Share capital

The authorized capital of Green Earth Group amounts to €750,000.00 and is divided into 18,750,000 ordinary shares, 18,749,900 preference shares, and 100 priority shares, each with a nominal value of €0.02.

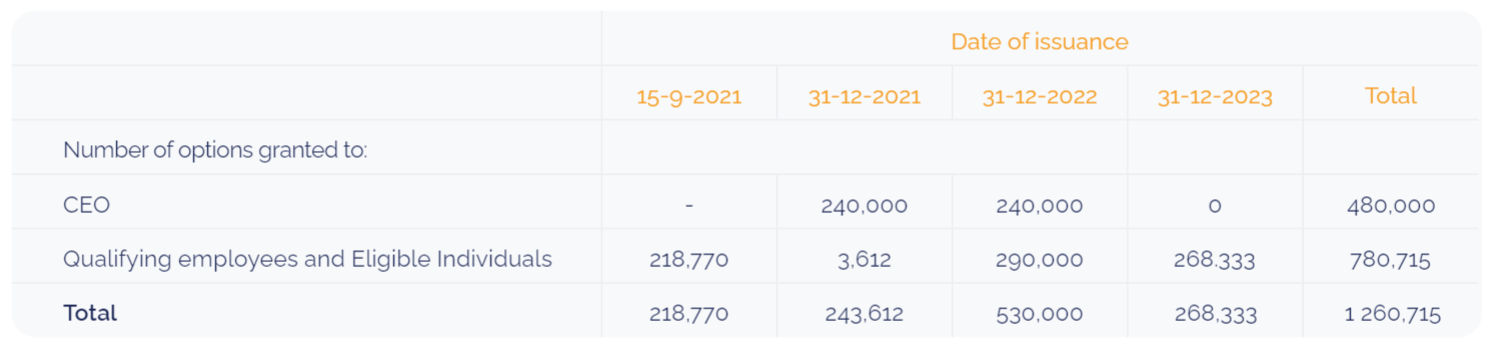

Share options

On 15 September 2021, the Group established share option programmes (link) that entitle qualifying employees and Eligible Individuals to purchase shares in Green Earth. Under these programmes, holders of vested options are entitled to purchase shares at the market price of the shares at the grant date. The key terms and conditions related to the grants under these programmes are as follows; all options are to be settled by the physical delivery of shares.

Per 1 January 2024, there are the total options outstanding:

The vesting period for the granted share options is 2 years after the grant date. After vesting, the share options must be exercised within 3 years.

Dividend policy

The dividend payment depends on the financial results and the equity of Green Earth. In the event of disappointing results or investments, it is possible not to distribute a dividend for that year. If a loss has been incurred in any year, no dividend will be paid for that year. In a dividend proposal, various factors will be taken into accounts, such as the financial and operating result, the capital position, legislation and regulations, and whether the available resources are required for repayment or investments.

The Board of Directors makes a proposal which, with the approval of the non-executive director, determines which part of the profit will be added to the reserves. This is done after the payment of dividends on the preference shares (no preference shares have yet been issued). Thereafter, the General Meeting of Shareholders, on the proposal of the Board of Directors, can resolve to distribute the part of the profit that remains after addition to the reserves as a dividend on the ordinary shares. Payment will be made after the adoption of the annual accounts showing that distribution is permitted.