Peatlands are essential ecosystems that cover 3% of the Earth's surface and are one of the largest natural terrestrial carbon stores. They sequester approximately 4 gigatonnes of carbon dioxide (CO2) per year, more than all other vegetation types. However, peatlands are vulnerable to degradation. Exploitation can cause them to release more carbon than they absorb, tipping the global peatland–greenhouse–gas balance from a carbon sink to a carbon source.

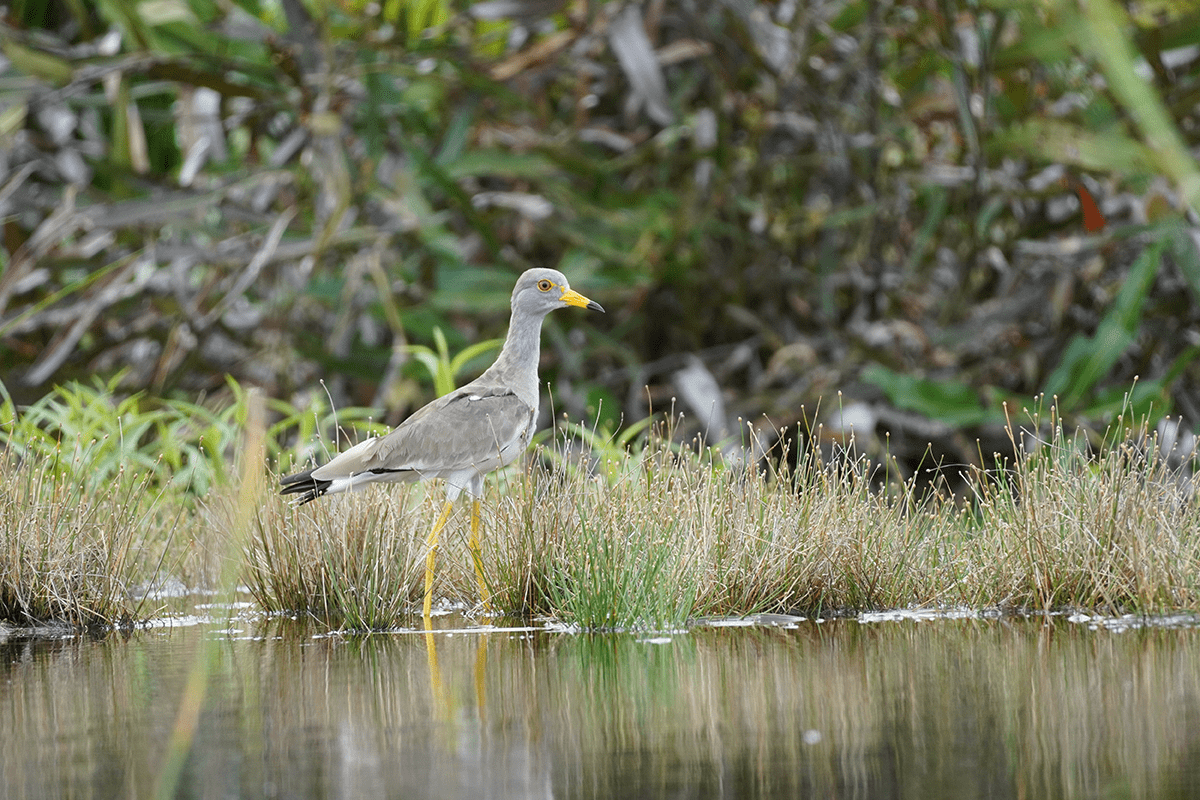

Aerial view over peatland landscape.

Aerial view over peatland landscape.

Financing peatland restoration

Peatland restoration is critical for countries to meet their climate goals, but its costs, such as rewetting, replanting, brash cutting, and sphagnum plugging, are capital-intensive. Public financing is unlikely to provide sufficient additional funds, and governments need to invest the required capital for peatland restoration.

A proposed solution is to set up a natural capital financing facility that blends public and private capital. The facility pools capital from various sources and offers upfront, low-cost, and long-duration capital to cover the capital and operating expenses for the peatland restoration programme.

Read more about DGB’s nature-restoration projects

Public finance would provide crucial capital grants to finance a significant portion of upfront restoration costs, while private investors cover the residual part of capital costs. Private capital providers would be investors with long-term investment horizons, such as pension funds and insurance companies, who have an appetite for taking illiquidity risks.

The financing facility can appoint a project developer responsible for assessing the peatland condition, restoring and maintaining the peatland, and collecting a management fee from the financing facility.

The primary financial benefit is derived from selling tradable carbon emissions from carbon sequestration. Additional revenue can be generated from payments for a guaranteed flow of ecosystem services, such as water purification, flood protection, and recreational benefits.

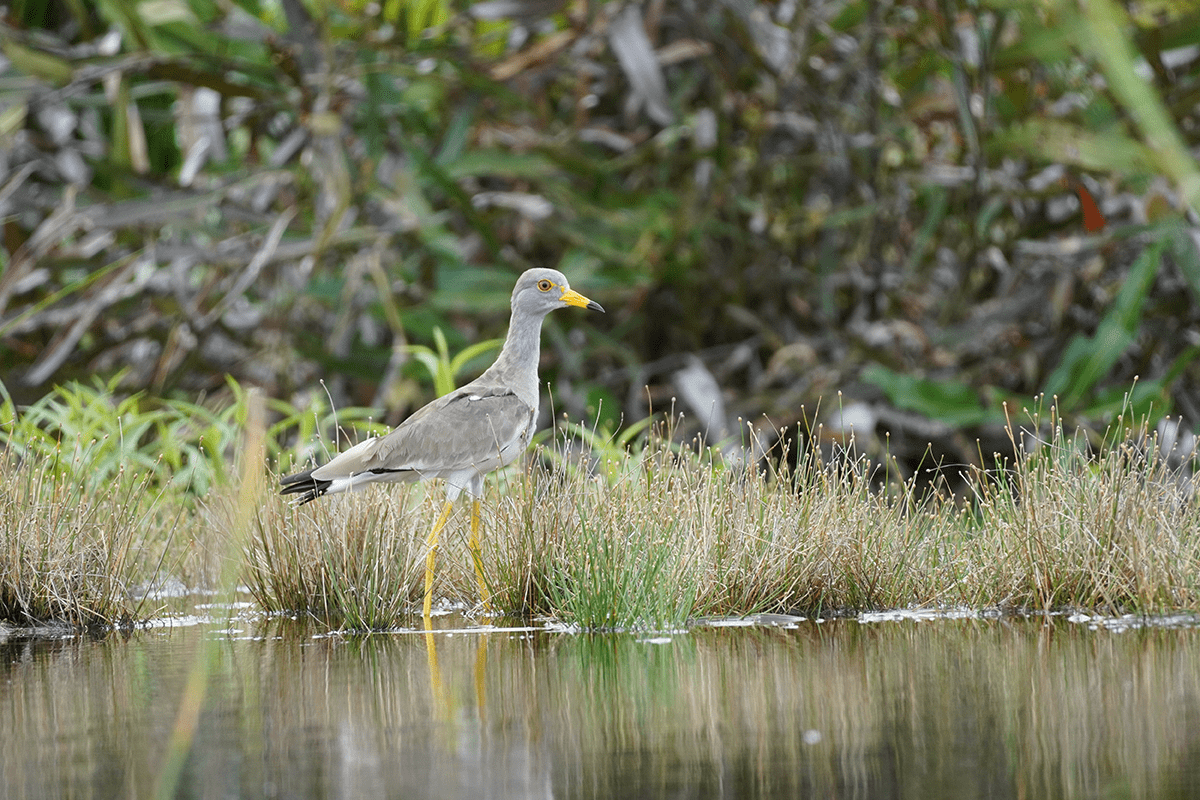

Water bird in peatland areas.

Water bird in peatland areas.

The proposed natural capital financing facility offers a revenue-generating, self-sustaining financing mechanism that provides a lucrative opportunity for private capital providers to participate in the peatland restoration business. It can help meet nationally determined contributions and goals under the 2015 Paris Agreement while preserving peatlands, which can help achieve global net-zero ambitions and benefit climate adaptation.

DGB Group supports restoration projects like peatland restoration. DGB is committed to restoring nature at scale, and it develops impactful projects that sequester large amounts of carbon and boosts biodiversity.

Contact us for more information