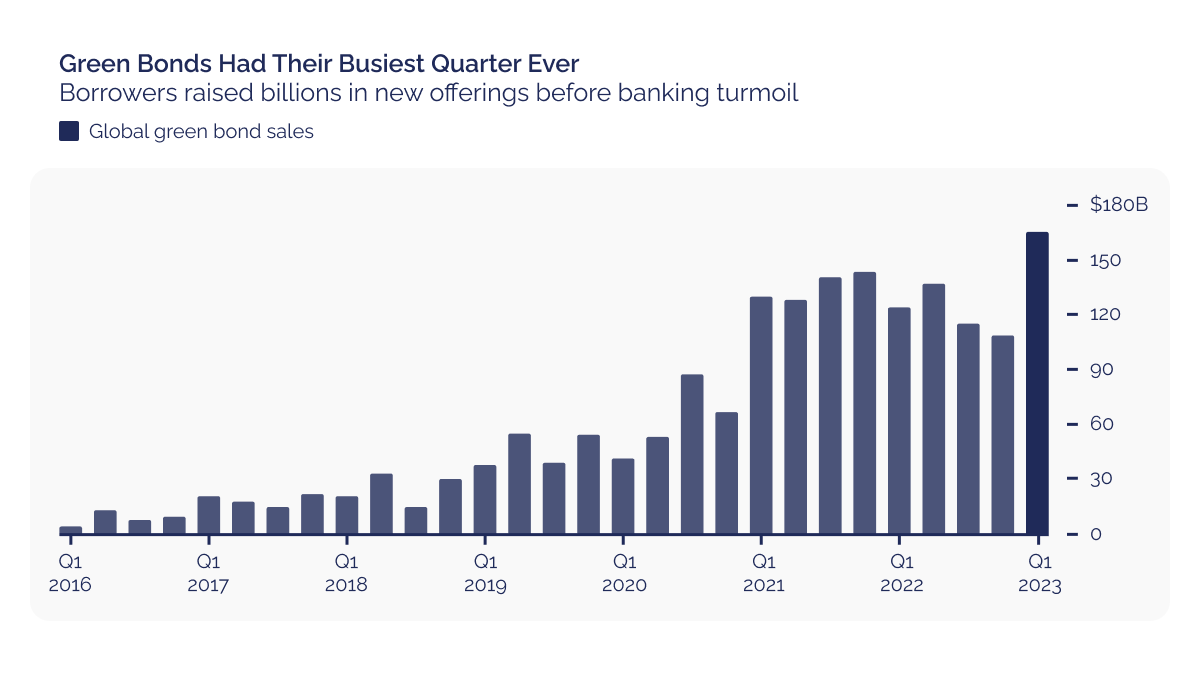

Green bond sales reached a new record high in the first quarter of 2023, despite a brief market shutdown due to banking turmoil. According to data compiled by Bloomberg, global issuance of green bonds, the largest category of sustainable debt, reached $163.9 billion, surpassing the previous record of $143.1 billion set in the last quarter of 2021. This represents a year-on-year increase of 32%. The favourable bond market conditions in January and February were cited as the main drivers behind the record-breaking quarter.

Baobab tree, Madagascar.

Baobab tree, Madagascar.

Various borrowers, including debt issuers, took advantage of the favourable conditions to tap into the green bond market. Ireland, for example, received overwhelming demand for its €3.5 billion ($3.8 billion) green sale, marking its first syndicated offering in a year. India also raised $1 billion in its maiden green deal, with plans to sell up to $3 billion more in bonds in the coming fiscal year.

The trend of green bond sales in recent years. Source: Bloomberg.

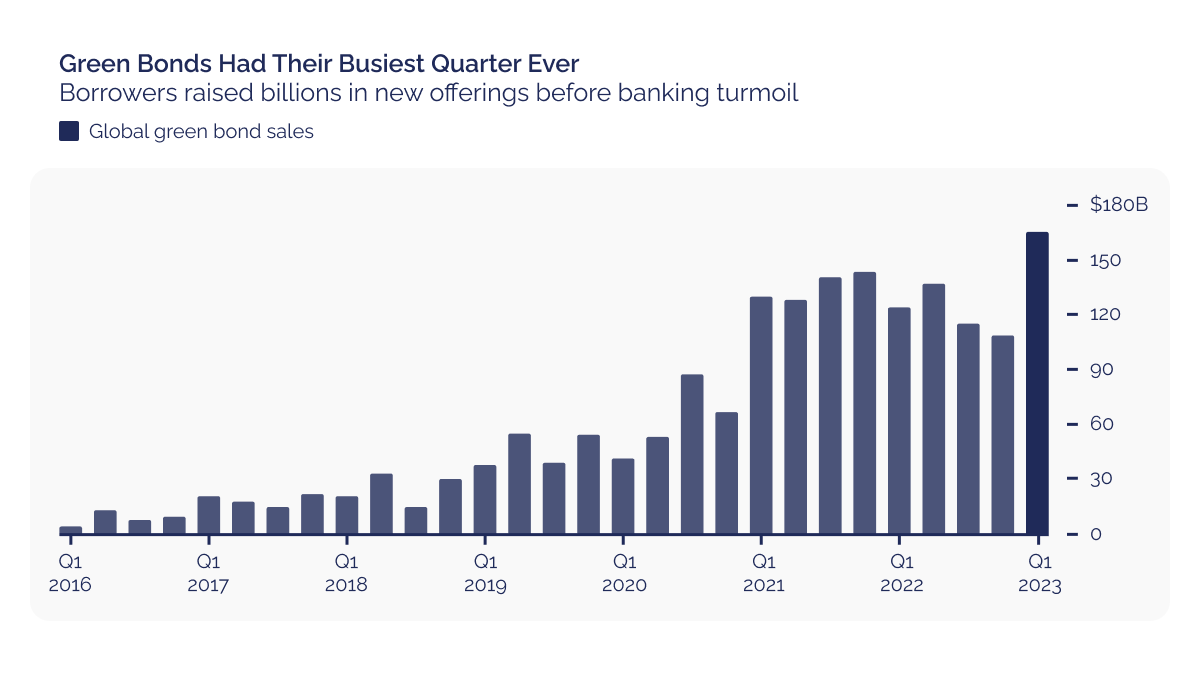

The trend of green bond sales in recent years. Source: Bloomberg.

Corporate issuers, including Comcast Corp., the largest US cable TV provider, also entered the green bond market for the first time, incorporating them into their long-term capital plans. Despite the temporary market shutdown in March due to banking turmoil, sales are already picking up in April, with Italy's €10 billion green deal helping push ESG debt to over 50% of Europe's market.

Read more: What will happen in the voluntary carbon markets in 2023

BNP Paribas SA, the largest underwriter according to current Bloomberg rankings, predicts that global green bond sales could reach approximately $600 billion this year, surpassing the record levels of 2021. The overall ESG bond market, which includes green, social, sustainability, and sustainability-linked debt, rose 13.9% to $282.5 billion in the first quarter, slightly lower than the peak in the first quarter of 2021.

Discover the benefits of DGB’s 8% green bonds

While ESG investing faced challenges in the past year, such as concerns over greenwashing and increased regulatory scrutiny, the market remains robust. Despite uncertainty in the global corporate bond market due to financial-sector turmoil, governments continue to seek funds for environmental projects through green bond issuances.

Recently, a record high price for carbon credits was reached on the European market: more than €100 per tonne. This event was significant beyond its record amount—it demonstrates that the carbon market is maturing, and the demand for sustainable solutions is on an ascending trend. For DGB Group, this means an opportunity to scale our projects’ impact on the environment and deliver steady returns to our investors.

Read more: EU carbon price hits record high

The increasing demand for green bonds and sustainable debt, as evidenced by the record-breaking issuance in Q1 2023, reflects a growing recognition of the urgent need to address biodiversity loss and changing environmental conditions. By leveraging the power of the carbon market, DGB believes that together with other stakeholders, we can continue to make meaningful strides towards restoring and protecting our planet's forests, mitigating harmful environmental impacts, and creating a more sustainable future for all.

Contact our experts and join our efforts