CIX is a leading global marketplace that provides a comprehensive platform for listing, discovering, comparing, purchasing, and retiring reliable credits that have been verified by internationally recognised standards such as Verra (VCS). As a key player in the Voluntary Carbon Market (VCM), CIX offers a trusted platform for trading carbon credits.

Carbon pricing page content

[image text and page title]

What is carbon pricing?

Carbon pricing is a mechanism to assign a monetary value to carbon emissions. It incentivises companies and countries to reduce and offset their emissions.

[CTA:] Get in touch to learn more

Understanding carbon credit pricing

What determines the price of carbon credits?

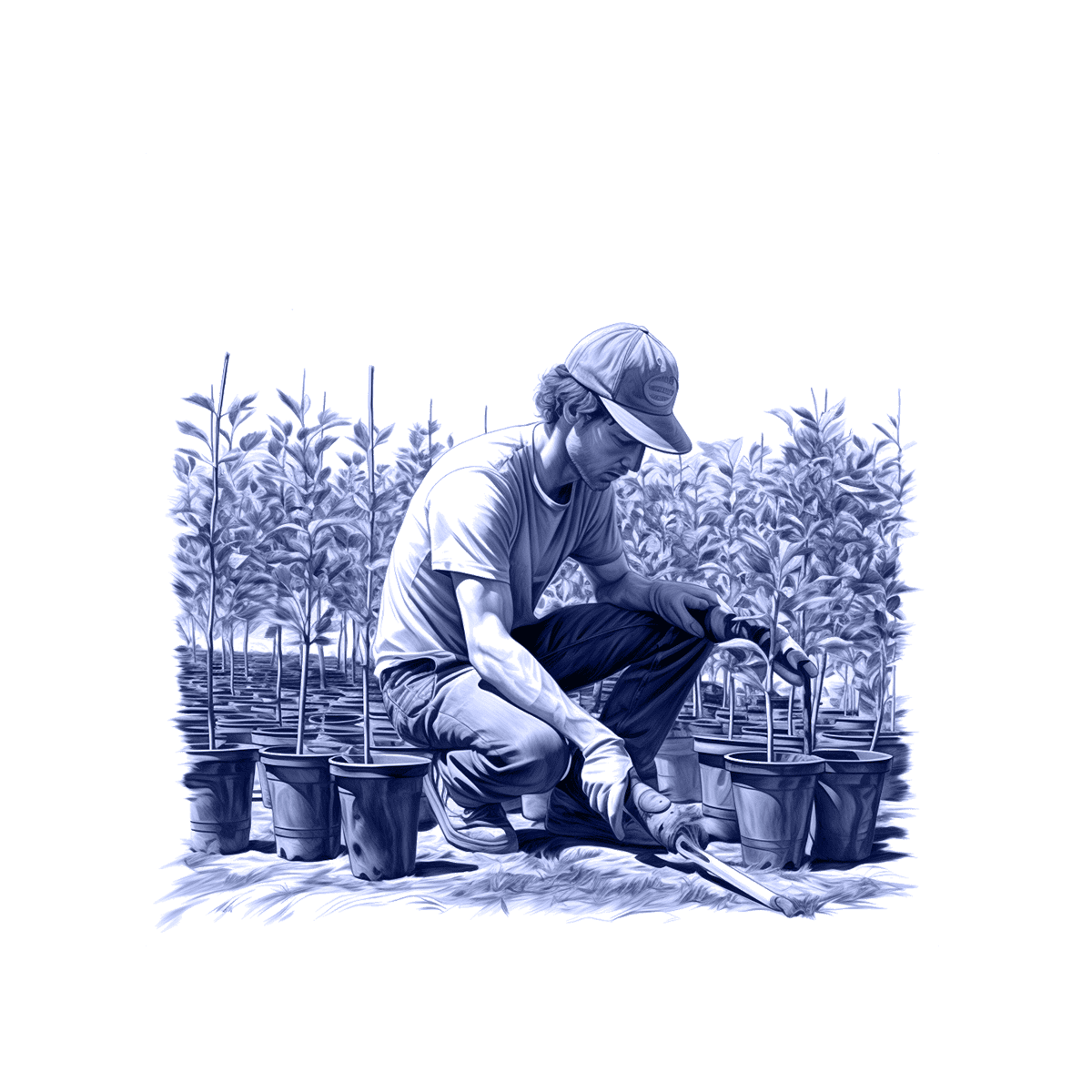

There are many ways to value a carbon credit, and many factors influence the price of carbon credits. A higher cost is generally required to ensure the quality of the project and that project benefits are real, long-term, and sustainable. This is why carbon credits from reforestation projects with strong co-benefits fetch higher prices than regular reforestation projects.

[remove blocks on the right side of page re Increasingly applied and Current state, and replace with visual/video (maybe our new video on carbon credits - CARLOS)]

[CTA:] Learn more about our high-quality carbon projects

Factors influencing carbon credit prices

Prices for carbon credits can vary significantly in the voluntary carbon credit market due to a variety of factors.

[use block design similar to this page for the below]

Type of project

|

Project location

|

Co-benefits

|

|

Different types of projects have varying levels of environmental and social impacts. The costs and benefits of these projects influence the price of the carbon credits generated. Nature-based projects, like the ones developed by DGB, command the highest prices in the market.

|

Project implementation costs vary depending on location, impacting the price of carbon credits. Projects in developing countries may have lower labour and land costs but can involve higher risks, while projects in developed countries may have more stringent regulations.

|

Projects that offer additional environmental or social benefits beyond carbon reduction are more attractive and command a premium. Co-benefits include biodiversity conservation, job creation, and air and water quality improvements. DGB’s projects have many co-benefits and are thus high quality.

|

Verification and certification

|

Carbon credit vintage

|

Regulatory environment

|

|

Projects with robust verification and certification by leading standards (such as the Verified Carbon Standard and Gold Standard) demand higher prices because they provide greater assurance of the project's environmental integrity and impact. DGB works only with leading standards for its projects.

|

The age of a carbon credit can impact its price. Generally, more recent credits are more valuable as they reflect current emissions reductions. These credits are typically more desirable to buyers as they demonstrate an active commitment to reducing emissions in line with current climate goals.

|

Government policies and incentives to reduce emissions can influence the demand for carbon credits. Changes in regulations or the introduction of new policies, such as carbon pricing, emissions trading schemes, and carbon taxes, can impact the price of carbon credits in the market.

|

Carbon pricing instruments

|

Article 6 of the Paris Agreement

|

Other factors

|

|

Carbon credits are generated through carbon pricing instruments such as carbon taxes, Emissions Trading Systems (ETS)—both on the regulatory market, and carbon crediting mechanisms. These instruments place a financial cost on emitting greenhouse gases, and their revenues contribute to the overall value of carbon credits.

|

Article 6 introduces new mechanisms for international cooperation and carbon accounting in carbon markets that can significantly impact the price of carbon credits, such as the Internationally Transferred Mitigation Outcomes (ITMOs) and the Sustainable Development Mechanism (SDM).

|

Supply and demand: A higher demand for credits can drive up prices, while an oversupply can lower prices.

Buyer preferences: Some buyers prefer certain project types, locations, or co-benefits.

Market sentiment: The public’s view of the carbon market and climate change affects price and demand.

|

Why is carbon pricing important? [add visual on left and text on the right]

Carbon pricing is a tool to place a financial cost on emitting greenhouse gases, primarily carbon dioxide (CO2). It ties emissions to their source. The financial cost of rising greenhouse gases can be seen in the damage caused by increased natural disasters, biodiversity loss, rising temperatures affecting food security, and rising health care costs due to poor air quality, dust storms, and heat waves.

Carbon pricing plays a vital role in promoting the transition to a low-carbon future, helping to address the urgent global challenge of climate change and biodiversity loss. It incentivises emission reductions, drives innovation, generates revenue for climate initiatives, and supports sustainable development. At DGB, we support better pricing of carbon emissions to incentivise these actions. To reach net-zero emissions, organisations can purchase carbon credits to offset their emissions combined with carbon-reduction strategies.

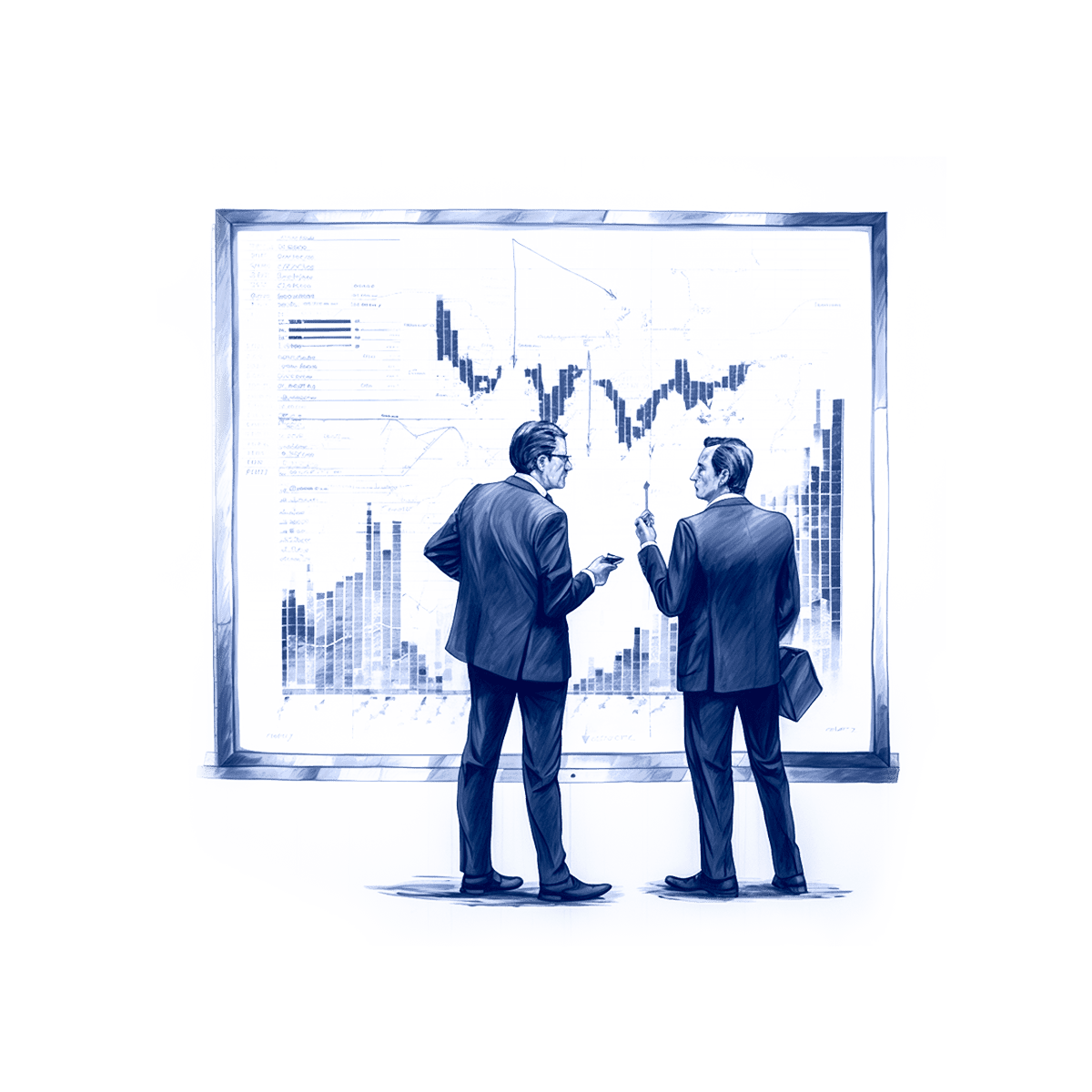

Expert insights

EY

“Prices for carbon could rise to a central estimate of $80–$150 per tonne by 2035.

BCG

“In 2021, the voluntary carbon market grew at a record pace, reaching $2 billion—four times its value in 2020—and the pace of purchases is still accelerating in 2022. By 2030, the market is expected to reach between $10 billion and $40 billion.

McKinsey

“Demand for carbon credits could increase by a factor of 15 or more by 2030 and by a factor of up to 100 by 2050. Overall, the market for carbon credits could be worth upward of $50 billion in 2030.

World Bank

“Revenues from carbon taxes and Emissions Trading Systems (ETS) grew by over 10% in 2022, reaching almost $95 billion globally—according to the World Bank’s annual State and Trends of Carbon Pricing report (2023).

Carbon exchanges

Carbon credits are traded on various exchanges, such as the Carbon Trade Exchange (CTX), Xpansive, Toucan Protocol, and AirCarbon Exchange (ACX). There are also more recent market entrants, such as Climate Impact X (CIX) and Viridios AI, to which many buyers will refer for price benchmarks. These exchanges provide daily and weekly carbon prices.

As the VCM continues to evolve, the role of companies like CIX and Viridios AI will become increasingly important in shaping the future of carbon markets.

The VCM has grown significantly, surpassing an annual value of $1 billion in 2021 and witnessing a 30% increase in 2022.

[CTA:] Begin your carbon-reduction journey

[add the two right columns in blocks next to the text like the first module on this page]

|

Climate Impact X

CIX is a pioneering global marketplace and exchange for high-quality carbon credits. CIX plays a crucial role in the Voluntary Carbon Market (VCM) by providing a platform for listing, discovering, comparing, buying, and retiring trusted carbon credits. It ensures all project credits listed are verified by internationally recognised standards such as Verra (VCS). Its quality screening process is completed by independent rating agencies like Sylvera. CIX is revolutionising the VCM by enhancing price transparency, providing unique market insights, and facilitating informed decision-making.

|

Viridios AI

Viridios AI stands out for its innovative approach to carbon credit pricing, valuation, and project information. With a mission to mobilise positive action towards net zero, Viridios AI is shaping the future of the VCM by providing market participants with advanced pricing and valuation tools, facilitating transparency and efficiency in the VCM. Its real-time pricing and historical data cover hundreds of the most investable carbon projects across various sectors, including blue carbon, forestry, energy efficiency, and renewable energy.

|

[Remove other modules currently on the page not mentioned here and add the sections below]

We develop and manage impactful projects

that generate carbon and biodiversity credits

We are an institutional project developer that develops and manages high-quality nature-based projects aimed at generating AAA-rated carbon and biodiversity credits. Our projects offer a sustainable, quality investment opportunity, as they offer many co-benefits in addition to carbon sequestration, such as biodiversity restoration, habitat protection, and community development.

[CTA:] Invest in our impactful projects

Frequently asked questions

Another company sells credits for $3. Why are yours more expensive? [is the dollar reference correct, should it not be euro?]

The cost of carbon credits varies depending on several factors, such as the type of project, location, co-benefits, and verification standards used. At DGB, we adhere to the highest verification standards, ensuring that our carbon offsets are credible and meet international climate programme requirements. This rigorous process can be more expensive, but it's necessary to ensure our projects’ integrity and quality and that they have a significant positive impact on the environment and local communities. Our projects are designed to have long-lasting impacts. For instance, our reforestation and afforestation initiatives not only sequester carbon but also restore biodiversity, promote sustainable land management, and support local communities. In contrast, other projects may focus on less sustainable or less impactful measures, which can result in lower prices. Our pricing ensures that our projects meet rigorous, industry-leading standards and deliver meaningful results.

Why is your Uganda project more expensive than the Cameroon one?

The cost of our projects can vary depending on several factors, such as the location, scope, scale, objectives, and complexity. Factors like local conditions, infrastructure, and logistics can also influence project costs. While both the Uganda and Cameroon projects are in Africa, they have different environmental and social contexts that affect their implementation and cost. For example, our reforestation initiative in Uganda involves planting and maintaining millions of trees in areas with degraded land and high deforestation rates. This requires a significant investment in land, labour, and ongoing maintenance to ensure the project's success. In contrast, our cookstove project in Cameroon is implemented on a smaller scale and in areas with existing infrastructure, making it easier to implement and monitor. Therefore, the unique challenges and opportunities of certain projects may require additional resources and investments to ensure their success and maximise their impact.

Why are your cookstove projects cheaper than your afforestation projects?

The cost of our projects can vary depending on several factors, such as the location, scope, scale, objectives, and complexity. Factors like local conditions, infrastructure, and logistics can also influence project costs. Cookstove projects are relatively cost-effective because they focus on providing energy-efficient cooking solutions to households, which can have immediate health and environmental benefits. Afforestation projects, on the other hand, involve planting and maintaining millions of trees over an extended period, which require more resources, labour, maintenance, and longer-term investments.

Why are carbon credits from nature-based projects more expensive than other projects?

Carbon credits from nature-based projects are often more expensive than other carbon projects due to various factors. These factors contribute to their greater value and overall higher prices in the carbon market.

1. Their limited supply—High-quality, nature-based carbon credits are in high demand as companies globally seek to reach net zero. However, the supply of these credits is limited, particularly because creating these projects takes time and effort.

2. Multiple co-benefits—Nature-based projects, such as afforestation, reforestation, and regenerative agriculture, not only sequester carbon but also provide numerous co-benefits. These projects contribute to ecosystem conservation, improve biodiversity, protect wildlife habitats, enhance soil health, and offer livelihood opportunities for local communities. These additional benefits increase the project’s overall value and impact, leading to higher costs compared to projects solely focussing on emissions reduction.

3. Long-term commitment— Nature-based projects, such as forest conservation and restoration, require long-term commitment and monitoring to ensure their effectiveness. This increases their cost as they require sustained efforts and resources to maintain their carbon sequestration benefits.

4. Stringent certification standards—Nature-based carbon credits tend to undergo rigorous certification processes to ensure their legitimacy and effectiveness. Certifying bodies like Verra (Verified Carbon Standard) and the Gold Standard evaluate and verify the environmental and social impacts of these projects, which can involve additional costs for project developers.

5. Significant scale and impact—Nature-based projects, especially those focused on preserving forests and ecosystems, have the potential to sequester significant amounts of carbon dioxide. The scale and impact of these projects make them more expensive to implement and manage compared to smaller-scale technology-based projects.

What is the difference between the voluntary and the regulatory carbon market?

The voluntary carbon market operates on a voluntary basis, where participants voluntarily choose to offset their greenhouse gas emissions by purchasing carbon credits from projects that reduce or remove carbon from the atmosphere. The voluntary market has grown exponentially with the increasing global pressure to achieve the net-zero goals of the Paris Agreement.

The regulatory carbon market exchange is governed by mandatory emission reduction targets and regulations set by governments to achieve broader climate goals. In these markets, companies must participate and comply with emission reduction targets set by government authorities. These emissions limits are known as ‘allowances’ or ‘caps’. Examples include the European Union’s Emissions Trading System (EU ETS) and California’s cap-and-trade programme.

Both markets play essential roles in addressing carbon emissions and contribute to the fight against the climate crisis, with the voluntary market offering an additional avenue for companies and individuals to support emission reduction efforts.

How does carbon pricing differ between the voluntary and regulatory carbon markets?

Pricing in the voluntary carbon market is determined through negotiation and market dynamics between buyers and sellers. Organisations wanting to offset their emissions through carbon credits engage in transactions with project developers or intermediaries, and the price is influenced by factors such as project type, location, and co-benefits. Pricing is also affected by demand, the availability of high-quality emission reduction projects, and the credibility of carbon credits.

In the regulatory carbon market, pricing is usually set by government authorities based on carbon reduction targets and the cap-and-trade system. Carbon allowances may be auctioned or allocated based on specific criteria, and companies must comply with the pricing structure set by the regulatory framework. The pricing dynamics in the regulatory market are directly impacted by government policies, emission reduction goals, and market mechanisms designed to achieve the overall targets of the compliance programme.

Do I need a broker to purchase carbon credits?

Brokers can play a pivotal role in the rapidly evolving Voluntary Carbon Market (VCM) by facilitating transactions, providing market liquidity, and contributing to price discovery. As intermediaries, they connect buyers and sellers, helping to negotiate prices and terms that satisfy both parties. Brokers such as EMSurge, ClearBlue Markets, Sigma Broking, and ACT Commodities serve as vital links in the VCM. They provide platforms for bilateral over-the-counter carbon trading and origination, offering access to various carbon credits across various sectors. Organisations however do not need brokers to acquire carbon credits from project developers. You can contact us directly to purchase carbon credits generated by our impactful projects.