Green bonds are a transformative force within the financial landscape, representing a strategic convergence of economic objectives and environmental responsibility. These instruments are designed to fund projects that contribute positively to the planet, ranging from reforestation initiatives to sustainable infrastructure development.

Aerial view of a forest with young trees planted in a row. AI generated picture.

Aerial view of a forest with young trees planted in a row. AI generated picture.

As we delve into the nuances of green bonds, it's crucial to understand their origins, principles, types, and the significant role they play in fostering environmental stewardship. This exploration will provide a comprehensive understanding of green bonds, facilitating informed communication and strategic decision-making in the dynamic landscape of sustainable finance.

What are green bonds?

Green bonds represent a specialised category of fixed-income debt securities designed to finance environmentally sustainable projects. Issuers, typically governments, corporations, or financial institutions, raise capital through green bonds with the explicit commitment to allocate the proceeds towards projects with positive environmental impacts. These projects span a wide range, including nature-based solutions, energy efficiency, and green buildings.

A local woman working at a tree nursery, Hongera Reforestation Project, DGB.

A local woman working at a tree nursery, Hongera Reforestation Project, DGB.

Green bonds are created and grouped based on adherence to established principles, such as the Green Bond Principles, which outline criteria for the use of proceeds, project evaluation, management of funds, and reporting practices. The significance of green bonds lies in their ability to channel financial resources directly into initiatives that promote environmental sustainability, offering investors a socially responsible investment avenue while supporting the global transition towards a greener and more sustainable future.

Read more: The interconnected world of carbon: exploring key carbon market concepts

Green bonds have gained popularity as a financial instrument that aligns with Environmental, Social, and Governance (ESG) criteria. Investors in green bonds may enjoy tax advantages or incentives, making them an attractive option for those seeking both financial returns and positive environmental impact.

A brief history of green bonds

The roots of green bonds delve into a pioneering era where the European Investment Bank (EIB) and the World Bank emerged as the vanguards of sustainable finance. The EIB, in particular, played a pivotal role by issuing the world's first green bond, labelled the Climate Awareness Bond, in 2007, setting a precedent for environmentally conscious financial instruments. By the end of 2020, the EIB had issued over €33.7 billion in green bonds. The World Bank followed suit in 2008, establishing itself as a significant issuer dedicated to financing projects with tangible environmental benefits.

In the nascent stages, these institutions spearheaded green bond issuance, directing funds towards projects ranging from renewable energy infrastructure to environmental restoration. The fundamental idea was to mobilise capital for initiatives that contributed positively to environmental sustainability, laying the groundwork for a financial mechanism that aligned economic growth with ecological responsibility.

As green bonds gained traction, their influence expanded globally. While early movers like the EIB and the World Bank set the stage, countries such as the United States and China emerged as current leaders in green bond issuances. The US and China's commitment to sustainability is reflected not only in the sheer volume of green bonds they issue but also in the diversity of projects they fund, encompassing areas like nature-based projects, renewable energy, green infrastructure, and environmental adaptation. In 2022, global green bond issuances amounted to nearly $500 billion, with the US market contributing approximately 13% of this total. Notably, the issuance of green bonds in the US has experienced substantial growth, particularly in recent years, reaching a peak of over $90 billion in 2021.

Read more: Carbon pricing: global solutions for a global challenge

Today, the landscape of green bonds has evolved into a dynamic global market, with various nations actively participating. The pioneering efforts of the EIB and the World Bank have catalysed a movement where green bonds have become a mainstream financial instrument, transcending geographical boundaries. The market's evolution continues to be shaped by diverse issuers, each contributing to the collective effort to address environmental challenges through innovative and sustainable financing.

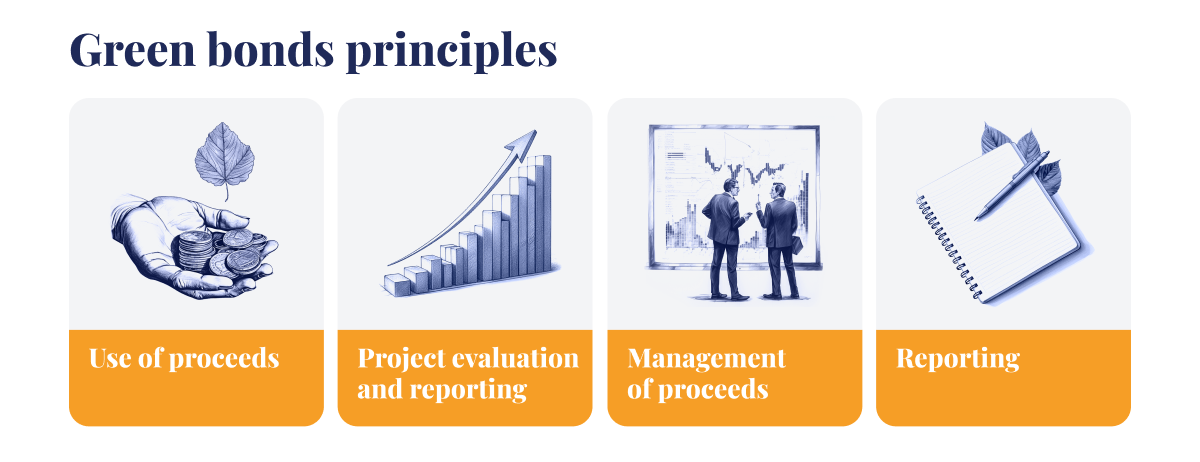

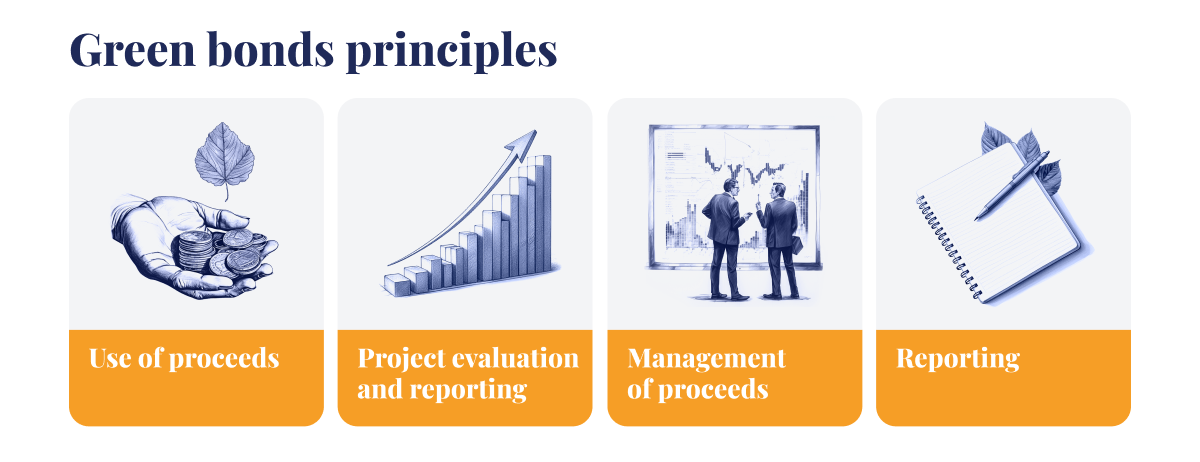

Green bonds principles

Green bonds are underpinned by a set of fundamental principles that not only safeguard their integrity but also propel issuers towards meaningful strides in environmental sustainability. These principles, which encompass the use of proceeds, project evaluation, the management of funds, and reporting practices, serve as a robust framework for ensuring the efficacy and credibility of green bonds.

At the core of the green bond market lies the Green Bond Principles, acting as the cornerstone for transparency and accountability. These principles, discussed below, guide issuers in aligning their financial activities with environmentally responsible practices, fostering a standard that enhances the overall credibility of green bonds.

- Use of proceeds: A critical component of green bonds is the explicit specification of the use of proceeds. This principle ensures that the funds raised through green bond issuances are channelled exclusively into projects that yield clear and measurable environmental benefits. This dedicated allocation ensures that the capital raised serves the intended purpose of fostering sustainability.

- Project evaluation and reporting: Rigorous evaluation processes are integral to the green bond framework. Issuers are obligated to assess the environmental impact of the funded projects systematically. Transparent reporting mechanisms further enhance accountability, allowing stakeholders to scrutinise the effectiveness of green bonds in meeting their intended environmental objectives. This commitment to robust evaluation and reporting practices distinguishes green bonds as a credible and impactful instrument in the world of sustainable finance.

- Management of proceeds: Effective management of proceeds is a cornerstone principle, ensuring that funds are utilised efficiently and in accordance with the green objectives outlined at the outset. This principle emphasises the need for clear governance structures and strategies to track and allocate funds, reinforcing the accountability of issuers.

- Reporting: Transparency is further bolstered by a robust reporting mechanism, where issuers provide clear and detailed accounts of the environmental impact of the funded projects. Stakeholders can scrutinise these reports, fostering accountability and ensuring that green bonds fulfil their intended role in advancing environmental sustainability.

An illustration describing green bond principles.

An illustration describing green bond principles.

In essence, the Green Bond Principles, comprising the specific use of proceeds, rigorous project evaluation and selection, the effective management of funds, and transparent reporting practices, collectively define the essence of green bonds. These principles not only safeguard the environmental integrity of funded projects but also contribute significantly to the broader mission of transitioning towards a more sustainable and eco-conscious future.

Read more: Net zero: benefits, challenges, strategies, and the power of nature-based solutions

Types of green bonds

Understanding the different types of green bonds is crucial for investors navigating this market. Notable categories include ‘use of proceeds’ bonds, revenue bonds, project bonds, securitisation bonds, covered bonds, and loans. Each type has unique characteristics, such as the purpose of proceeds, debt recourse, and specific examples.

- ‘Use of proceeds’ bonds: These bonds specify the precise use of funds for environmentally friendly projects.

- Revenue bonds or asset-backed securities (ABS): Bonds backed by specific revenue streams, ensuring financial support for green initiatives.

- Project bonds: Tied to a particular environmentally-focused project, providing targeted funding.

- Securitisation bonds: Bonds where green assets generate cash flows supporting further sustainability projects.

- Covered bonds: Secured by a specific pool of green assets, offering stability to investors.

- Loans: Financing instruments supporting green projects with flexible repayment terms.

Drone picture of local people and DGB team members during cookstove distribution, Hongera Energy Efficient Cookstoves Project, DGB.

Drone picture of local people and DGB team members during cookstove distribution, Hongera Energy Efficient Cookstoves Project, DGB.

Main uses of green bonds

Green bonds serve as a linchpin in the financial landscape, providing crucial funding for projects that actively contribute to environmental sustainability. These bonds play a pivotal role in directing capital towards a diverse array of eligible projects, spanning various sectors essential for mitigating environmental challenges.

Green bonds allocate capital to projects that represent the forefront of environmental stewardship. The spectrum of supported initiatives encompasses nature-based solutions, renewable energy projects, or green technology developments. Nature-based solutions (NBS) refer to sustainable and regenerative approaches that utilise natural processes and ecosystems to address environmental challenges and promote resilience. These solutions leverage the inherent capacities of ecosystems, biodiversity, and natural resources to provide social, economic, and environmental benefits. Examples include reforestation, afforestation, wetland restoration, and other practices that work in harmony with nature to enhance ecosystem services, restore natural habitats, and contribute to sustainable development goals. Nature-based solutions are increasingly recognised for their effectiveness in tackling issues like environmental challenges, biodiversity loss, and natural resource management. Green bond investments can also be dedicated to sustainable infrastructure and wastewater management projects.

Read more: As green bonds grow, what should investors know?

Beyond the specific project focus, green bonds contribute significantly to financing initiatives that prioritise sustainability and social responsibility by directing funds towards projects with positive environmental impacts. The financing facilitated by green bonds is not merely a transaction; it represents a commitment to fostering a sustainable future, aligning financial objectives with environmental and social responsibility.

The main uses of green bonds extend beyond the mere allocation of funds; they represent a strategic investment in projects that collectively contribute to a more nature-positive and resilient world. By financing initiatives like nature-based solutions, afforestation, habitat restoration, wetland restoration, energy-efficient cookstoves, clean transportation, green buildings, and wastewater management, green bonds stand as a testament to the financial sector's commitment to environmental and social wellbeing.

Two pupils from a local school during tree planting training, Hongera Reforestation Project, DGB.

Two pupils from a local school during tree planting training, Hongera Reforestation Project, DGB.

Why invest in green bonds

Investing in green bonds presents a compelling proposition that goes beyond traditional financial considerations, offering a unique amalgamation of financial and environmental benefits. The attractiveness of these instruments lies in their ability to align investment portfolios with sustainability goals, catering to the growing demand for environmentally conscious investment avenues.

Green bonds stand out for delivering both financial returns and environmental benefits. Investors engaging in green bonds contribute to projects with positive environmental impacts, ranging from nature-based solutions to sustainable infrastructure. This dual benefit allows investors to not only achieve financial objectives but also actively participate in fostering a more sustainable and resilient future.

Green bonds align seamlessly with Environmental, Social, and Governance (ESG) criteria, a critical consideration for socially responsible investors. By integrating ESG considerations into investment decisions, green bonds offer a pathway for investors to support companies and projects that prioritise ethical and sustainable practices. This alignment with ESG requirements further enhances the social responsibility profile of investors' portfolios.

According to a 2021 survey by EY, 74% of institutional investors expressed a higher inclination to divest from companies displaying inadequate sustainability performance. Additionally, a significant 90% indicated an increased focus on a company's sustainability performance in their decision-making processes regarding investments.

Read more: Investors: build a carbon-efficient portfolio

Incorporating green bonds into investment portfolios also contributes to a holistic approach to risk management. The environmental focus inherent in these bonds aligns with the broader trends towards sustainability and resilience and increased global calls and commitments for environmental action. As markets evolve, companies with robust environmental practices are better positioned to navigate regulatory changes and societal expectations, offering investors a more secure and sustainable long-term investment strategy.

According to the Business Harvard Review, increasing evidence indicates that companies committed to sustainability demonstrate notable positive financial outcomes, prompting investors to place higher value on such enterprises. Of these studies, 90% suggest that maintaining robust ESG standards contributes to a reduction in the cost of capital. Additionally, 88% indicate that adopting commendable ESG practices leads to improved operational performance. Furthermore, 80% establish a positive correlation between stock price performance and effective sustainability practices.

Read more: Why add green bonds to your investment portfolio?

In summary, the decision to invest in green bonds transcends traditional financial motivations. Investors are drawn to these instruments for their dual benefits of financial returns and positive environmental impacts. The availability of tax incentives, alignment with ESG criteria, and the contribution to effective risk management further reinforce the appeal of green bonds in the contemporary investment landscape.

Advantages of green bonds

Green bonds offer investors a compelling avenue for achieving competitive financial returns while supporting projects with positive environmental impacts. This dual benefit provides a unique proposition for those seeking both financial success and a meaningful contribution to sustainability goals.

Investing in green bonds goes beyond financial gains; it represents a proactive effort to address environmental issues and promote sustainability. The funds channelled into environmentally responsible projects through green bonds actively contribute to mitigating environmental challenges, fostering a more ecologically balanced and resilient planet.

Close-up of a young tree seedling, Hongera Reforestation Project, DGB.

Close-up of a young tree seedling, Hongera Reforestation Project, DGB.

One of the standout advantages of green bonds is the availability of tax incentives for investors. Governments globally recognise the importance of incentivising investments in projects with clear environmental benefits. This additional layer of attractiveness in the form of tax incentives enhances the overall appeal of green bond investments, providing investors with a tangible financial advantage.

Green bonds also align with ESG criteria. By incorporating green bonds into their portfolios, investors not only meet but can exceed ethical standards. This alignment ensures that investment choices are consistent with broader environmental and social goals, offering investors a robust framework for responsible and sustainable investment practices.

An illustration describing ESG criteria.

An illustration describing ESG criteria.

Another distinct advantage of green bonds lies in their lower default risks, contributing to the creation of a more stable investment portfolio. The focus on environmentally sustainable projects aligns with broader market trends, positioning investors to navigate regulatory changes and societal expectations more effectively. This emphasis on risk management enhances the overall resilience and sustainability of investment portfolios.

Green bonds, such as those of DGB Group, can also offer attractive returns to investors, further motivating investors to include them in their portfolios and invest in nature-centric initiatives.

The advantages of green bonds extend beyond financial considerations, encompassing positive environmental outcomes, tax incentives, compliance with ESG criteria, and effective risk management. Investors engaging in green bonds find themselves not only on a path to financial success but also as contributors to a more sustainable and socially responsible global landscape.

Read more: Exploring innovative structures for green bonds

How are green bonds different from other types of ethical investments?

Understanding the differences between green bonds and other ethical investment options is crucial for investors seeking sustainable choices. Green bonds stand out by offering a holistic approach to environmental impact, providing direct project financing, and falling within the fixed-income asset class. Their adherence to standardised criteria, such as the Green Bond Principles, ensures transparency, setting them apart from other ethical investments. The broad scope of impact, influencing both financial markets and environmental practices, distinguishes green bonds as impactful instruments in driving sustainability.

Two Bulindi chimpanzees sitting in a tree, Bulindi Chimpanzee Habitat Restoration Project, DGB.

Two Bulindi chimpanzees sitting in a tree, Bulindi Chimpanzee Habitat Restoration Project, DGB.

DGB Group's green bonds for a greener future

DGB's green bonds symbolise a resolute commitment to a sustainable and socially responsible future. The dedicated use of proceeds towards our high-quality nature-based projects with positive environmental and socio-economic impacts reflects our dedication to creating a greener world. These sustainable bonds not only provide investors with a stable return on investment (ROI) of up to 9%, but they also provide the satisfaction of supporting initiatives that resonate with their values.

In the era of a global green transition and heightened commitments towards a low-carbon economy, DGB stands at the forefront as a developer of impactful nature-restoration projects. The world's pursuit of net-zero goals, as outlined in the UN Paris Agreement, has amplified the demand for high-quality carbon credits. DGB's strategic focus on large-scale environmental projects generating carbon credits verified by leading certification standards positions us perfectly to meet this demand, ensuring significant growth in the process.

DGB is actively managing multiple projects and conducting preliminary studies on numerous others. Our robust pipeline of Verified Emission Reduction (VER) credits in development (60.1 million as at Q1 2024) allows for additional scaling in all existing afforestation, reforestation, and community-based agroforestry projects.

Our distinctive methodology-driven and transparent business model serves as a competitive advantage, offering investors an opportunity to participate in a market estimated to reach $7 trillion annually. As a publicly traded purpose company focused on nature restoration, we embody the unique approach of purpose-driven work coupled with efficient business operations. This dual approach ensures the conservation of nature while simultaneously providing expansive investment opportunities.

DGB takes pride in developing and managing verified nature-based projects. Our dedicated teams and partners are actively engaged on the ground at project sites, allowing us to originate top-quality carbon and biodiversity credits that meet the highest industry standards.

Through our transparent and high-integrity model, businesses can contribute to nature restoration, and investors can reap the rewards of restoring nature while empowering communities. DGB's green bonds, with their noteworthy ROI, not only align with sustainable investment goals but also actively contribute to a greener, more sustainable future.

Aerial view of a forest with young trees planted in a row. AI generated picture.

Aerial view of a forest with young trees planted in a row. AI generated picture. A local woman working at a tree nursery, Hongera Reforestation Project, DGB.

A local woman working at a tree nursery, Hongera Reforestation Project, DGB.

An illustration describing green bond principles.

An illustration describing green bond principles. Drone picture of local people and DGB team members during cookstove distribution, Hongera Energy Efficient Cookstoves Project, DGB.

Drone picture of local people and DGB team members during cookstove distribution, Hongera Energy Efficient Cookstoves Project, DGB.

Two pupils from a local school during tree planting training, Hongera Reforestation Project, DGB.

Two pupils from a local school during tree planting training, Hongera Reforestation Project, DGB. Close-up of a young tree seedling, Hongera Reforestation Project, DGB.

Close-up of a young tree seedling, Hongera Reforestation Project, DGB. An illustration describing ESG criteria.

An illustration describing ESG criteria.

Two Bulindi chimpanzees sitting in a tree, Bulindi Chimpanzee Habitat Restoration Project, DGB.

Two Bulindi chimpanzees sitting in a tree, Bulindi Chimpanzee Habitat Restoration Project, DGB.