In an era where sustainability and responsible business practices are paramount, investors are increasingly seeking opportunities to invest their money in an ethical and sustainable manner. Many publicly traded companies, exchange-traded funds (ETFs), and futures are now available for investors looking for attractive returns and a positive impact on our planet.

Nature and sustainability

Over the past decade, we have witnessed a remarkable transformation in how businesses and individuals address nature conservation and sustainability. One of the most notable changes is the rapid growth and evolution of the voluntary carbon market. Once a niche area, it has become a crucial tool for entities aiming to reduce their carbon dioxide (CO2) footprint and achieve sustainability goals.

Read more: The power of sustainability: Why investing in sustainability drives faster company growth

The exponential growth of the carbon market

The voluntary carbon market has undergone impressive growth and transformation in the past 10 years. Driven by the increasing importance of nature, consumer demand for sustainable development, and commitments by entities to achieve net-zero emissions, this market has become an essential tool in the fight against deforestation. With the market's ongoing evolution, emphasis on quality and integrity, and the integration of advanced technologies, the future of the voluntary carbon market is promising. It plays a crucial role in our collective efforts to create a more sustainable and carbon-neutral future.

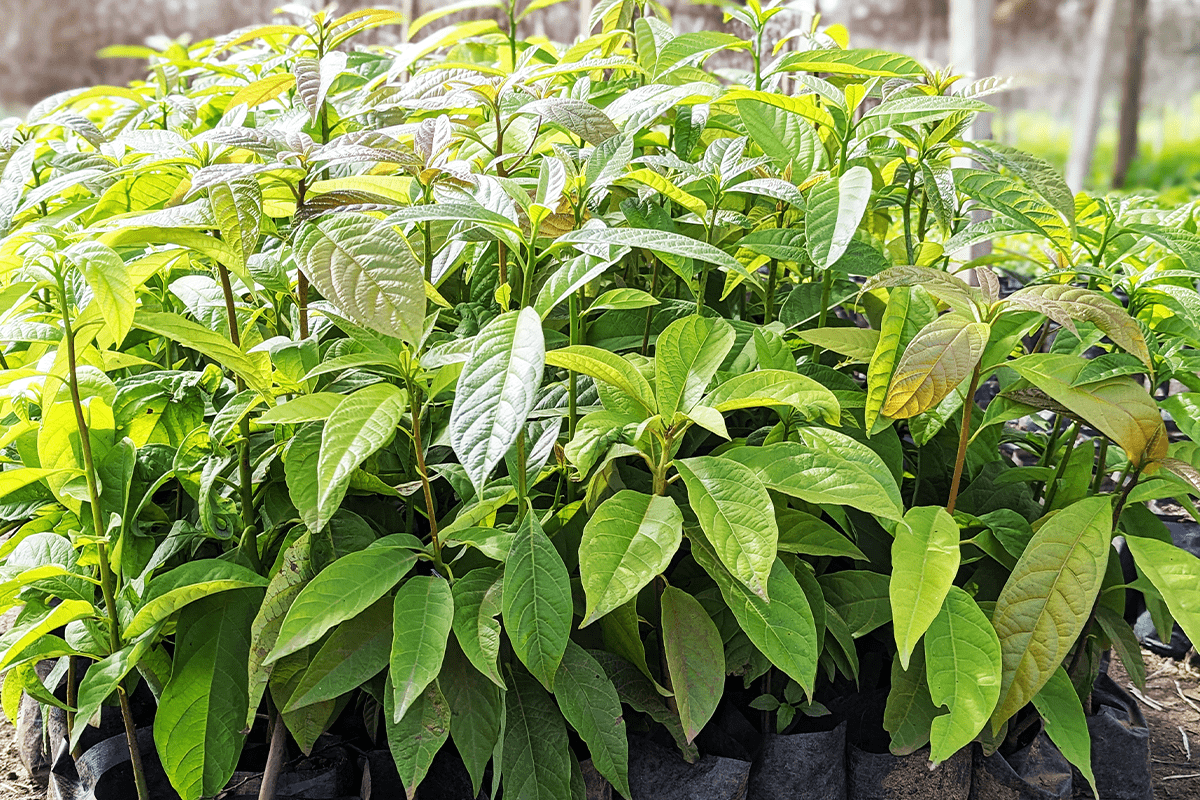

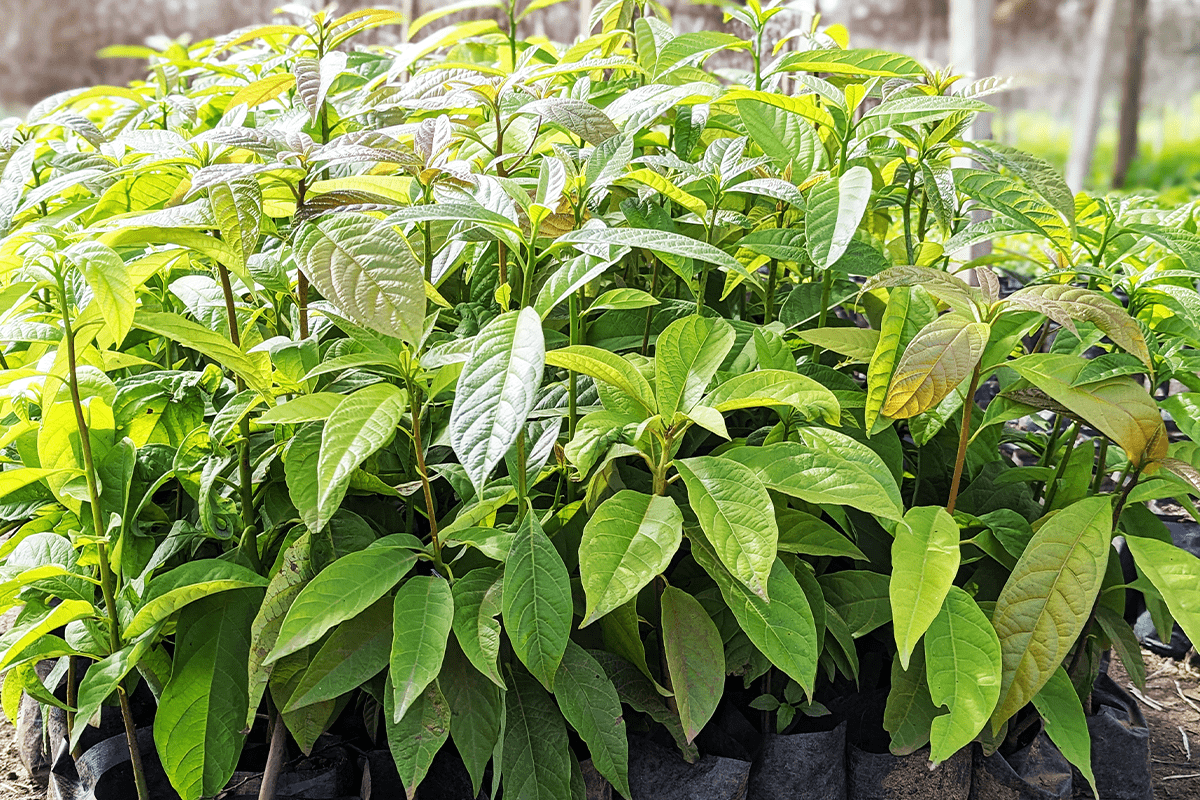

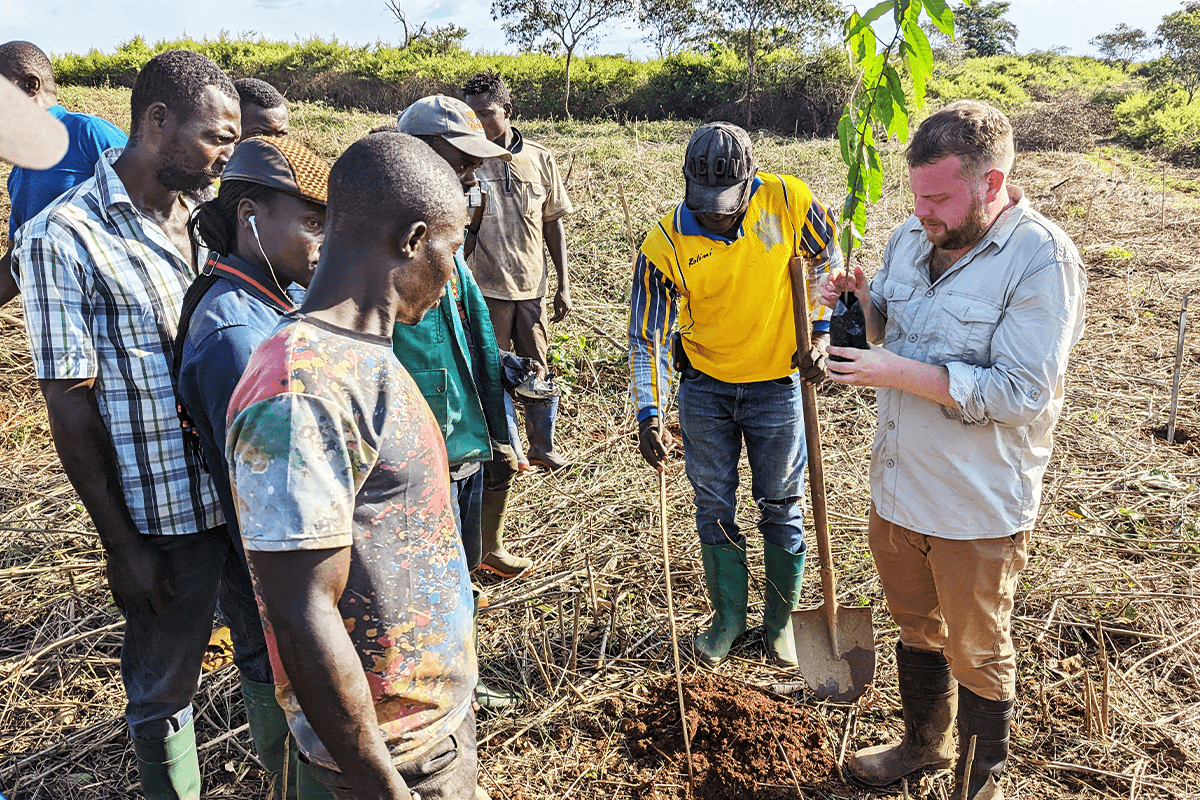

Tree seedlings - Greenzone Afforestation Project, Cameroon, DGB.

Tree seedlings - Greenzone Afforestation Project, Cameroon, DGB.

The world of low-carbon investments

The world of low-carbon investments is diverse and rapidly growing, with numerous opportunities for investors interested in supporting sustainability and combatting deforestation. This article explores the various ways one can invest in carbon credits, including stocks, ETFs, and more.

The voluntary carbon market vs compliance markets

The voluntary carbon market fundamentally differs from compliance markets, where entities are legally required to offset their emissions. In the voluntary market, entities proactively choose to offset their CO2 emissions, often driven by a sense of corporate responsibility or the desire to achieve sustainability goals. This market has experienced exponential growth over the past 10 years, fueled by increasing awareness of nature's importance and growing consumer demand for environmentally friendly businesses and products.

Read more: The interconnected world of carbon: exploring key carbon market concepts

Trends and developments

The voluntary carbon market is constantly evolving, with various trends determining the direction and pace of growth. A notable trend is the increasing demand for CO2 emission rights, especially from companies making net-zero pledges. These pledges, where entities commit to fully offsetting their CO2 emissions, have led to a significant increase in demand for reliable and effective ways to offset CO2 emissions and reduce carbon footprints.

In addition to growing demand, there is also a clear shift towards quality. There is a growing preference for high-integrity CO2 emission rights, known as Verified Emission Reduction (VER) credits. These credits are rigorously monitored and validated to ensure they genuinely contribute to emission reduction.

Another key trend is the diversification of projects generating CO2 emission rights. Developers are exploring a wide range of projects, from reforestation and sustainable agriculture to methane capture and renewable energy projects. This diversity not only provides more options for entities wanting to buy CO2 emission rights but also contributes to a broader range of environmental and social benefits, with projects like reforestation often offering many environmental and socio-economic benefits in addition to CO2 sequestration.

Read more: How nature-based projects contribute to net-zero goals

Technological integration

Technological integration plays a crucial role in the evolution of the voluntary carbon market. Advanced technologies, such as satellite monitoring and blockchain, are increasingly used to validate, monitor, and ensure that the generated credits are reliable and transparent.

The importance of net-zero pledges

Net-zero pledges are a driving force behind the growth of the voluntary carbon market. These pledges reflect a fundamental shift in the attitude of businesses and governments towards decarbonisation and sustainability. They recognise that reducing emissions is not enough; we must aim for a balance where the amount of CO2 we emit is equal to the amount we remove or offset.

CO2 emission rights play an essential role in this equation. They offer a tangible path for entities to offset emissions they cannot directly eliminate and act as a crucial tool in the global push for decarbonisation. As more entities commit to achieving net-zero emissions, the demand for CO2 emission rights is expected to continue rising, especially for high-quality credits that have a measurable impact on the environment.

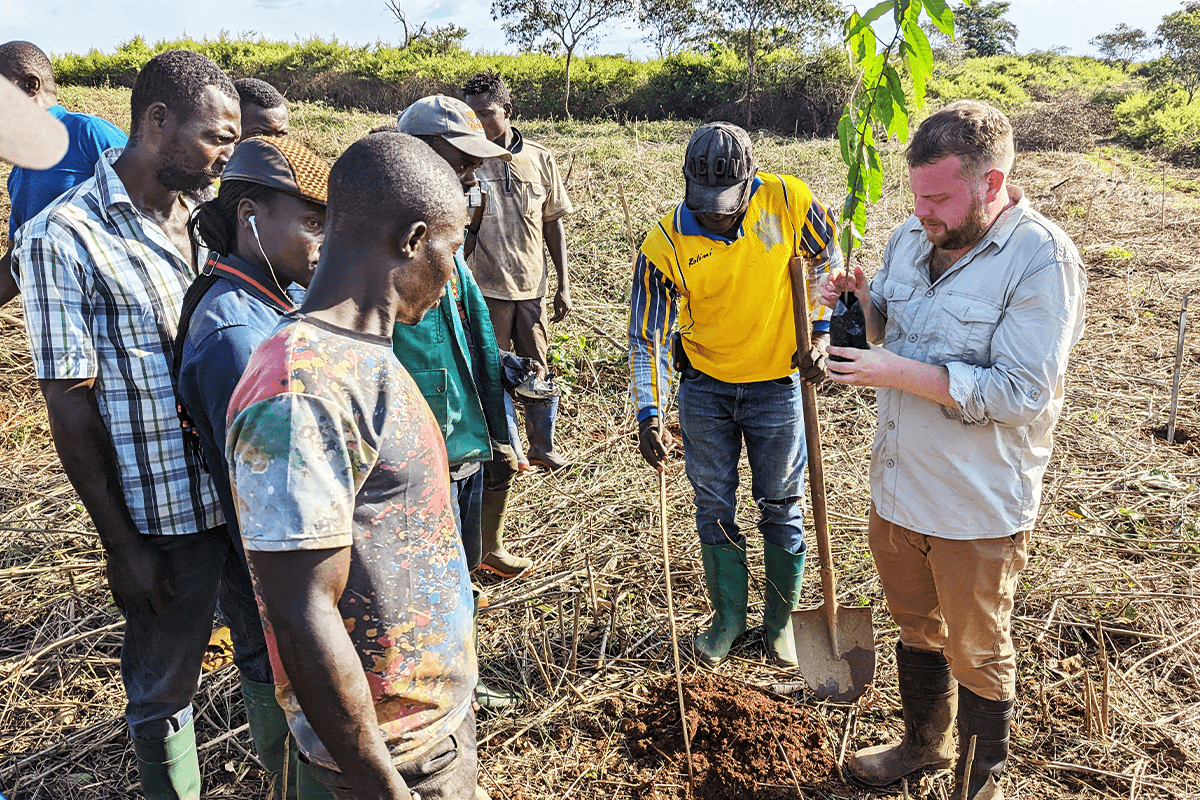

Nicholas Wall providing training - Greenzone Afforestation Project, Cameroon, DGB

Nicholas Wall providing training - Greenzone Afforestation Project, Cameroon, DGB

Futures

What are carbon credit futures?

Carbon credit futures are a type of financial instrument based on carbon credits. They represent a reduction in carbon emissions. Carbon credits are issued as certificates or permits, and each equals one metric tonne of CO2. Carbon credits are used to reduce overall carbon emissions and mitigate environmental instability. Carbon credit futures are a credit instrument allowing the buyer to offset emissions through carbon offset projects without directly investing in those projects at such time.

Read more: How are carbon credits issued?

How carbon credit futures trading works

Carbon credit futures contracts physically deliver carbon credits. Each futures contract equals 1,000 carbon credits generated from projects that protect natural ecosystems. A futures contract is a kind of derivative wherein two parties agree to trade an underlying asset at a specific date for a specific price. The underlying assets, in this case, are the carbon credits. With fluctuating carbon prices, carbon credit futures can mitigate risk when added to an investment portfolio. However, it's important to note that futures contracts are a more advanced trading strategy and are a more complicated way of investing in the assets that underlie an ETF, as they track the performance of the futures.

Read more: Cracking the code of carbon pricing: How does it work?

Carbon credit futures in the carbon market

Carbon credit futures allow investors to participate in the carbon market and reduce their risk. With several available carbon credit ETF instruments to assess, an investor can customise their portfolio allocation to the global carbon credit market. While the carbon credit futures market can be exciting, it also comes with risks, as it's not possible to predict with certainty what the future holds. However, the upward trend in the price performance of most carbon ETFs is a good reference point for an investor to test the waters of carbon trading.

Net-zero stocks: a look into the future

CO2 reduction stocks represent companies directly involved in the carbon market or contributing to the reduction of CO2 emissions. A notable player in this space is DGB Group. We are committed to sustainability and creating solutions for a greener future.

Carbon Streaming Corporation (NETZ.NE)

Carbon Streaming Corporation is a royalty-type company focusing on building a portfolio of high-quality CO2 reductions. By providing capital for financing CO2 reduction projects, it obtains the right to receive all or a fixed portion of all future CO2 emission rights generated by these projects. The revenues are then generated from the sale of these CO2 emission rights. Although it is a higher-risk investment, Carbon Streaming Corporation offers excellent exposure to the growth of the carbon market. It has a portfolio of 21 projects in 12 different countries and is involved in some of the largest REDD+ projects in the world.

DevvStream (DESG.NE)

DevvStream is a relatively new company that provides funding for green projects in exchange for rights to CO2 emission rights. It utilises an advanced blockchain-based Environmental, Social, and Governance (ESG) platform for managing the generated CO2 emission rights. DevvStream stands out for its unique partnerships and its position in both the voluntary and compliance carbon markets. It has access to a rapidly growing market and can target this growth thanks to Devvio's technology. DevvStream is an attractive option for investors willing to take on higher risk.

Base Carbon (BCBN.NEO)

Base Carbon is involved in financing CO2 reduction projects that generate voluntary CO2 emission rights. It has two executed project agreements estimated to generate a total of 34 million carbon credits. Base Carbon has committed to projects in Rwanda and Vietnam, focusing on improving cooking methods and reducing dependence on biomass. It has a strong balance sheet and continues to seek other high-quality carbon credit projects. Base Carbon is an option for investors with a high-risk tolerance.

Brookfield Renewable Partners (BEP)

Brookfield Renewable Partners is one of the world's largest publicly traded renewable energy companies, with a pure-play focus on renewable energy sources. It owns a diverse portfolio of assets worldwide and has an extensive development pipeline to increase its operational capacity significantly. It offers investors a stable and proven business model, strong cash flows, and an attractive dividend yield. It is a good option for investors looking for exposure to the carbon market with a lower risk profile.

DGB Group (DGB.AS)

DGB Group is a listed company focused on nature restoration and innovation in the green sector. We specialise in creating large-scale nature-based solutions that extend beyond carbon sequestration, focusing on ecosystem restoration, biodiversity preservation, habitat creation, and tangible community benefits. Our products include top-quality carbon credits, 8% ROI green bonds, and trees for businesses. We are dedicated to making the carbon market an inclusive space where individuals, investors, and organisations can actively contribute to a more sustainable and resilient future. DGB—with its strong focus on green initiatives—is an excellent option for investors interested in creating a greener portfolio with sustainable returns.

Explore DGB’s nature-based projects

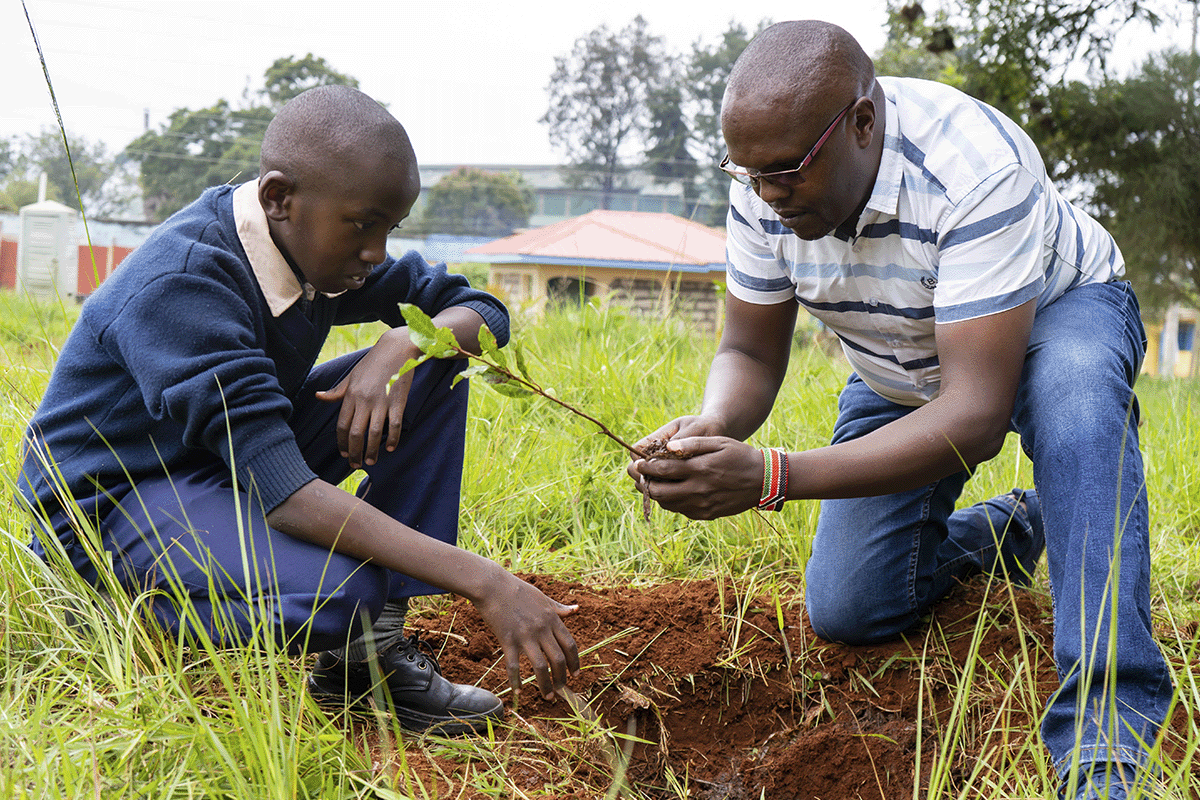

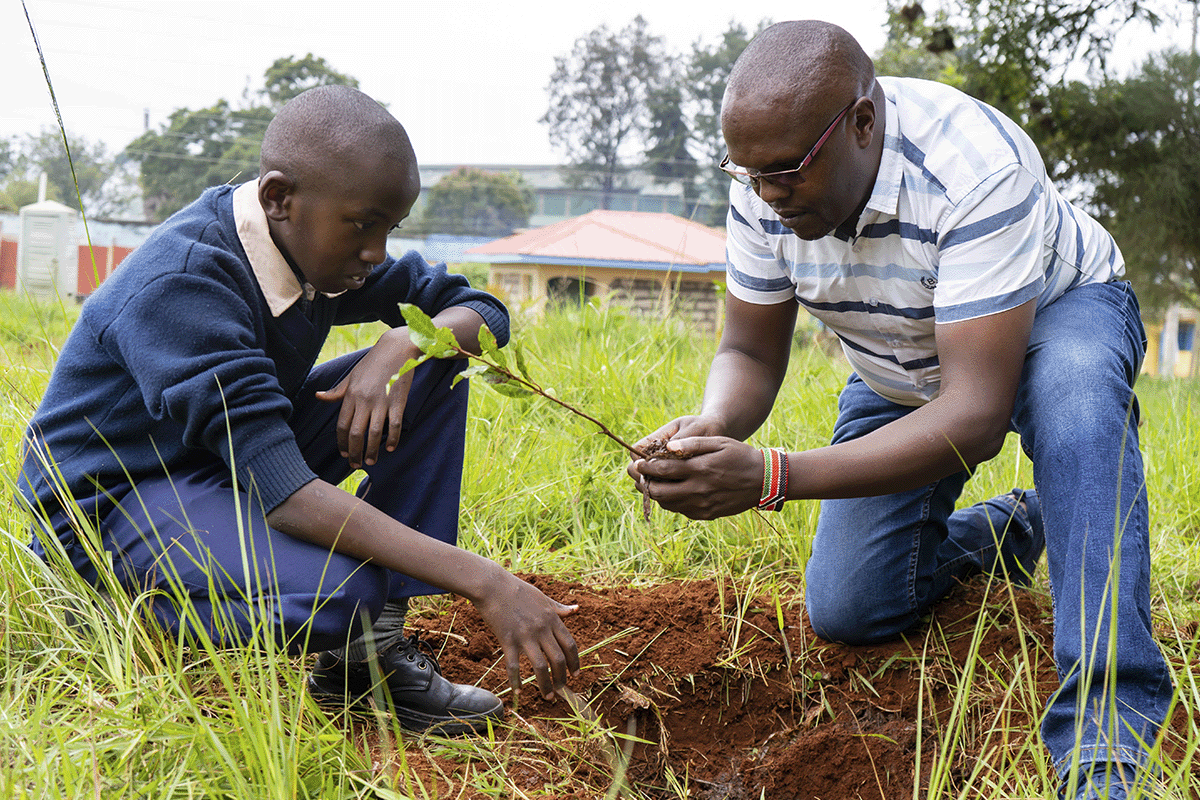

DGB providing training on tree planting to a local school in Kenya, Hongera Reforestation Project, DGB.

DGB providing training on tree planting to a local school in Kenya, Hongera Reforestation Project, DGB.

Carbon credit ETFs

Several carbon credit ETF instruments are available, such as the:

- KraneShares Global Carbon ETF (KRBN). KRBN provides exposure to mostly the European Union Emissions Trading System (EU ETS) carbon credits, California's CCA carbon credits, and the RGGI carbon credits of the northeastern United States.

- KraneShares Global Carbon Offset Strategy ETF (KSET). KSET offers exposure to carbon offset futures contracts.

- KraneShares California Carbon Allowance ETF (KCCA). KCCA provides direct exposure to the California Carbon Allowances traded under California's cap-and-trade program.

- KraneShares European Carbon Allowance ETF (KEUA). KEUA provides direct exposure to a portfolio of carbon credit futures contracts that trade under the world's largest carbon market, the EU ETS.

- Horizons Carbon Credits ETF (CARB). CARB trades on the Toronto Stock Exchange.

- iPath Series B Carbon ETN (GRN). GRN provides exposure to carbon credit futures contracts that trade on the ICE Futures Europe exchange. This ETF tracks the Barclays Global Carbon II TR USD Index, which consists almost entirely of EU ETS CO2 reduction futures. This provides good exposure to the growth of the carbon market, though with greater risk and volatility.

- SparkChange Physical Carbon EUA ETC (CO2.L). CO2.L directly buys and holds EU allowances traded under the EU ETS.

- iShares MSCI ACWI Low Carbon Target ETF (CRBN). This ETF contains over 1,000 companies with low CO2 emissions worldwide, including major names like Apple, Microsoft, and Amazon.

- BlackRock US Carbon Transition Readiness ETF (LCTU). LCTU consists of medium to large American companies well-positioned to benefit from the transition to a low-carbon economy.

ETFs offer a way for investors to diversify and gain exposure to the carbon market without having to select individual stocks.

Investing in a greener tomorrow

Investing in CO2 reduction offers a range of opportunities for investors interested in sustainability and nature. From stocks and ETFs to green bonds and ETSs, there are numerous options available to gain exposure to this growing market. As the world commits to achieving net-zero emission targets, the demand for CO2 emission rights and sustainable solutions is expected to increase, offering opportunities for forward-looking investors.

At DGB, we are committed to setting a precedent for transparency and accuracy in the carbon credit market and believe the success of this market is vital to achieving our goals of helping nature to prosper. By participating in the carbon market via carbon projects, carbon credits, and green bonds, we help companies and investors reduce their carbon footprint and contribute to a greener, more sustainable future. The potential for growth in the carbon market is enormous, and we are excited to be at the forefront of this movement, helping to shape the industry and drive positive change for the planet.