Dutch Green Business Group N.V. (“DGB”, “DutchGreen” or “the Group”) (Euronext: DGB), a leader in carbon offsetting and ecosystem restoration company, is excited to announce its Q1 update. The first quarter has seen a period of continued momentum as the Group pursues its strategic objective of becoming a world leading project developer of high quality large-scale carbon and biodiversity projects accredited by third-parties.

DGB is a project developer for nature-based projects to originate high-integrity carbon credits known as Verified Emission Reduction (“VERs”). VERs are also commonly known as voluntary emission reductions, carbon offsets or carbon credits. VERs are essentially a reduction in greenhouse gas emissions (“GHG”) from a project that is independently audited (i.e., verified) against a third-party certification standard. Each VER represents one metric tonne of carbon dioxide equivalent emissions.

The robust project pipeline of the Group now consists of over 13.6 million tons of carbon credits ready for offtake agreements, making it the largest project developer of carbon credits in The Netherlands.

¨I am thrilled to see the rapid growth of DGB and am proud of what our team achieved last quarter, but even more excited about our strong project pipeline and our ambitions for the future. Global mega trends drive the demand for carbon credits and underpin our growth opportunities. The completion of DGB’s first large carbon credit offtake agreement of approximately €1.1 million in Q1 demonstrates our ability to successfully close large transactions. We are perfectly positioned for substantial growth throughout the rest of the year.¨

- Selwyn Duijvestijn, Chief Executive of DGB

Q1 2022 Highlights

Carbon markets & pricing:

- Carbon credit prices are rising in a market that is rapidly expanding. The current average index price for Nature Based Carbon Offset Credit in the voluntary carbon markets is $11,14.

- DGB has been experiencing strong demand at premium prices for its carbon credits. DGB continues to participate in the global discussion around the best way to value the price of carbon credits - alongside leading accountancy firms - including their impact in contributing towards biodiversity and societal impact on the ground where reforestation projects are being developed.

- A near-record volume of nature-based carbon credit supply was approved for inclusion in Verra's Voluntary Carbon Standard (VCS) in the first quarter of the year. Forestry projects with annual emission cuts of 10.7 million mt registered under the VCS programme in Q1, up from 10.1 million mt in Q4. The figure is more than double the volume approved in Q1 2021 and the third-largest since the programme began issuing credits in 2009.

Project milestones:

- The DGB Hongera Afforestation Project, for which DGB has the right to receive 100% of the carbon credits originated and has exclusive carbon and marketing rights, is expected to create over 7 million credits over its 30-year project lifetime (approximately 225,00 carbon credits per annum). The project entered the development phase.

- The Hongera Energy Efficient Cookstove Project, for which DGB has the right to receive 100% of the carbon credits originated and has exclusive carbon and marketing rights, is expected to create over 1.8 million credits over its 6-year project lifetime (approximately 300,00 carbon credits per annum). The project entered the development phase.

- Today, DGB announced its two large-scale carbon projects in Cameroon which are expected to originate over 5.1 million carbon credits over their project lifetime, also entered the development phase.

Project Financing:

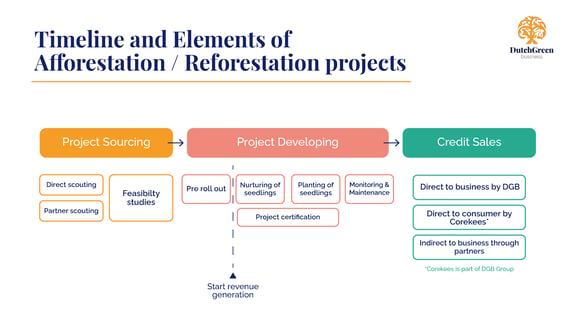

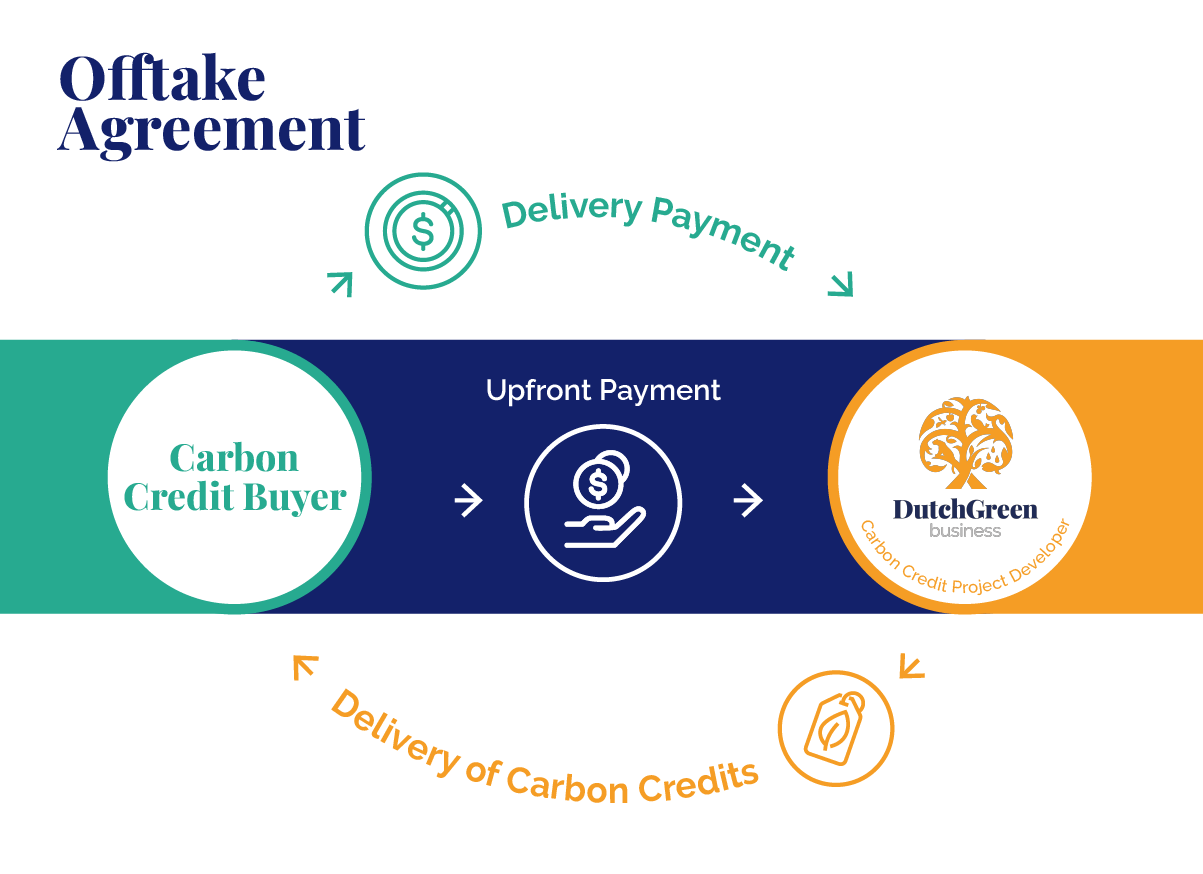

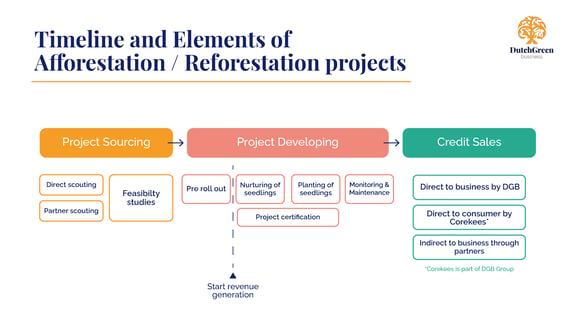

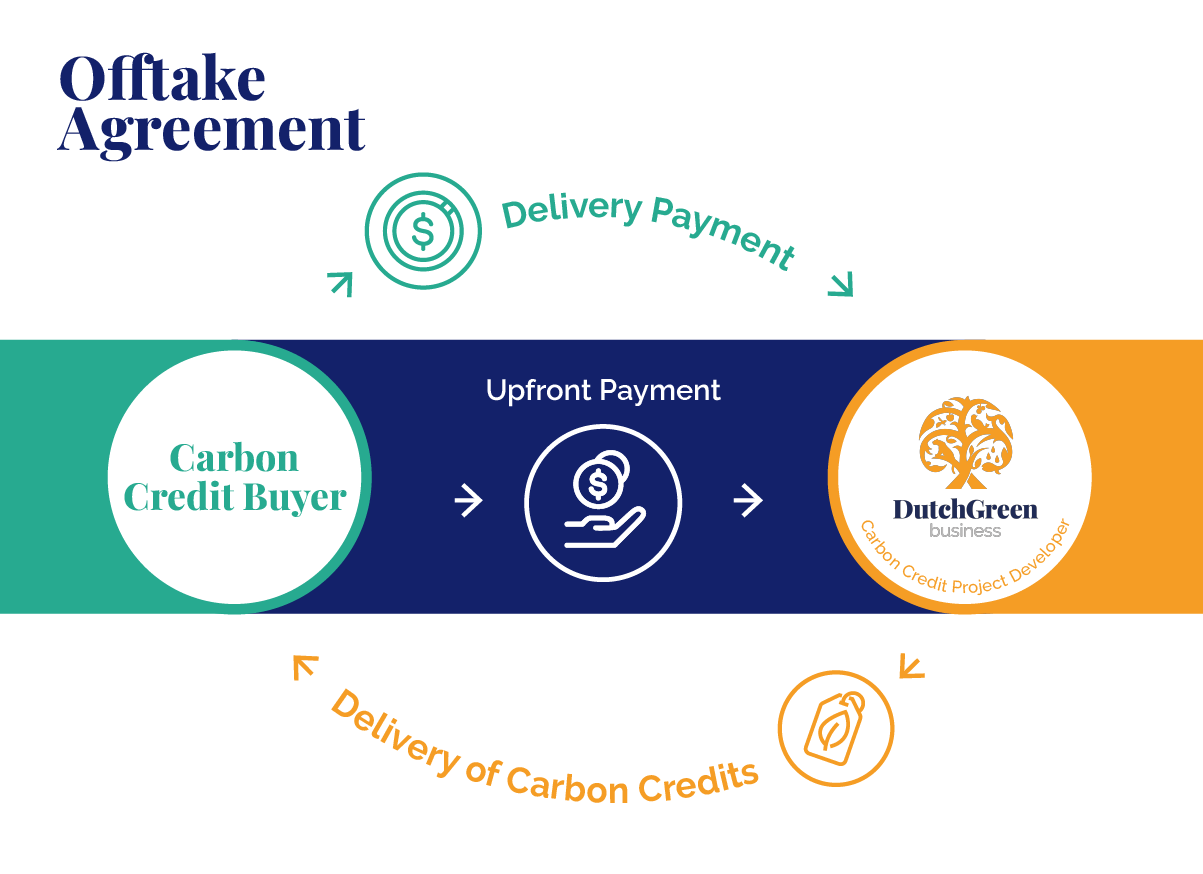

- DGB is focused on scaling its operations and financing the projects by entering into long-term offtake agreements for carbon credits to be verified later in 2022 and onwards. This is an important part of its carbon credit sales and distribution strategy.

- A long-term offtake agreement is a legal contract in which a buyer agrees to purchase a set amount of carbon credits at set price points at a set time, usually several years into the future. Long-term offtake agreements provide DGB with predictability as to how many carbon credits intend to be sold and the revenue generated by a project in the future. This helps seed confidence in forest carbon projects, de-risking capital investments of the Group.

- In Q3 2021 DGB has entered into its first binding carbon credit offtake agreements pursuant to which DGB committed to offset carbon emissions for various customers. In Q1 DGB completed the first large offtake agreement for Verified Emission Reduction worth €1.1m with a major international energy company.

- Subsequently, DGB has raised over €750,000 with the issue of convertible green bonds to fund the development of its projects. Investors in this green impact bond receive a return of 6% per annum with a maturity of 4 years and the notes contain a mandatory conversion into DGB equity shares on 30 September 2025 at a price of €2.00. The closing price of DGB on April 1st, 2022 was €1,04.

- In Q1 the Board of Directors of the Group welcomed a new major shareholder to its investor base and was delighted to see the Bleijenberg family sharing DGB's mission and observing the long-term perspective of its business model by acquiring a 4.82% stake.

Sales & distribution network:

- To boost the amount of offtake agreements and finance its project pipeline, DGB in Q1 actively expanded its sales and distribution network by partnering with key-players in the sector.

- DGB signed a marketing agreement with Emstream and their proprietary wholesale voluntary carbon marketplace, Emsurge Carbon, as a primary route to market for its verified emission reductions (“VERs”) developed from its project pipeline.

- DGB signed a cooperation agreement with StenVi to stimulate further growth of its CO2 calculator. The CO2.expert platform enables retail and corporate clients to measure their carbon footprint and provides recommendations about how to address it with carbon offsets.

- DGB partnered with The Diar Group to build a greener future in the Middle East and Africa. The joint-venture in Kenya will operate as Diar Dutch Green for the purposes of carbon consultancy and carbon project finance across both the continent of Africa and the entire stretch of the Middle East, including Saudi Arabia and the UAE, with a first office in Nairobi, Kenya to support the development.

GreenTech Solutions

- In 2021 DGB launched its new carbon calculator enabling SME clients to measure their carbon footprint and offer recommendations on how to address it. CO2.expert is the first platform developed by DGB’s wholly-owned subsidiary, GreenTech Solutions, in collaboration with its software development company, Statix Artificial Intelligence B.V. The calculator has already been well received by the Company’s clients and has seen a strong user growth in Q1.

- DGB has increased its software development team and expects to launch its state-of-the-art cloud-based online habitat banking platform in the first half of 2022. DGB continued the development of its range of greentech solutions highlighted on biodiversity.space

Outlook:

- The outlook for DGB is robust, driven by increasing global demand for carbon credits as the world moves towards its net zero goals and by an expanding project pipeline.

- DGB delivered on its strategic and operational objectives in 2021 and plans to expand its project pipeline from 13 million offsets to over 16 million tonnes of carbon offsets in Q2 of 2022 - this will enable it to offer more offsets to a broader range of corporate clients with binding offtake agreements and retail clients.

Contact details:

DGB GROUP NV

press@dgb.earth

+31 (0) 20 8080825 (NL)

+44 (0) 20 8064 0936 (EN)

About DGB:

Dutch Green Business Group N.V. is a public company traded on the main Dutch stock exchange Euronext Amsterdam under the ticker symbol AEX:DGB and ISIN-code NL0009169515. DGB is a project developer of high quality large-scale carbon and biodiversity projects accredited by third-parties, focusing on nature conservation and making biodiversity flourish by helping governments and corporations achieve net zero through ecosystem restoration. DGB’s vision is to be a leading high-impact investor in sustainably managed nature-based solutions by providing competitive real investment returns for shareholders combined with high social impact. www.dgb.earth

Disclaimer:

This press release does not contain (an invitation to make an) offer to buy or sell or otherwise acquire or subscribe to shares in DGB Group N.V. and is not an advice or recommendation to take or refrain from taking any action. This press release contains statements that could be construed as forward-looking statements, including with regard to the financial position of the DGB Group, the results it achieved and the business (ies) it runs. Forward-looking statements are all statements that do not relate to historical fact. These statements are based on information currently available and on forecasts and estimates made by DGB Group management. Although the DGB Group believes that these statements are based on reasonable assumptions, it cannot guarantee that the ultimate results will not differ materially from those statements that could be construed as forward-looking statements. Factors that may lead to, or contribute to, differences in current expectations include, but are not limited to: developments in legislation, technology, tax, regulation, stock market price fluctuations, legal proceedings, regulatory investigations, competitive relationships and general economic conditions . These and other factors, risks and uncertainties that may affect any forward-looking statement or the actual results of DGB Group are discussed in the annual report. The forward-looking statements in this document speak only as of the date of this document. Subject to any legal obligation to do so, the DGB Group assumes no obligation or responsibility to update the forward-looking statements contained in this document, whether related to new information, future events or otherwise.