Tesla has positioned itself as a leader in sustainable innovation, disrupting the automotive industry with electric vehicles (EVs) and renewable energy solutions. However, beyond its electric fleet, Tesla’s most underappreciated asset might be its carbon credit business—a strategy that has generated billions in revenue and underscores the immense value of carbon markets. This case study examines how Tesla monetises carbon credits, why the market is growing, and how investors can capitalise on this booming opportunity through DGB’s high-quality carbon credits.

A close-up of growing tree saplings by the roadside, with a Tesla car driving in the background. AI generated picture.

A close-up of growing tree saplings by the roadside, with a Tesla car driving in the background. AI generated picture.

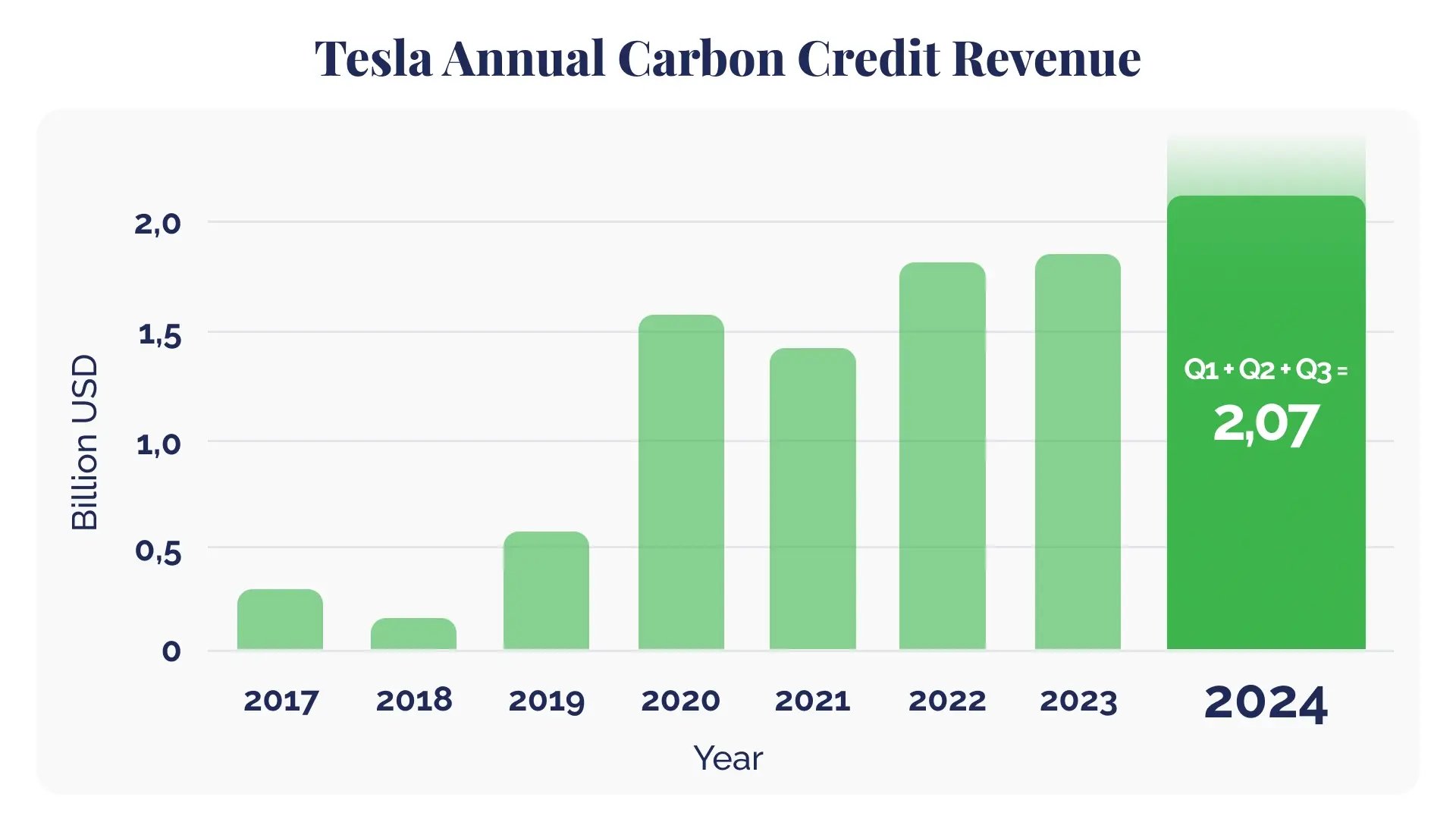

Tesla’s business model goes beyond selling EVs—it profits significantly from selling regulatory carbon credits. In 2024 alone, Tesla earned $2.76 billion from carbon credit sales, a 54% increase from 2023. Since 2017, the company has accumulated over $10.4 billion from emissions credit sales, making it a dominant force in compliance solutions for automakers struggling to meet environmental regulations.

Read more: Tesla’s carbon credit profits hit $2.76 billion as EV market shifts

While traditional automakers face growing emissions deficits due to tightening US and EU regulations, Tesla has turned its zero-emissions status into a lucrative business model, selling credits to companies that exceed their carbon allowances. This proves that carbon markets aren’t just about compliance—they represent a massive financial opportunity.

Tesla's carbon credit earnings have provided it with a strategic financial advantage, allowing the company to reinvest in R&D, expand production, and weather economic downturns while competitors struggle under regulatory fines. This reinforces the reality that carbon credits are no longer a secondary revenue stream—they are a key strategic asset for forward-thinking companies.

Graph showing Tesla's annual carbon credit revenue.

Graph showing Tesla's annual carbon credit revenue.

Tesla’s success in carbon credits highlights a fundamental truth: Carbon compensation is here to stay, and demand is only increasing. Governments worldwide are tightening emissions standards, forcing businesses to purchase credits to offset their footprint. With new regulations requiring US automakers to reduce emissions by 49% by 2032, the market for carbon credits will only expand.

Furthermore, as global net-zero commitments accelerate, companies outside the automotive sector are also seeking carbon credits to balance their emissions. Industries such as aviation, logistics, heavy industry, and even tech giants are turning to carbon credits as part of their sustainability strategies. This expanding demand underscores the long-term value of investing in high-quality carbon credits now, before prices surge further.

Read more: Industry carbon footprints: transport, events, and celebrities

Why does this matter for investors? Tesla has shown that carbon credits aren’t just a regulatory tool—they’re a high-value, revenue-generating asset. Companies and investors who recognise this early will be best positioned to profit from the shift toward a low-carbon economy.

Tesla’s playbook proves that carbon credits are a billion-dollar opportunity. As industries scramble to meet emissions targets, the demand for high-quality, verifiable credits will rise exponentially. Investors looking for sustainable, high-return opportunities should consider DGB Group’s carbon credits, which provide both financial upside and environmental impact.

The trend is clear: companies will increasingly rely on market-driven carbon credit solutions to meet emissions targets. The smartest investors are moving now—before demand skyrockets further.

Read more: Overcoming sustainability challenges: practical solutions for your business

Tesla’s carbon credit success demonstrates the potential of this market, but the opportunity isn’t limited to automakers. DGB is at the forefront of nature-based carbon credits, offering investors a way to capitalise on the carbon economy.

Unlike Tesla’s regulatory carbon credits, which depend on government policies and compliance frameworks, DGB’s carbon credits come from verified nature-based solutions, such as afforestation, reforestation, and energy-efficient cookstoves. These credits offer a stable and future-proof investment opportunity as corporations increasingly seek nature-based offsets for voluntary and compliance-based carbon reductions.

Investing in DGB’s high-quality carbon credits means:

- Exposure to a booming market: As regulations tighten, demand for verified carbon credits will soar.

- Diversification: Unlike Tesla’s regulatory credits, DGB’s nature-based credits are not tied to fluctuating policy shifts and provide long-term value.

- Tangible impact: Investors contribute to reforestation, biodiversity conservation, and sustainable development while gaining a financial return.

- Scalability: Nature-based credits provide an ever-growing supply to meet increasing demand from companies striving to reach net-zero goals.

Carbon markets are evolving rapidly, with prices expected to rise sharply as more corporations and governments commit to aggressive decarbonisation targets. The opportunity to invest in verified carbon credits through DGB offers early adopters a chance to capitalise on one of the fastest-growing asset classes of the decade.