from the accord during his first term in 2017. The withdrawal was finalised in November 2020, and President Joe Biden rejoined the agreement shortly after taking office in early 2021.

Despite the backlash during his first term, Trump had long promised to exit the agreement if he returned to office. On the campaign trail for his second term, he described the Paris Accord as ‘unfair’ and ‘one-sided’, claiming it would destroy jobs and businesses in America.

Trump has often declared his commitment to the environment, claiming that he and his administration achieved ‘the lowest carbon emissions America has seen in 35 years.’ However, he insists that environmental challenges should be addressed using his own methods, stating that ‘his administration has done an incredible job environmentally and will continue to lead in reducing carbon emissions.’

Trump’s new policies and market implications

One of Trump’s first actions was to revoke nearly 80 executive orders from the Biden administration, including those addressing clean energy, climate-related financial risks, and electric vehicle mandates. His return to the White House introduces several potential scenarios likely to influence international climate policy and the carbon market:

- Fossil fuels prioritised: Trump strongly supports US fossil fuel production, intends to reverse key climate policies, and plans to expedite drilling permits.

- Renewable energy setbacks: He has expressed intentions to scale back clean energy provisions within the Inflation Reduction Act. His previous term saw the reversal or weakening of 112 environmental protections.

- Support for domestic projects: Trump’s ‘America First’ stance could prioritise US-based carbon offset initiatives, potentially boosting domestic demand while presenting challenges for international carbon credit sellers.

Read more: The voluntary carbon market's journey through 2023 and beyond

Trump’s emphasis on nature and conservation

During his previous term, Trump’s commitment to preserving American landscapes became evident through various conservation initiatives. The Great American Outdoors Act, signed in 2020, allocated $9.5 billion to restore and maintain national parks and public lands, representing the largest conservation investment in over 50 years. This legislation underscored Trump’s interest in safeguarding US natural heritage, with a strong focus on public land conservation, tourism, and recreation.

Trump’s support for the Trillion Trees Initiative further highlights his preference for practical, nature-based solutions to environmental challenges. This global effort aims to plant and conserve a trillion trees worldwide, aligning with voluntary carbon markets by promoting nature-based carbon sequestration solutions. Such initiatives encourage the development of projects that contribute to carbon sequestration and biodiversity, potentially increasing demand for high-quality, nature-based carbon credits.

An aerial view of a vast, lush green forest, highlighting its expansive and vibrant natural landscape. AI generated picture.

An aerial view of a vast, lush green forest, highlighting its expansive and vibrant natural landscape. AI generated picture.

By fostering domestic conservation projects, Trump’s policies could stimulate demand for voluntary carbon credits linked to US-based natural resource initiatives. These credits appeal to corporations and investors focused on sustainable growth—as corporations look for innovative ways to meet sustainability goals in a less regulated landscape—offering opportunities to offset carbon emissions while supporting the conservation of valuable landscapes.

Read more: Deforestation in the United States: causes, consequences, and cures

Elon Musk: a powerful ally to boost the carbon credit market

Trump appointed Elon Musk to lead the newly created Department of Government Efficiency. While the department is advisory, Musk’s influence could shape policies that align economic growth with sustainable innovation.

Musk's relationship with Trump is notably strong, having rallied for his campaign. This alliance positions Musk as a key influencer within the administration, potentially shaping policies that could advance sustainability efforts.

In 2017, Musk briefly served on an advisory board for Trump but resigned following the US’s withdrawal from the Paris Agreement, underscoring Elon’s commitment to environmental causes.

Musk’s advocacy for the green economy and his progressive stance on environmental issues make him a unique voice in the Trump administration. As a staunch supporter of carbon tax and reforestation initiatives, Musk is likely to push for greater awareness of sustainability challenges and opportunities. His focus on cutting-edge technology continues to inspire innovative solutions in energy efficiency, renewable energy, and sustainable mobility.

Read more: Era of revolution: groundbreaking carbon market development

Tesla’s carbon credit success: A case study in market leadership

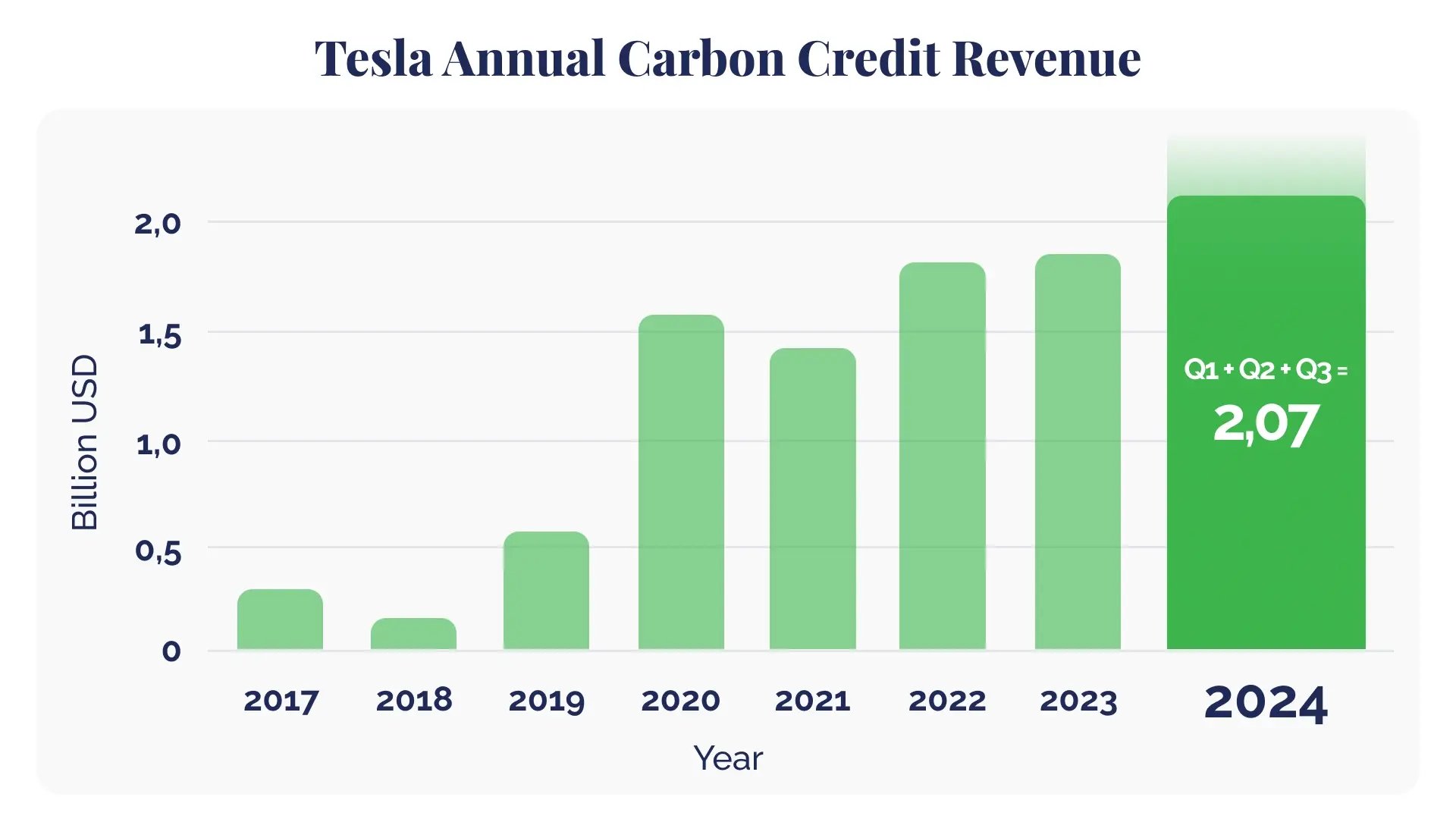

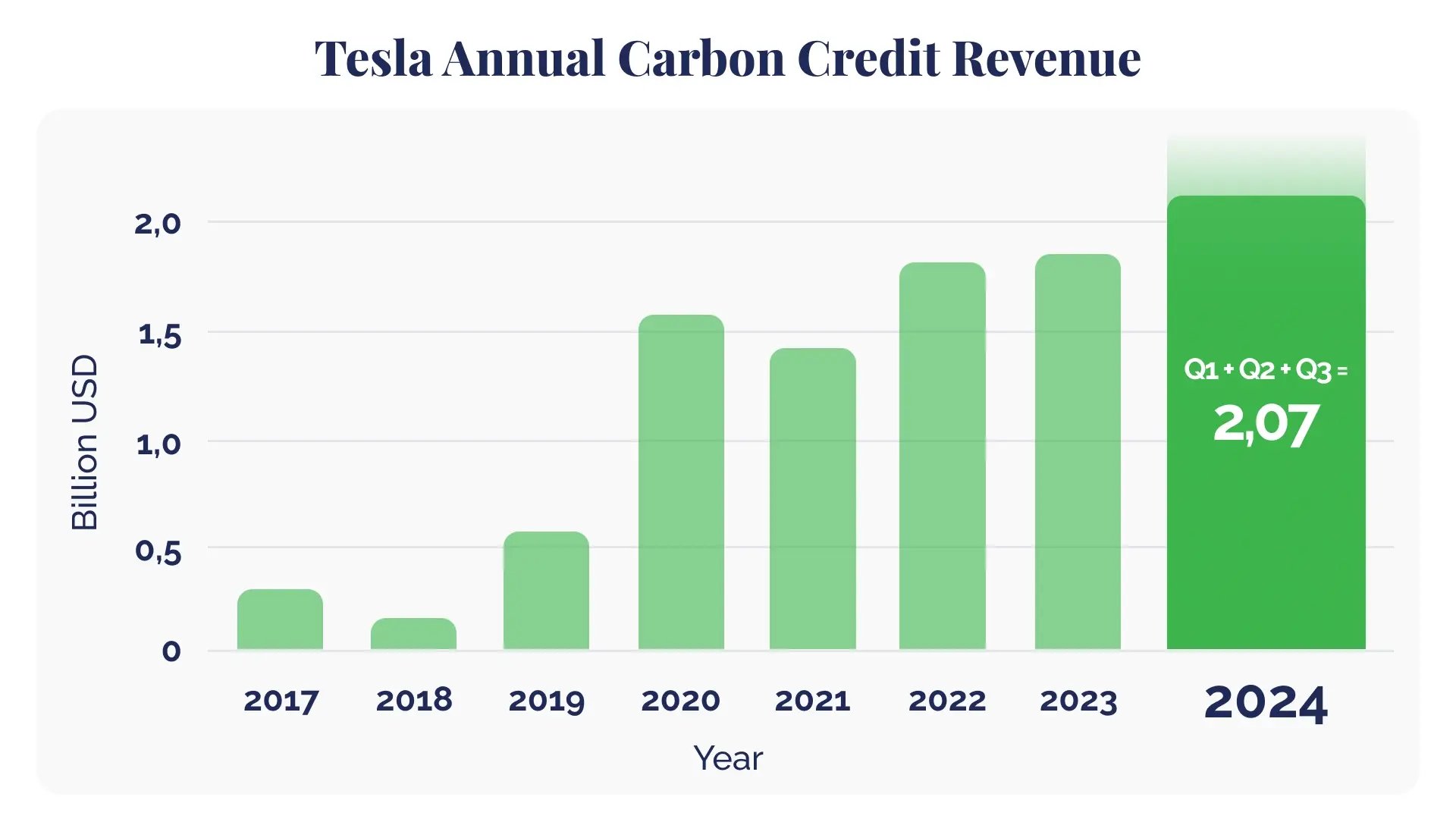

Tesla, one of Musk’s flagship enterprises, has demonstrated the profitability and potential of the carbon credit market. Since Musk began investing in carbon markets in 2017, Tesla has consistently leveraged these credits to drive revenue and innovation. By 2024, Tesla generated $2.07 billion in carbon credit revenue during the first three quarters alone—surpassing previous full-year totals and reinforcing the upward trajectory of the carbon market.

Graph showing Tesla annual carbon credit revenue.

Graph showing Tesla annual carbon credit revenue.

This remarkable growth underscores the increasing demand for carbon credits (or carbon units) and Musk’s ability to position his ventures at the forefront of sustainability and business innovation. With Tesla’s track record and Musk’s influence in policy-making, there is significant potential for the carbon credit market to expand further under his guidance.

Robert F Kennedy Jr: a legacy of environmental advocacy

Robert F Kennedy Jr, a prominent environmental attorney and activist, has spent decades championing the preservation of natural resources and advocating for policies that combat pollution. As a member of the influential Kennedy family, his career has been marked by a dedication to environmental justice, particularly in the areas of clean water and renewable energy. His work with organisations like the Natural Resources Defense Council and Waterkeeper Alliance underscores his commitment to safeguarding ecosystems and ensuring environmental accountability.

Kennedy’s role in the Trump administration

Under Donald Trump’s reelection, Kennedy has emerged as a surprising yet strategic ally within the administration. Recognising his vast experience and reputation in the environmental sector, Trump appointed Kennedy as a key advisor to his administration's green initiatives. This partnership highlights a shift in the administration's priorities, aiming to blend economic growth with ecological responsibility. Kennedy’s influence brings to the forefront the necessity of legislation that fosters renewable energy development, promotes clean technologies, and enforces pollution controls.

His involvement emphasises the importance of bipartisan collaboration to address environmental challenges, aligning policy frameworks with the needs of both the economy and the planet. By advocating for robust regulatory measures and incentives, Kennedy amplifies the urgency of transitioning to a sustainable economy.

A powerful duo: Musk and Kennedy leading the charge

The collaboration between Robert F Kennedy Jr and Elon Musk signifies a pivotal moment for the green economy. Musk’s technological innovation and Kennedy’s environmental advocacy attract substantial investments in renewable energy, clean technology, and ecosystem restoration projects. Together, they legitimise the green economy as a dynamic and profitable sector, transcending its perception as a niche movement.

Musk and Kennedy’s combined influence not only accelerates the global transition to sustainability but also underscores the profitability of environmentally conscious initiatives. Their advocacy promotes legislative frameworks that incentivise investment in green industries, ensuring long-term economic stability while addressing pressing ecological concerns.

Read more: The power of sustainability: Why investing in sustainability drives faster company growth

By championing green innovation and pushing for comprehensive environmental policies, Musk and Kennedy are reshaping the narrative around sustainability—making it central to economic growth, job creation, and the global fight against environmental instability. Their leadership inspires a new era where environmental stewardship and economic success go hand in hand.

Emerging markets and new opportunities for carbon projects

Although Trump’s administration is expected to favour a lighter regulatory approach, corporations face growing pressure to align with ESG standards, regardless of government policy. Public companies, institutional investors, and consumers increasingly expect businesses to demonstrate environmental responsibility, driven by reputation, brand value, and sector-specific reliance on carbon credits.

As organisations seek verifiable ways to address emissions, demand within the voluntary carbon market is projected to grow, increasing the need for high-quality carbon credits. For many corporations, fulfilling carbon-neutral pledges and ESG commitments is essential for maintaining credibility among stakeholders.

Trump’s pro-business approach to energy independence and economic growth could encourage US companies to pursue cost-effective carbon compensation projects internationally. Emerging markets create new opportunities for impactful carbon projects—particularly in Asia, Africa, and Latin America—offering lower project costs and substantial environmental benefits:

- Cost-effective carbon projects abroad: US companies seeking economical carbon offsets may turn to international projects, particularly in regions where initiatives deliver environmental and social benefits. These projects provide impactful results at lower costs, giving companies a competitive advantage in ESG-aligned investments.

- Nature-based solutions for carbon sequestration: Reforestation, soil carbon sequestration, and habitat restoration are highly valued in the voluntary market for their ability to capture carbon while promoting biodiversity and supporting local communities.

- Positive impact on local communities: Many carbon credit projects in emerging markets contribute to local economies by creating jobs, improving infrastructure, and fostering sustainable practices. These initiatives can align with Trump’s pragmatic approach to economic growth, offering compelling opportunities for ESG-minded investors.

A close-up of a Bulindi chimpanzee in its natural habitat, captured in the lush forests of Uganda. Bulindi Chimpanzee Habitat Restoration Project, DGB.

A close-up of a Bulindi chimpanzee in its natural habitat, captured in the lush forests of Uganda. Bulindi Chimpanzee Habitat Restoration Project, DGB.

Investment in emerging-market projects could drive up the value of voluntary carbon credits, especially those with dual environmental and social benefits, making them attractive to corporations and investors alike. At DGB, we develop high-quality nature-based projects across the globe, focusing on high-priority regions like Africa. Our projects are not only environmentally impactful but also economically viable and generate verified carbon credits that help organisations reach their sustainability goals. With the increasing demand and rising prices of quality nature-based credits, we can help you capitalise on the growing demand of carbon markets.

Trump on Africa and its impact on the voluntary carbon market

Trump’s reelection may signal an economic-focused approach to Africa, which could indirectly influence the voluntary carbon market. His administration’s policies towards Africa have emphasised economic partnerships, security interests, and investment over aid. This stance presents opportunities for carbon markets through initiatives prioritising business investment and sustainable development:

- Economic and security focus: Trump’s policies on Africa are centred on economic and security interests. This focus could benefit the voluntary carbon market as US companies invest in impactful projects aligned with Africa’s development goals, including carbon projects tied to reforestation, renewable energy, and sustainable agriculture.

A farmer inspecting avocado trees, carefully assessing their growth and health. Hongera Reforestation Project, DGB.

A farmer inspecting avocado trees, carefully assessing their growth and health. Hongera Reforestation Project, DGB.

- Business investment over aid: Trump’s Prosper Africa initiative promotes American investment across African economies, encouraging private-sector engagement in sustainable projects. As the voluntary carbon market turns to Africa for cost-effective compensation projects, US companies may invest in initiatives that support carbon sequestration while benefiting local communities.

- Reducing external influence: Trump’s focus on reducing foreign influence, particularly from China, could motivate US companies to invest in African carbon compensation projects. This may also support companies in meeting ESG goals while strengthening US–Africa trade partnerships.

Africa’s potential within the voluntary carbon market is promising. With Trump’s investment-oriented approach, the continent could see increased capital flow into high-quality carbon projects, supporting both environmental sustainability and economic growth. Lower project costs and high-impact potential make Africa an ideal region for voluntary carbon initiatives, potentially driving up demand and prices for carbon credits.

Read more: Ultimate guide to Africa’s 47 afforestation and reforestation projects

Long-term price implications for the voluntary carbon market

Trump’s policies may reduce compliance requirements, but the voluntary market is expected to thrive as corporations and investors sustain demand for verifiable carbon credits. The combination of corporate commitments, strong investor interest, and enhanced transparency is likely to create sustained upward pressure on voluntary carbon credit prices:

- Quality-driven price differentiation: Emphasis on quality and integrity may lead to price differentiation, with higher-quality credits commanding a premium while lower-quality credits stagnate.

- Sustained demand for credible offsets: Companies with reputational stakes in sustainability are expected to prioritise high-quality offsets, sustaining demand and pushing up prices.

- Market confidence in stability: Trump’s business-friendly, conservation-oriented policies could stabilise the investment climate for the voluntary carbon market, boosting investor confidence.

Investor confidence and the growing appeal of voluntary markets

Investors have demonstrated strong interest in the voluntary carbon market, directing trillions of dollars towards ESG-focused funds and sustainable investments. Trump’s reelection could further bolster this trend by allowing companies greater flexibility to innovate in carbon offset solutions without stringent compliance costs. This added flexibility may make voluntary carbon credits more appealing to investors, particularly as companies strive to meet sustainability goals.

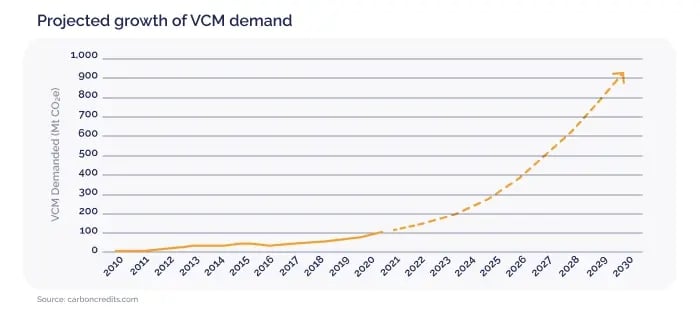

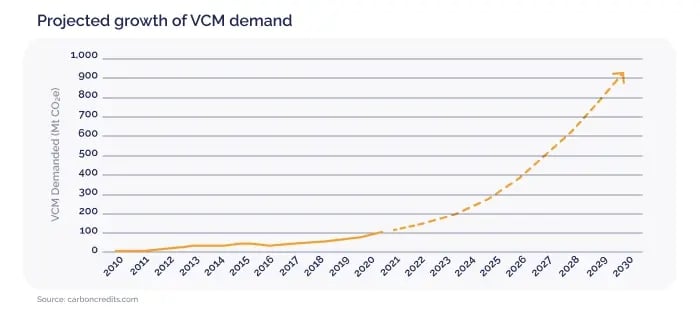

From a carbon market perspective, projections from EY, McKinsey, and BCG estimate market values ranging from $30 billion to $50 billion by 2030. More optimistic outlooks from Goldman Sachs and Wood Mackenzie forecast a market size of $100 billion by the same year. Even conservative estimates, like PwC’s $30 billion forecast, represent a tenfold increase compared to today’s $3 billion market. The consensus across predictions underscores the rapid and substantial growth of the market, marking it as a promising long-term investment opportunity.

Graph showing projected growth of VCM demand.

Graph showing projected growth of VCM demand.

‘Making nature great again?’

In summary, Trump’s reelection presents a complex yet promising landscape for the voluntary carbon market and nature-based solutions. His policies may reduce compliance pressure, but his emphasis on conserving American natural resources and fostering business-friendly environments could bolster voluntary carbon markets.

While Trump’s direct statements on Africa, carbon markets, nature, and trees remain nuanced, his allies and policies show a preference for conservation, economic partnerships, and voluntary solutions over regulatory mandates. His support for nature conservation and reforestation initiatives suggests potential backing for nature-based solutions within the voluntary carbon market framework.

A close-up of a tree seedling in a tree nursery in Kenya. Hongera Reforestation Project, DGB.

A close-up of a tree seedling in a tree nursery in Kenya. Hongera Reforestation Project, DGB.

These winds of change are anticipated to fuel demand for high-quality voluntary carbon credits. With a strong emphasis on nature, responsibility, and innovation, the voluntary carbon market is set to thrive, delivering both environmental benefits and financial opportunities. DGB’s high-quality nature-based carbon projects and expert guidance ensure you can benefit from this evolving paradigm. Ultimately, Trump’s return could indeed ‘make nature great again’—offering businesses and investors alike the opportunity to capitalise on natural assets and invest in nature-based solutions.