The carbon credits market is expanding. According to Trove Research, the carbon credit market could increase by up to 40% to about $1.9 billion in value by 2023. In the next few years, there will be an increase in demand for carbon offsets.

McKinsey analysis indicates that demand in 2030 may be met by the possible annual supply of carbon credits of 8 to 12 billion tonnes of carbon dioxide (CO2) per year. These carbon credits would come from three sources: prevented deforestation; nature-based sequestration, such as reforestation; and avoidance or reduction of emissions from landfills, such as technology-based removal of CO2 from the atmosphere.

A carbon credit is equal to one tonne of atmospheric CO2 emissions removed from the atmosphere. This can be accomplished through a variety of techniques, including planting trees and sustainable land management practices.

This guide will explain the benefits of carbon credits, the types of carbon markets, where you can buy carbon credits, and where you can sell your carbon credits.

What are the benefits of carbon credits?

Carbon credits have many benefits for the environment, countries, and businesses.

Selling carbon credits helps the environment and removes carbon from the atmosphere by planting trees, or avoiding emissions from other sources, like switching to clean energy.

Businesses, organisations, and countries that manage to reduce their carbon footprint have boosted their economies by using the funds they save to invest in sustainable activities. Businesses also benefit from buying carbon credits for their brand image.

Read more: The rising demand for nature-based credits

What are the types of carbon markets?

The voluntary carbon market (VCM)

The voluntary carbon market enables the trading of carbon credits granted to people and businesses who have eliminated, avoided, or limited atmospheric greenhouse gases (GHGs). The global voluntary carbon market is expected to develop at a compound annual growth rate (CAGR) of 42.91% between 2022 and 2027. Meanwhile, the voluntary carbon market traded volume is predicted to rise at a 14.69% CAGR.

The regulated carbon credits market

Mandatory national, regional, or international carbon reduction regimes develop and govern the regulated carbon credit market. The global carbon credit trading market is predicted to grow at a CAGR of 24.4% from 2022 to 2027, from an estimated $67.3 billion in 2022.

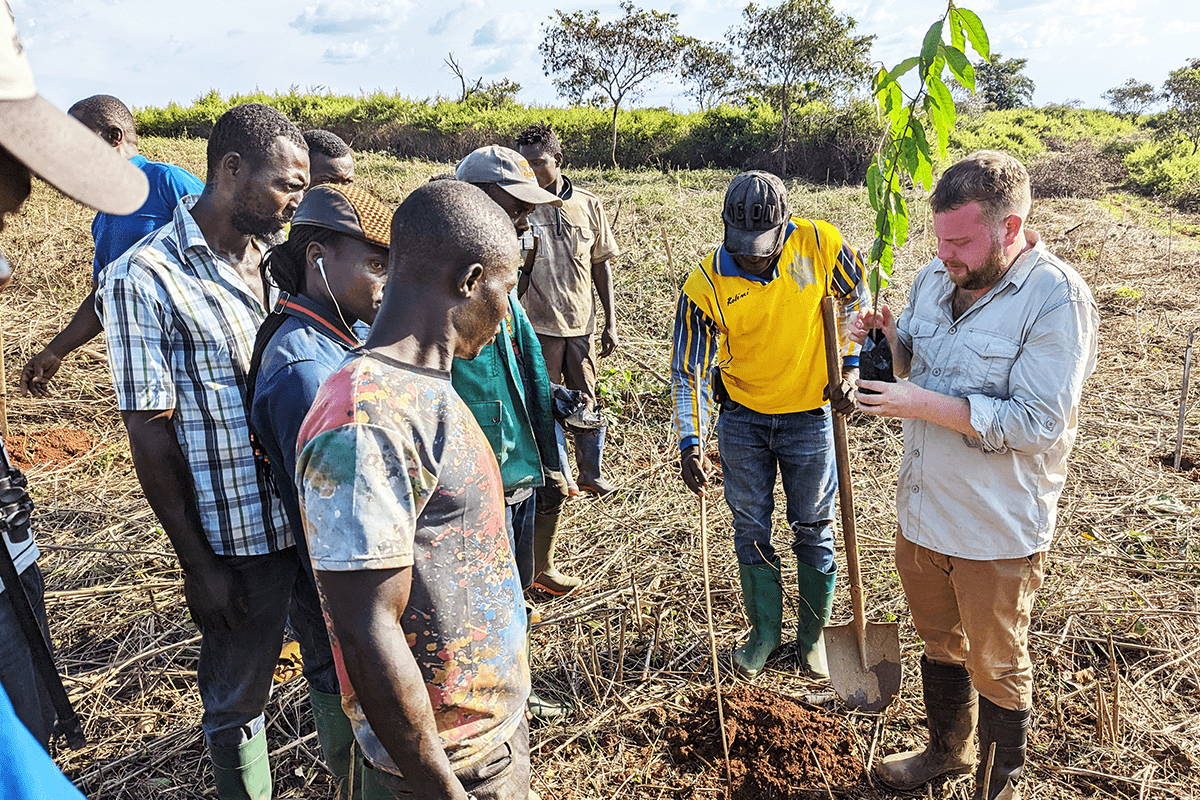

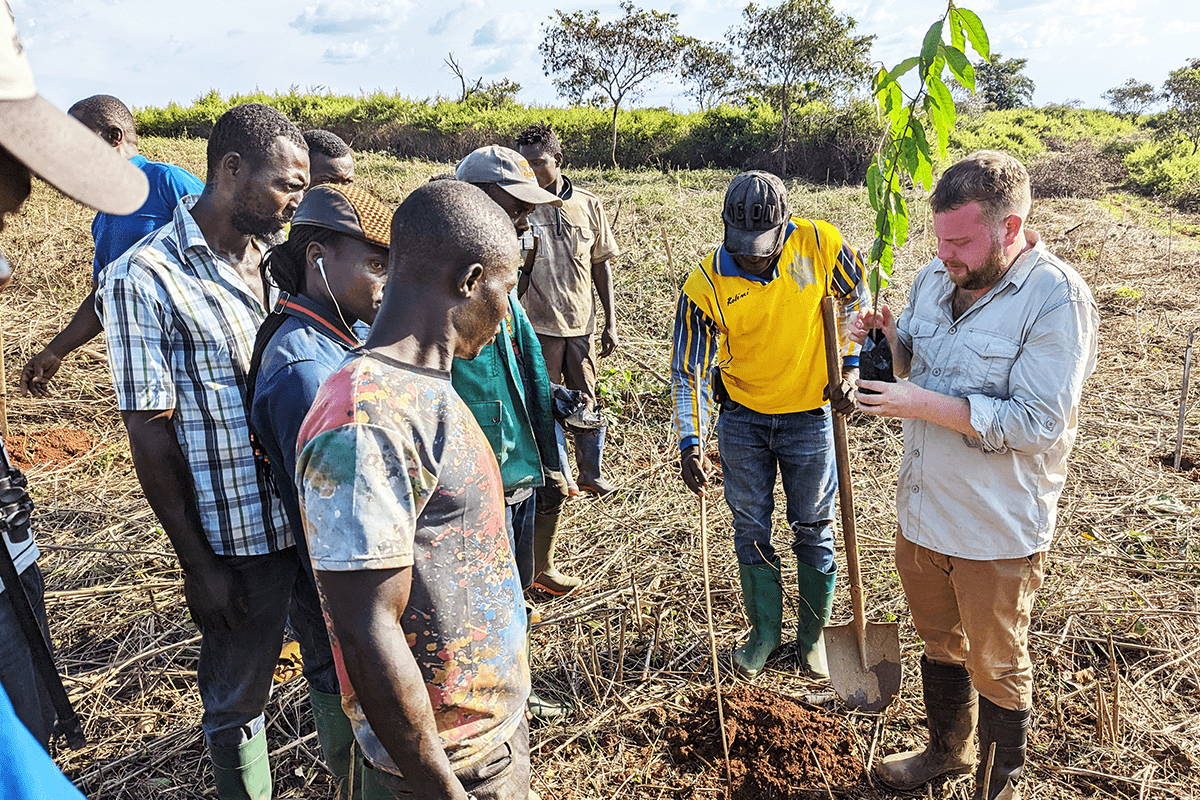

Nicholas Wall, DGB’s Lead ecologist, instructing local workers about afforestation processes at the Sawa Afforestation Project.

Nicholas Wall, DGB’s Lead ecologist, instructing local workers about afforestation processes at the Sawa Afforestation Project.

Where can you buy carbon credits?

Buying carbon credits is a clear operation process that individuals or businesses can do. There are different places where you can purchase carbon credits all the around the world, such as:

-

In the United States: The Western Climate Initiative, a collaborative venture with Quebec, one of the emerging cap-and-trade programmes.

-

In Europe: The EU Emissions Trading System (EU ETS) structure supports both cap-and-trade markets and the world's largest carbon market.

Read more about carbon markets

Where and how can you sell carbon credits?

The practice of buying and selling credits that permit businesses or other parties to emit a specific amount of CO2 is known as carbon trading, sometimes known as carbon emissions trading. Carbon emission rights can be traded on a variety of markets, including international, national, state, and local markets.

Large companies like Tesla benefit from selling carbon credits to other businesses. This enables other automakers to comply with emissions laws and avoid paying charges. Big automakers, like Stellantis, have purchased credits worth more than $2 billion from Tesla in the past two years.

And if laws governing carbon emissions become stricter, as expected, you can bet that more businesses will base their profits on carbon credits.

The process of selling carbon credits is simple. There are three ways to sell your carbon credits.

-

Direct carbon credit selling. The first way to sell carbon credits is by contacting emitters who want to purchase the offsets directly.

-

Selling to offsetting organisations. The second way to sell carbon offsets is to contact specialised companies developing carbon credits, like DGB Group.

-

Selling carbon credits for brokers. The third way is to find brokers in the carbon trading market. Brokers in carbon markets can take a buyer's quote and locate an appropriate offset on the market.

Seedlings nursery being monitored at the Sawa Afforestation Project, DGB.

Seedlings nursery being monitored at the Sawa Afforestation Project, DGB.

What is the cost of carbon credits?

The carbon credit market, which consists of firms and investors who buy and sell carbon credits, determines the cost of carbon credits. The price varies according to demand and supply, but it typically ranges from $40 to $80 per metric tonne.

Although carbon prices change depending on market conditions, price increases are expected both this year and in the upcoming years.

What will carbon credits cost in the future?

February 2023 saw the EU carbon price reach an all-time high of €100 per tonne, marking a symbolic turning point in the 27-nation bloc's efforts to reduce emissions. Analysts predict that this pricing will encourage businesses to start looking at more sustainable options or making investments in cutting-edge technologies like carbon capture and storage. Carbon prices under the EU ETS are expected to be over €130 per tonne in 2030.

How does the carbon market affect DGB Group?

The carbon credit market and increases in the carbon price play an important role in the business of DGB Group. DGB uses carbon credits to promote global sustainability. DGB's large-scale nature-based projects generate purchasable carbon credits that can be used to offset the emissions of businesses and individuals.

We assist businesses in reducing their carbon footprint to meet net-zero emission goals. DGB's experts will ensure that you and your company are future-proofed and ready to participate in a decarbonised economy.

Get in touch with our experts to start offsetting your emissions