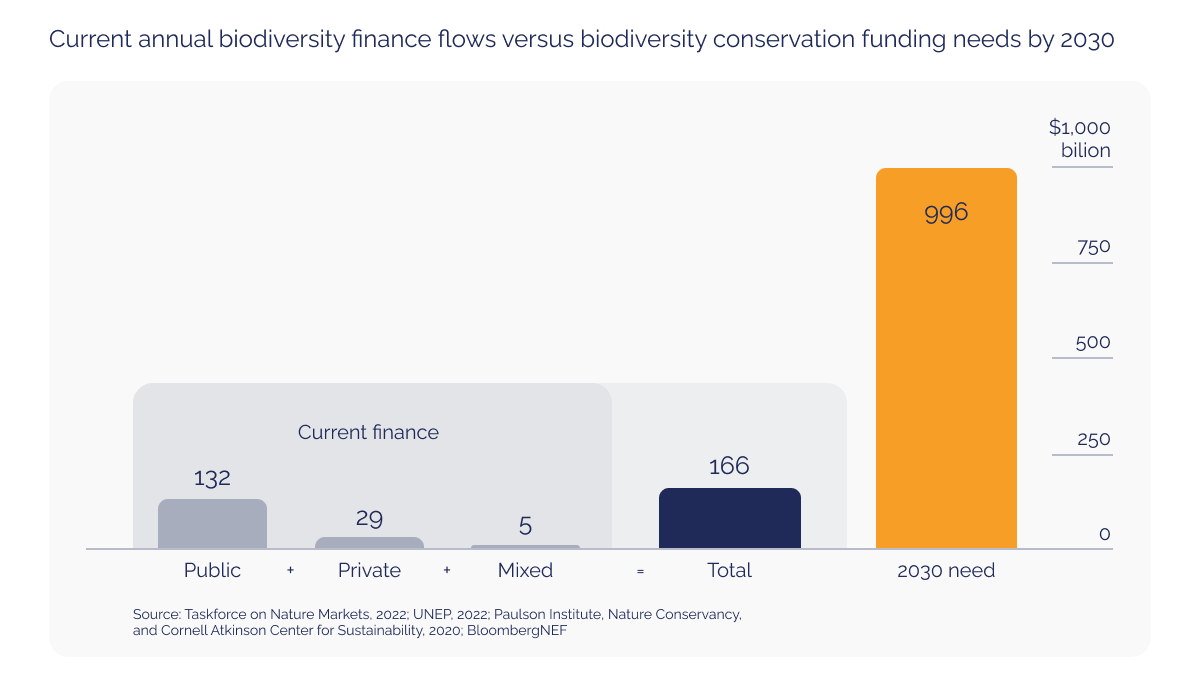

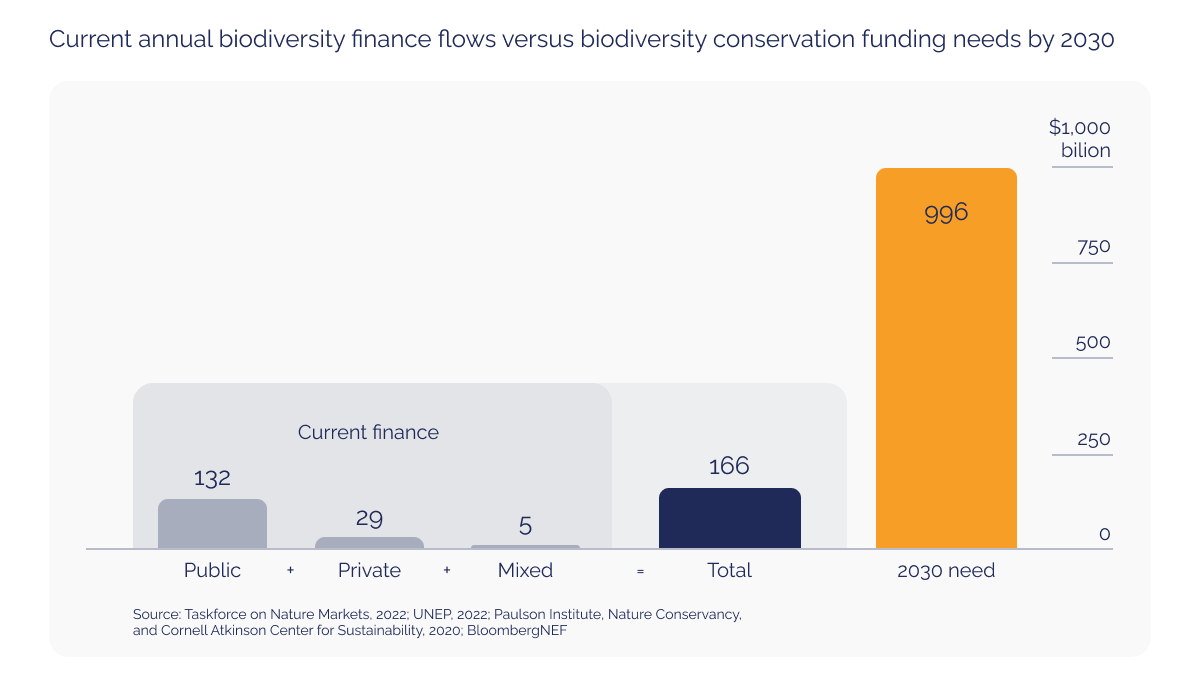

Protecting and restoring the planet's delicate natural resources comes at a price, but it's far less costly than the alternative. Research conducted by BloombergNEF reveals that financing explicitly for safeguarding biodiversity currently amounts to $166 billion annually. While this may seem substantial, it is merely a fraction of the funds allocated to the energy transition. This figure must rise to nearly $1 trillion by 2030 to ensure the sustainable management of biodiversity and the preservation of ecosystems' integrity.

Group of cattle egret sitting on a bush in Lake Albert with the mountains of Kongo in the background, Africa.

Group of cattle egret sitting on a bush in Lake Albert with the mountains of Kongo in the background, Africa.

While $1 trillion may appear daunting, it pales compared to the projected economic repercussions of biodiversity loss by the end of this decade. Even by conservative estimates from the World Bank, the decline in natural processes, such as wild pollination and marine fisheries, could result in an annual global GDP decrease of $2.7 trillion compared to projected levels by 2030.

To address this urgent issue, BloombergNEF has released the Biodiversity Finance Factbook, which provides finance, policy, and sustainability professionals with vital data to assess current and required financial flows. The Factbook identifies priority areas for funding and offers insights into strategies to achieve this goal.

The Global Biodiversity Framework, established in Montreal last year, necessitates a significant increase in financial support. Failure to achieve this could lead to severe material risks with financial implications, including supply-chain disruptions, price volatility, and asset destruction due to soil erosion or wildfires. Moreover, companies may face transition risks such as higher costs resulting from stricter regulations to mitigate biodiversity loss, permit denials, and reputational damage.

Read more: 5 Ways businesses can implement the new Global Biodiversity Framework

Victoria Cuming, the head of global policy at BloombergNEF and lead author of the Factbook, emphasised the need for action, stating, ‘The 2022 biodiversity deal won't be worth the paper it's written on unless governments, financial institutions, and companies ramp up financing and integrate nature into their plans and policies.’

Currently, public financing, in the form of government spending and tax breaks, dominates capital flows for biodiversity. The majority of this support is allocated domestically. ‘[Bloomberg]NEF's new prioritization framework is based on the premise that funding should be directed at developing countries where biodiversity is plentiful, provides economic value and [is] at risk of being lost', explained Jon Moore, CEO of BloombergNEF.

Read more: Deforestation in the Amazon Rainforest: causes, effects, solutions

Although regions share common characteristics, the biomes and species needing protection exhibit substantial variations. Terrestrial and marine resources, plants, and animals all require preservation efforts tailored to their unique circumstances.

Preserving Earth's biodiversity is not merely an environmental concern; it is a wise investment for the future. Redirecting funds and integrating nature into plans and policies is crucial to ensuring a sustainable and prosperous world for generations to come.

Read more: New dataset reveals companies' dependency on nature

DGB Group is dedicated to harnessing the inherent strength of nature and supporting the critical importance of biodiversity in preserving life on Earth. We embrace the mission of advancing and conserving biodiversity through our carbon projects. Our goal is to help nature flourish and prosper through our projects in close partnerships with farmers, landowners, and conservation groups. Together, we strive to turn this vision into tangible results.

Join us in our conservation efforts